Enhancing Business Valuation: Aligning Owner Perception with Market Realities

VCFO

SEPTEMBER 21, 2023

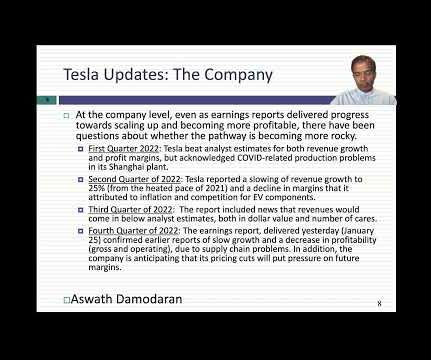

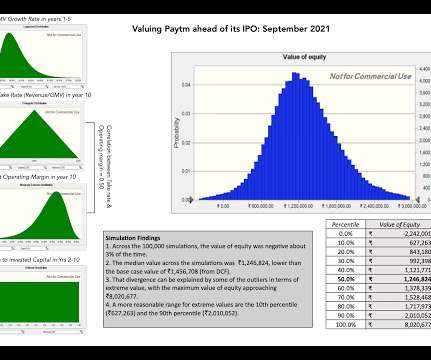

Owner’s opinions of their business value can be influenced by inherent biases, flawed valuation methodologies, and factors lurking beyond their control. The delta between an owner’s expectations and the market’s potential can be considerable and is based on a number of financial and non-financial metrics.

Let's personalize your content