Bank Single Gateway for efficient connectivity

Simply Treasury

AUGUST 3, 2022

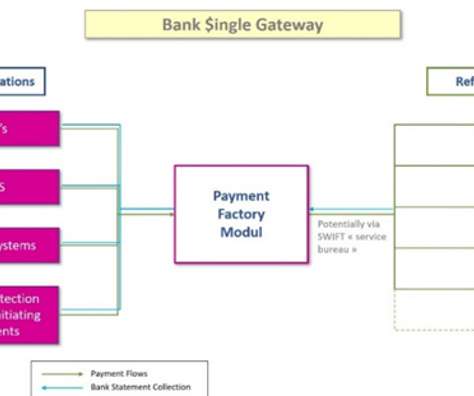

Automated bank connectivity through a single secure channel has become essential to reduce costs, facilitate on-boarding by banks, secure transactions, speed up and automate reconciliations and reduce staff workload. True bank connectivity. Bank Single Gateway: how it works?

Let's personalize your content