How Can Carbon Accounting Impact the Value of M&A Deals?

Bramasol

JANUARY 31, 2022

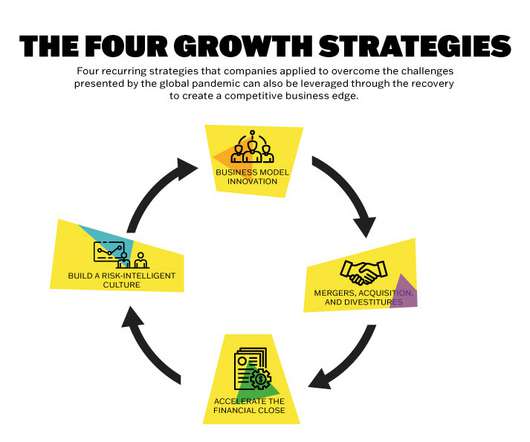

Carbon Accounting was previously identified as one of the Five Key Trends to Watch in 2022 , and the compliance implications were explored in this blog post Are You Ready for "Carbon Accounting" Compliance? So, how does all of this play into impacting M&A activity? 1 stock holding for such funds".

Let's personalize your content