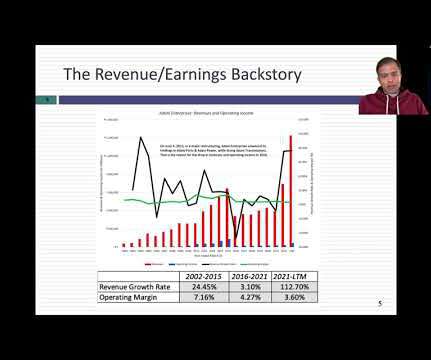

1st Quarter 2024 Economic And Market Outlook: Potential Increased Volatility, Threats To Economic Growth, And Equity Markets

Nerd's Eye View

APRIL 3, 2024

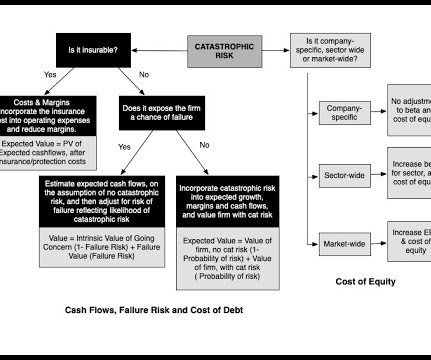

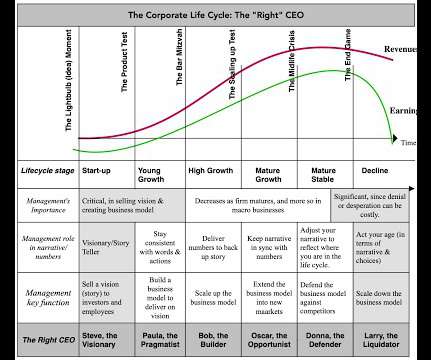

Yet, by taking a measured look at factors driving economic activity and influencing behavior, advisors can help clients face risks they can't control and (hopefully) position themselves to take advantage of opportunities as they develop. Meanwhile, a smorgasbord of potential risks threatens economic growth's "soft landing" narrative.

Let's personalize your content