Salesforce says over 8,000 customers using new agentic AI tool

CFO Dive

MAY 29, 2025

The “Agentforce” tool is also now producing $100 million in average order value, CEO Marc Benioff said.

CFO Dive

MAY 29, 2025

The “Agentforce” tool is also now producing $100 million in average order value, CEO Marc Benioff said.

Navigator SAP

MAY 2, 2025

Part of why so many businesses choose an SAP ERP solution is that SAP is robust and widely supported. SAP invented ERP, and it still dominates the space. Because it is so commonly used, businesses served by SAP North America never have to go it alone; there is a robust community of consultants and third-party support service providers that can assist with rollout and post-implementation support.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Finance

JUNE 9, 2025

Regional Winners Most Innovative Bank in Middle East| ARAB BANK Acabes, Arab Bank’s in-house development factory, enabled the bank to launch an updated version of its Reflect banking app in 2024. Reflect benefits from a host of new digital features, including multicurrency subaccounts for deposits, savings, and payments. Customers can also use Salary Transfer and instant transfer features with these currencies.

Fpanda Club

JANUARY 23, 2025

As FP&A professional, how often do you feel that you do something you shouldnt? FP&A is an evolving function that falls into the intersection of finance, operations and strategy aimed at driving better decision-making trough insightful analysis, forecasting and goal setting. Having unique access to data about all the activities throughout an organization, it is not uncommon that FP&A teams are often asked to perform tasks which are not necessarily aligned with their core objectives.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Barry Ritholtz

JANUARY 2, 2025

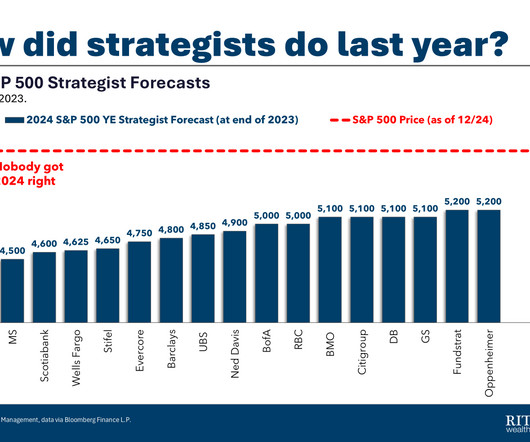

A regular theme around these parts is “ Nobody Knows Anything. ” Specifically, nobody knows what will happen in the future. This is true about equity and bond markets, specific company stocks, and economic data series. We do not know which geopolitical hot spot will erupt in turmoil; we have no idea where or when the next natural disaster will hit.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

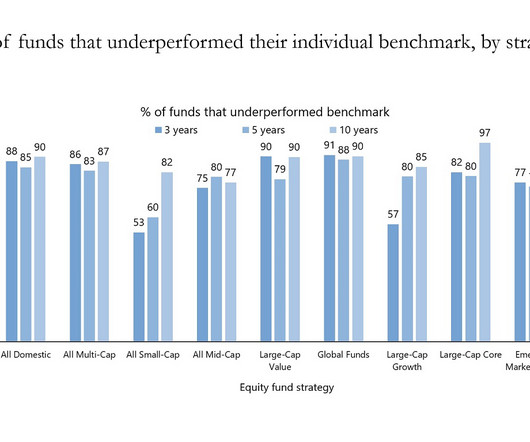

The Big Picture

MAY 29, 2025

Sometimes, the data is so overwhelming that little commentary is needed. From SPIVA , here is the data on large-cap fund performance in the United States, showing the percentage of all large-cap funds that over and underperformed the S&P 500 over various time frames: 1 Year: 65.24% of funds underperformed the S&P 500; 34.76% outperformed the S&P 500 3 Years: 84.96% underperformed; 15.04% outperformed 5 Years: 76.26% underperformed; 23.74% outperformed 10 Years: 84.34% underperformed;

Future CFO

JANUARY 14, 2025

As with anything in the world, the finance leadership landscape has been evolving especially following the COVID-19 pandemic which brought about drastic changes into the market. The finance function has been handling shifts here and there and chief finance officers have time and again strove to find the balance as they now work as strategic advisors to the C-suite team to bring in specific strategies for innovation.

Nerd's Eye View

JUNE 6, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent report finds that the number of SEC-registered RIAs, the assets that they manage, and the number of clients they serve all increased between 2023 and 2024 and suggests the industry is robust across the size spectrum, with both smaller and mid-sized firms seeing growth (often pushing them into higher size brackets and/or from state to SEC registration) and re

CFO Thought Leader

FEBRUARY 26, 2025

Kevin Rhodes recalls one of the earliest lessons in his finance career. I wanted to understand the business, he tells us, describing his decision to ride along with a Waste Management truck crew. Clipboard in hand, he meticulously recorded stop distances, tonnage collected, and time spent at each location. By the end of the week, he had compiled a customer-by-customer profitability analysis.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CFO News

MARCH 24, 2025

Amid an ongoing debate over whether CMA and CS should be included as accountants in the new Income Tax Bill and allowed to conduct tax audits a role currently reserved for Cas the Lok Sabha's Select Committee has likely tasked EY with reviewing the curriculums of these professional courses. Based on the findings, the committee will likely decide who can conduct tax audits, examining the curricula to assess whether professionals from the other two bodies are qualified for this role.

CFO Dive

JUNE 2, 2025

Outside of manufacturing, the U.S. economy has so far shown signs of weathering a two-month-long trade war.

Navigator SAP

MAY 16, 2025

GROW with SAP is not a product. It is a journey. It is a framework for helping a business digitally transform and streamline operations with the industry-leading SAP S/4HANA Cloud Public Edition enterprise resource planning solution (ERP).

Global Finance

JANUARY 2, 2025

Baruch Lev is Philip Bardes professor emeritus of Accounting and Finance, Kaufman Management Center, Leonard N. Stern School of Business at New York University. Feng Gu is chair and professor of Accounting and Law at the School of Management, State University of New York at Buffalo. Together, they recently published The M&A Failure Trap: Why So Many Mergers and Acquisitions Fail, and How the Few Succeed (Wiley).

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Fpanda Club

MARCH 19, 2025

Hi everyone! My name is Anna, and I am an FP&A-holic. Yes, I said that, I am addicted to financial planning and analysis. I am excited when all the checks in my financial models are colored green, and I get thrilled out of digging into data and finding insights that lead to better business decisions. After 15+ years in Financial Planning & Analysis (FP&A), Ive learned some hard truths things I wish someone had told me earlier in my career.

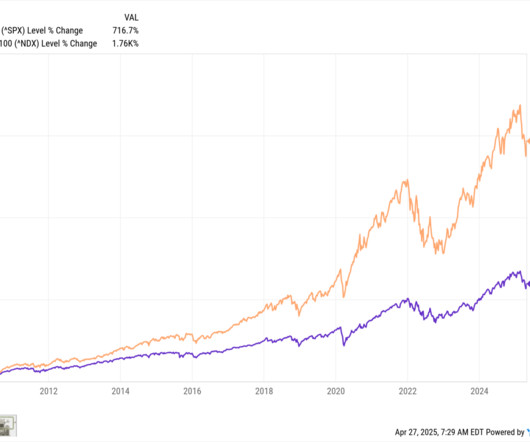

Barry Ritholtz

APRIL 28, 2025

We have no idea how good we had it. Lets consider the returns data from the period post-Great Financial Crisis (GFC), and then unpack what it might mean. Starting January 1, 2010, the S&P 500 generated a total return (with dividends reinvested) of 566.8% , or 13.3% per year from the start of 2010 through the end of Q1 2025. The Nasdaq 100 has nearly doubled that.

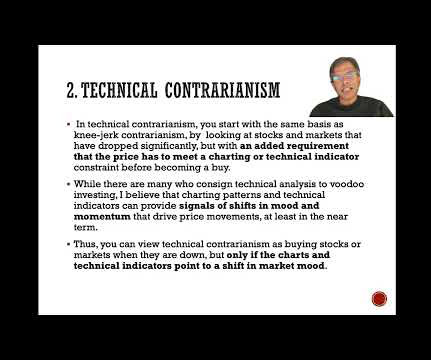

Musings on Markets

APRIL 20, 2025

When markets are in free fall, there is a great deal of advice that is meted out to investors, and one is to just buy the dip , i.e., buy beaten down stocks, in the hope that they will recover, or the entire market, if it is down. "Buying the dip" falls into a broad group of investment strategies that can be classified as "contrarian", where investors act in contrast to what the rest of the market is doing at the time, buying (selling) when the vast majority are selling (buying) , and it has bee

The Big Picture

JUNE 3, 2025

I’m on the road visiting our new office in Chicago and then heading to meet clients in San Francisco. However, after hearing some misinformation on TV from the usual suspects, I felt compelled to remind people of some key facts about the US debt and deficits. For a period of ~20 years, beginning after the September 11th attack, accelerating after the GFC, and running up until the 2022 rate hikes, the United States enjoyed incredibly low interest rates.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Future CFO

JANUARY 22, 2025

At the FutureCFO Conference series, organised by Cxociety, finance leaders in Indonesia, Malaysia, Singapore, the Philippines and Thailand ranked automation and degitalisation (80%), investing in talent and employee development (58%) and continuous innovation (47%) as the top three strategies most important to sustainable growth in 2024. Source: Data collected during the FutureCFO Conference series in 2024, Cxociety Research Coming into 2025, as finance leaders face mounting pressure to do more

Nerd's Eye View

JUNE 13, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent survey of U.S. investors found that while 96% of respondents said they trust their (human) financial advisor, only 29% said they trust algorithms, suggesting that consumers continue to impose a "trust penalty" on algorithmically generated advice.

CFO Thought Leader

FEBRUARY 5, 2025

Early in his career, Lior Maza chose to immerse himself in smaller, venture-backed startups rather than large enterprisesa move that exposed him to a range of responsibilities, from fundraising and recruiting to crisis management. When youre in a small team, Maza tells us, you end up doing everything, and thats where the agility mindset really takes root.

Focus CFO

JUNE 3, 2025

A balance sheet is one of the most critical corporate financial documents, yet many business owners dont fully understand the what, how, and why behind it. As a result, many small businesses fail to maximize their purpose and potential, particularly those in the early stages of development.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CFO Dive

MAY 8, 2025

This week the Big Four firm shed 1,500 workers in its assurance and tax units — including accountants — layoffs that aren’t tied to AI, PwC said.

Navigator SAP

JUNE 13, 2025

Discover how fast-growing mid-market companies leverage SAP Cloud ERP to scale operations, enter new markets, and drive international growth.

Global Finance

MARCH 2, 2025

Global Finance: Can you briefly describe what your model does? Joanne Horton: Yes. Weve got what we think is a rather exciting model, which we describe in a working paper, that helps forecast in advance the likelihood that a firm will go on to commit accounting fraud. Whats the likelihood that fraud will take place in the future? Theres lots of motivation, obviously, because a lot of fraud takes place: few cases, but each one is very expensive.

CFA Institute

MAY 21, 2025

Guido Baltussen serves as the head of Quantitative Strategies International at Northern Trust Asset Management. Prior to joining Northern Trust, Baltussen was, amongst others, the head of Equity Factor Investing and co-head of Quantitative Fixed Income. He is also a professor of Finance at Erasmus University Rotterdam, where he teaches courses on behavioral finance and factor risk premia.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Let's personalize your content