Tesla's Trillion Dollar Moment: A Valuation Revisit!

Musings on Markets

NOVEMBER 9, 2021

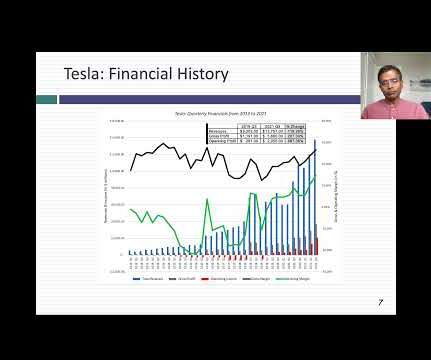

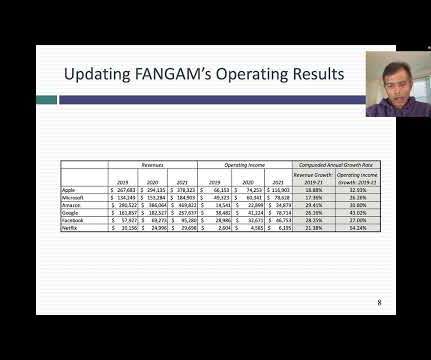

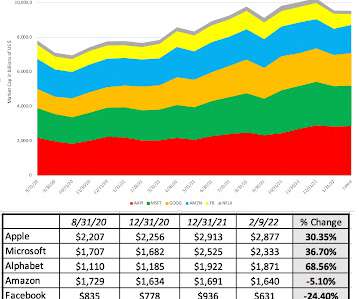

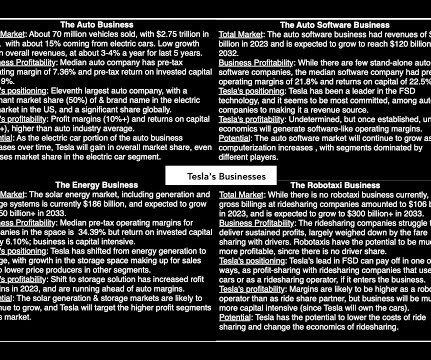

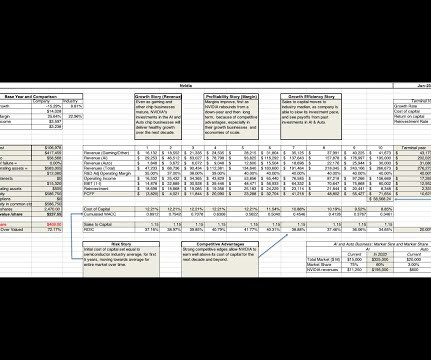

If you are interested, you can see my valuations from 2014 , 2016 and 2017. The automobile business has been in trouble for quite a while, struggling with anemic revenue growth in the aggregate, and abysmal profit margins, with even the very best in the group struggling to earn returns that match, let alone beat, their costs of capital.

Let's personalize your content