Do Nonprofits Pay taxes? It’s Complicated.

The Charity CFO

DECEMBER 21, 2021

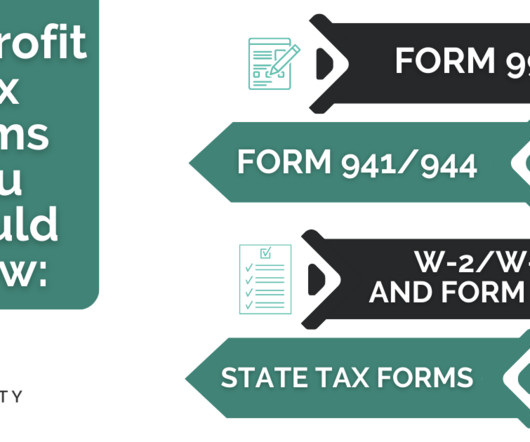

Many nonprofit founders think that they won’t have to worry about taxes. “Tax-exempt “ doesn’t mean that you don’t have to pay any taxes. It simply means that you don’t have to pay most federal and state income taxes. Do nonprofits pay income tax?

Let's personalize your content