The Basics of Nonprofit Bookkeeping

The Charity CFO

FEBRUARY 4, 2022

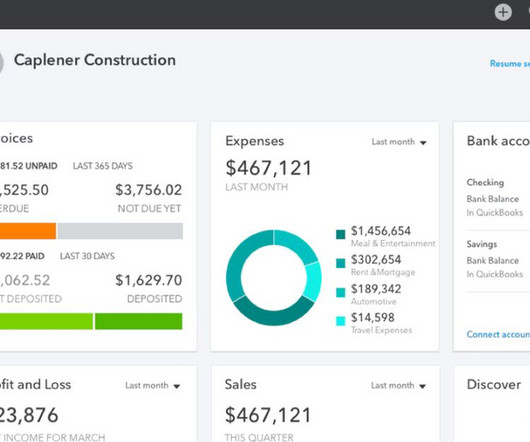

A bookkeeper records and organizes financial data; an accountant interprets and presents that data. . The nonprofit bookkeeper is the front line in the battle for the accurate financial data you need to run your business, so let’s review the core responsibilities of a nonprofit bookkeeper. . Invoicing .

Let's personalize your content