US Equities: 9% Forever?

Barry Ritholtz

MAY 6, 2024

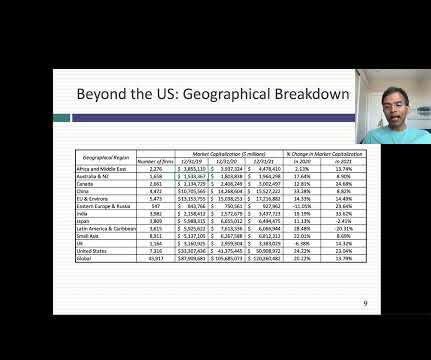

Calculating returns back to May 1974 gives us numbers that look like this: S&P 500 Index annualized generated gains of 8.44%; if you reinvested the dividends, the annualized gains were 11.43%.2 Kudos to Ibbotson and Sinquefield for their work, and to Justin Fox for reminding us of their contributions (in 2005!).

Let's personalize your content