Navigating treasury trends in 2024: challenges, strategies, and the role of technology

Future CFO

FEBRUARY 7, 2024

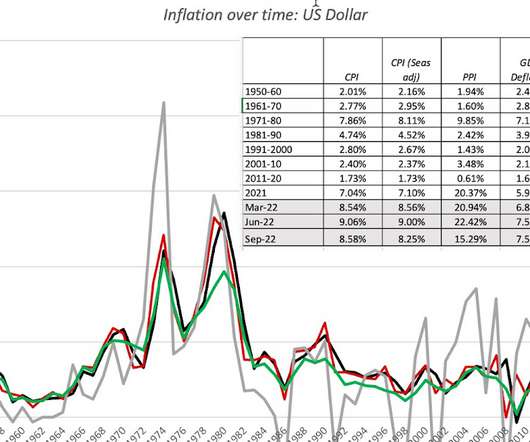

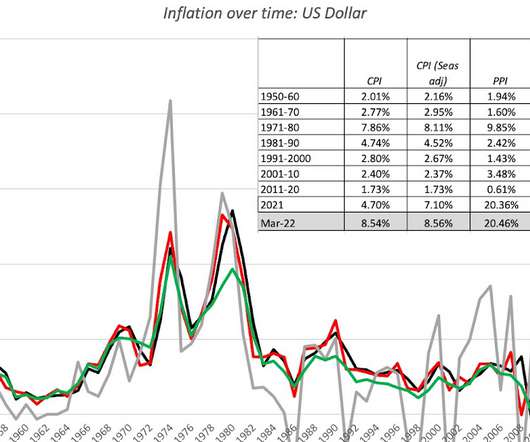

Delving into the key trends shaping the treasury landscape in 2024, the focus is on themes such as staffing challenges, macroeconomic risks, technology adoption, and strategic financial management. Liquidity risk, driven by rising rates and borrowing costs, remains a key challenge for medium-sized and investment-grade companies.

Let's personalize your content