To NPV or Not to NPV: That Is the Question

Fpanda Club

JULY 24, 2022

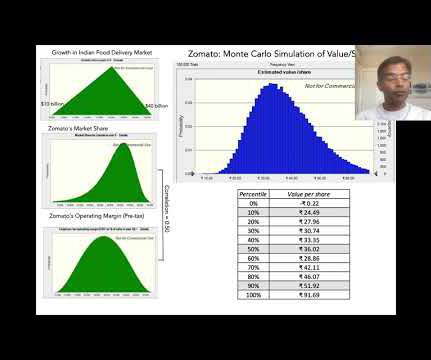

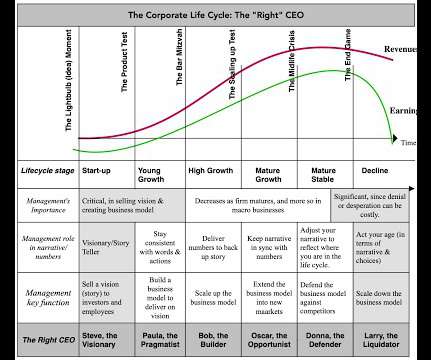

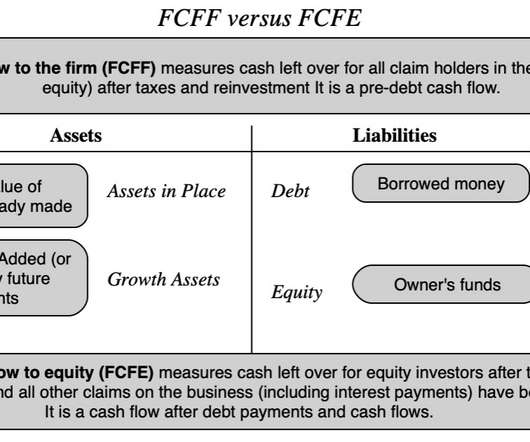

oracle Aesop formulated his investment insight "a bird in the hand is worth two in the bush" and since that time the model for calculating the value of an asset as the present value of the cash generated by this asset throughout its life has remained unchanged. In about 600 B.C. and help identify most probable outcomes.

Let's personalize your content