The Pushback on my Tesla Valuation

CFO News Room

FEBRUARY 3, 2023

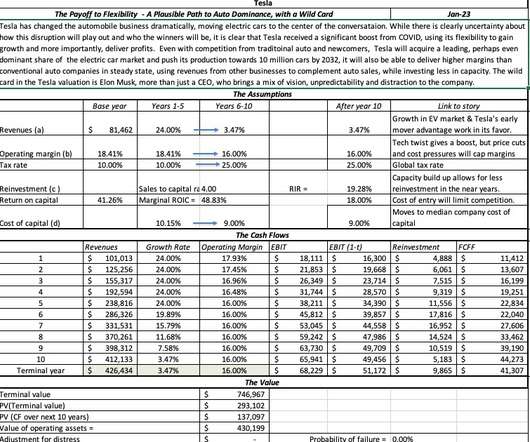

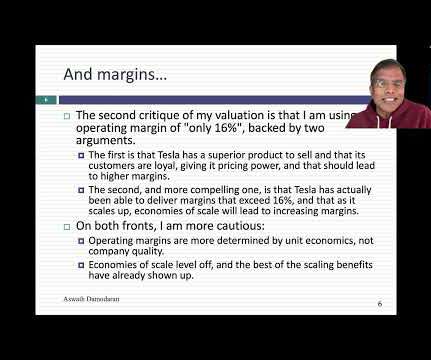

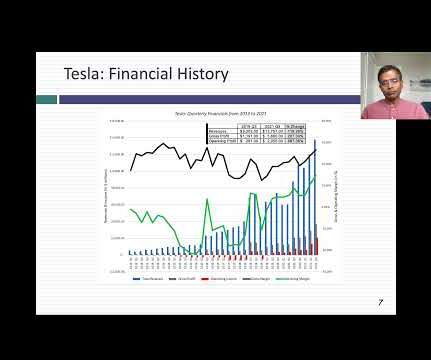

I wrote about my most recent valuation of Tesla just over a week ago , and as has always been the case when I value this company, I have heard from both sides of the Tesla divide. Based at least on the reactions, I have realized that some may be misreading my story and valuation, ore reacting just to a picture in a tweet.

Let's personalize your content