Valuation and Corporate Governance Consequences

CFO News Room

JANUARY 15, 2023

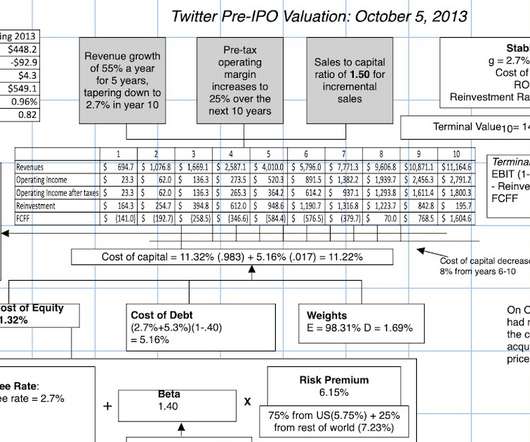

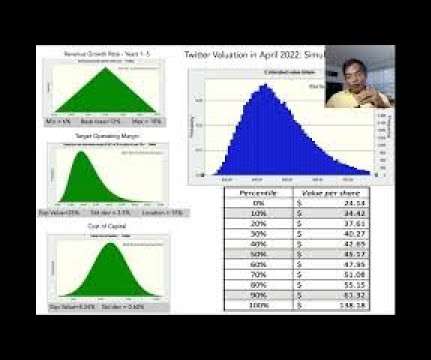

To get a measure of Musk’s bid for Twitter, you have to also understand the company’s path to its current status. I am also fascinated by Elon Musk, and even more so by his most prominent creation, Tesla, and I have valued and written about him and the company multiple times. The Twitter Story. by December 26, 2013. .

Let's personalize your content