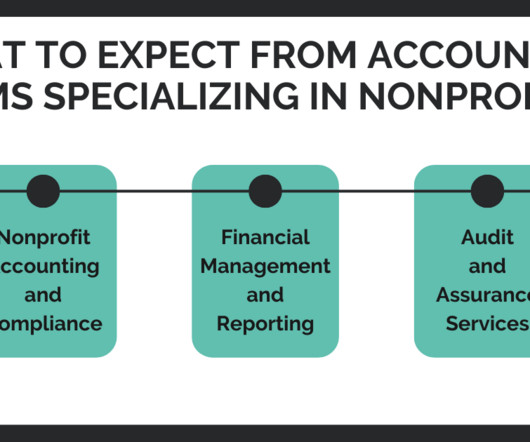

What to expect from accounting firms specializing in nonprofits

The Charity CFO

APRIL 28, 2023

Is there an advantage to working with accounting firms specializing in nonprofits? However, running a nonprofit comes with unique challenges that require specialized expertise, particularly in financial management and accounting. Accounting firms specializing in nonprofits can help you comply with these regulations.

Let's personalize your content