Elevating tomorrow’s finance leaders today

Future CFO

AUGUST 30, 2021

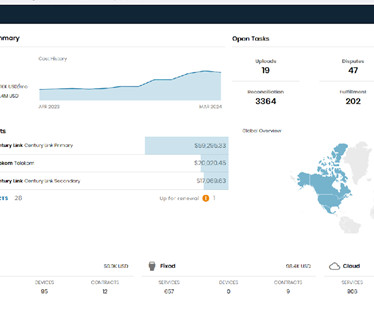

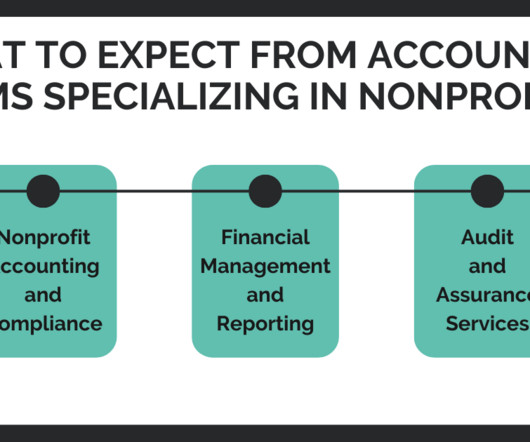

These days, strong computer skills, as are advanced knowledge of accounting, budgeting, and finances. Controllers: Companies don’t have access to historical data to benchmark their responses and performance against or help model future scenarios. But these are table stakes of the profession.

Let's personalize your content