Transcript: Bill Bernstein on Navigating Uncertainty

The Big Picture

JUNE 16, 2025

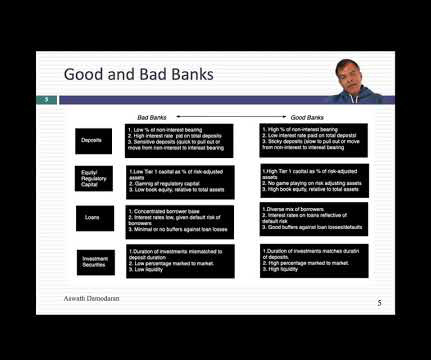

Ken Fisher, bless his soul, supplied me with a fair amount of data and I, you know, impersonated a professional investor at certain large banks and was able to get that sit from them as as well. So at least in the us so if there’s inflation, the cost of their goods go up and, and their total dollars, maybe their profits get squeezed.

Let's personalize your content