What is Financial Planning and Analysis (FP&A)?

Spreadym

JUNE 27, 2023

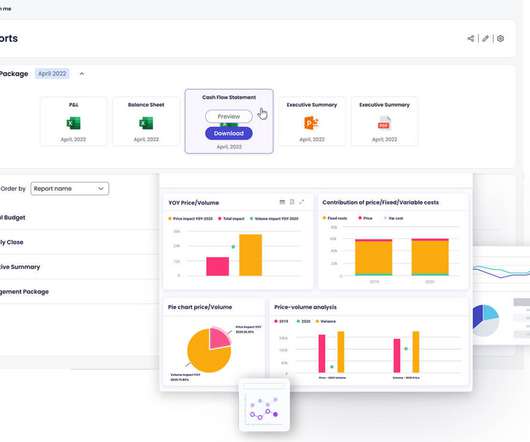

What is Financial Planning and Analysis or FP&A? FP&A is a process used by organizations to develop and manage their financial plans and make informed decisions based on financial analysis. The primary objectives of FP&A. The primary objectives of FP&A.

Let's personalize your content