CVS interim CFO takes permanent seat

CFO Dive

JANUARY 5, 2024

The CVS Health executive is taking on the top finance seat as it looks to get back on track following a corporate restructuring, company-wide layoffs, and rising costs.

CFO Dive

JANUARY 5, 2024

The CVS Health executive is taking on the top finance seat as it looks to get back on track following a corporate restructuring, company-wide layoffs, and rising costs.

Navigator SAP

JANUARY 5, 2024

There are many enterprise resource planning solutions (ERP) on the market today. For most businesses, SAP automatically makes the shortlist during the selection process because the company is one of the largest ERP vendors with wide industry adoption and some of the deepest understanding of the ERP space. Nobody ever gets fired for choosing an SAP solution.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

JANUARY 5, 2024

Among the states with lower tax burdens is Arkansas, where corporate income tax rates are dropping to 4.80% this year from 5.30%.

CFO News

JANUARY 5, 2024

In 2023-24, India's economy anticipates a robust 7.3 per cent growth, driven by thriving sectors, notably construction and manufacturing. However, agriculture's modest 1.8 per cent growth diverges from the trend.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

CFO Dive

JANUARY 5, 2024

Despite the increase, the technology industry added nearly 13,000 new positions last month, marking its largest increase since April 2023.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Barry Ritholtz

JANUARY 5, 2024

This week, we speak with Matt Levine , Opinion columnist at Bloomberg. He is the author of Money Stuff , one of the most popular daily newsletters on Wall Street. Previously, he was an investment banker at Goldman Sachs and a mergers and acquisitions lawyer at Wachtell, Lipton. He explains how his career meandered from studying classics, teaching Greek, clerking for a Federal Judge, working on M&A at a big firm, and eventually doing derivative transactions on Wall Street.

E78 Partners

JANUARY 5, 2024

Integration work is hard and a struggle for companies who lack “corporate” transaction advisory staff and resources to help manage them. For companies doing strategic M&A transactions in the mid and lower markets, integration planning and execution can be a drain on business continuity, and a demoralizing exercise for those involved. The purpose of this article is to share best practices and lessons learned from our carve-out and integration work in the lower to mid-market deal range (referr

CFO News

JANUARY 5, 2024

GST taxpayers in India can now pay their tax via credit and debit cards, with the Goods and Services Tax Network (GSTN) enabling online methods like net banking, Immediate Payment Services (IMPS), and Unified Payments Interface (UPI), starting in 10 states/UTs.

E78 Partners

JANUARY 5, 2024

Audits are an essential part of ensuring that a company’s financial statements are accurate and compliant with accounting standards. We recently wrote about how to prepare for an audit however, in the context of an acquisition, the first audit after the transaction can be particularly challenging, as it often involves additional complexities due to the combined financials and potential integration of different accounting systems.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

CFO News

JANUARY 5, 2024

"The relaxation will allow non-residents to claim tax exemption in India on income from financial products offered by GIFT city intermediaries and is expected to give a boost to financial products and solutions offered from GIFT City," Rajesh Gandhi, Partner, Deloitte India said. "Among various intermediaries, the foreign clients of the brokers trading on various financial products on the IFSC stock exchanges are likely to be major beneficiaries of this exemption," Sunil Gidwani,

CFO Simplified

JANUARY 5, 2024

View Part One of this article here Breaking up the ownership of a company can have dire consequences for the company as well as for the business owners. There are things that you can do during the formation of your business partnership that will set the proper, non-combative approach to a change in ownership, but not everyone has the foresight to deal with those things.

CFO News

JANUARY 5, 2024

The Indian government faces challenges in achieving its 5.9% fiscal deficit ratio due to a lower-than-anticipated nominal GDP in FY24. The government must either reduce spending by ₹37,000 crore or increase revenue from the budgeted levels. The fiscal deficit is expected to be ₹17,49,807 crore, slightly breaching the target and reaching 6% of GDP.

Adam Kae

JANUARY 5, 2024

What is the Financial Elevation Group? I'm so glad you asked. It's for business owners (just like you). It's a safe space to ask questions and get real answers. , This includes answers to EVERY Financial Question you've EVER had about your business (from a GROWTH-Focused CFO). Where do we meet? We meet online 1 hour per month (the 1st Wednesday of the month at 1 ET).

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

CFO News

JANUARY 5, 2024

Interim Budget 2024: India may set a lower divestment target for state firms in fiscal 2024-25, falling short of this year's goal to be the lowest in nine years. The government is unsure whether regulatory delays will allow it to complete the sale of a majority stake in IDBI Bank, which is expected to bring more than RS 200 billion into government coffers when completed.

Adam Kae

JANUARY 5, 2024

Smart Borrowing for Businesses Welcome, fellow business owners, to the world of smart borrowing – a realm where financial acumen meets strategic growth. As a seasoned , Fractional CFO specializing in small business finance and Digital Marketing Agencies, I've witnessed firsthand the transformative power of borrowing done right. Today, I'm excited to share insights and practical advice on navigating the intricate art of smart borrowing for businesses.

CFO News

JANUARY 5, 2024

The Reserve Bank of India has requested Federal Bank to submit two candidates to replace current Managing Director and CEO Shyam Srinivasan, whose term ends on September 22, 2024. The bank is advised to submit a fresh proposal with a panel of at least two fresh names, considering the candidate's likely tenure and the bank's longer-term requirements.

CFO Leadership

JANUARY 5, 2024

Both workers and managers faced unique challenges in 2023. From the push and pull of remote work to rising employee burnout and shifting economic pressures, organizations and professionals have had to navigate a complex environment this year.With a few short weeks left in the calendar year, here’s a look back at the top trends that have impacted the workplace in 2023 and will continue to take shape as we head into 2024: Bonuses came back in a big way.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

CFO News

JANUARY 5, 2024

The maker of Saffola and Parachute oil brands also said constraints on liquidity and profitability in the general trade (GT) channel remained an overhang, while alternative channels continued to fare well. It has initiated significant steps towards improving the return on investments of its general trade partners and structurally re-igniting growth including a primary stock correction.

CFO Leadership

JANUARY 5, 2024

If a group of chief financial officers (CFOs) from 2018 stepped out of a time machine into their 2023 offices, they would be astonished by what they saw. Environmental, social and governance (ESG) metrics and measurements would top their priority lists. Most of their finance organizations would be using generative artificial intelligence (GenAI) to enhance their business planning and analysis (BP&A) capabilities and/or bolster the company’s fraud-prevention activities.

Musings on Markets

JANUARY 5, 2024

In January 1993, I was valuing a retail company, and I found myself wondering what a reasonable margin was for a firm operating in the retail business. In pursuit of an answer to that question, I used company-specific data from Value Line, one of the earliest entrants into the investment data business, to compute an industry average. The numbers that I computed opened my eyes to how much perspective on the high, low, and typical values, i.e., the distribution of margins, helped in valuing the co

CFO Leadership

JANUARY 5, 2024

After a tumultuous few years, 2023 brought business travel — and its corresponding expenses — fully back to life. But while the volume of traveling employees has returned to pre-pandemic levels, much has changed. And before we get too familiar with the new travel patterns, generative AI is set to upend the world of T&E and beyond. The way we book travel, pay for business expenses, and manage the spectrum of T&E will look quite different 12 months from now.

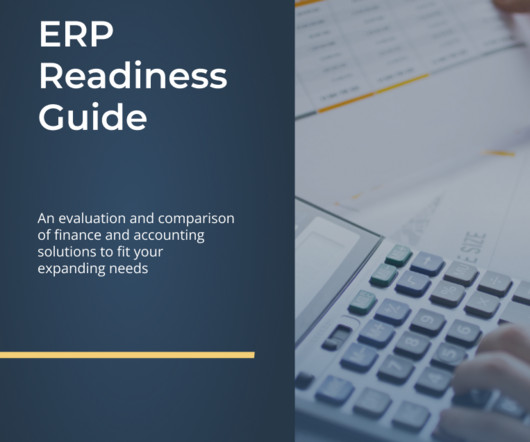

Advertisement

In this white paper, we explore the factors to consider in deciding whether the time is right for your Company to consider a new ERP or accounting software, the total cost of ownership and plans necessary to make the potential leap to these systems.

CFO Simplified

JANUARY 5, 2024

Every business needs to be careful about the procedures that they put in place to keep control over and protect the assets of the company. That may involve management of cash, payables and receivables, payroll, their computer system, employee access and more. And in most businesses, there is one person at the top that takes full responsibility for everything that happens within the business.

CFO Leadership

JANUARY 5, 2024

The current office market landscape is witnessing a pronounced downturn, primarily catalyzed by the pervasive adoption of hybrid work models, resulting in substantial disruptions across major central business districts (CBDs) in the United States. This paradigm shift is significantly impacting non-trophy Class A office assets without views or other features that welcome workers to the office.

CFO Dive

JANUARY 5, 2024

The New York Attorney General’s office has also upped the fine it is asking the judge to impose on the Trump Organization to $370 million.

CFO Leadership

JANUARY 5, 2024

As CFOs start a new and intriguing year, the question arises: What should populate their agenda? We heard from numerous finance leaders and experts at SuiteWorld 2023, NetSuite’s annual user conference, and they were brimming with fresh and challenging ideas that can help companies right now. Some ideas are super practical, some are more big picture.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

Let's personalize your content