What is Cash-adjusted EBITDA

The SaaS CFO

AUGUST 23, 2022

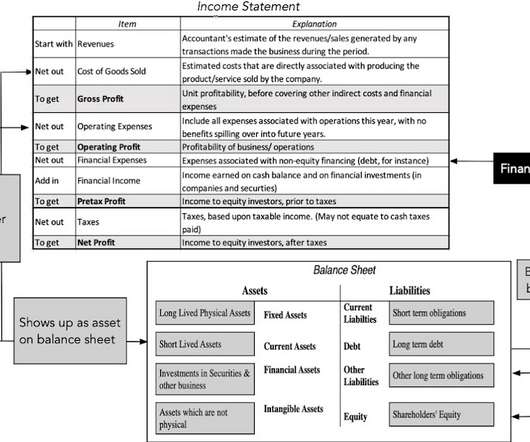

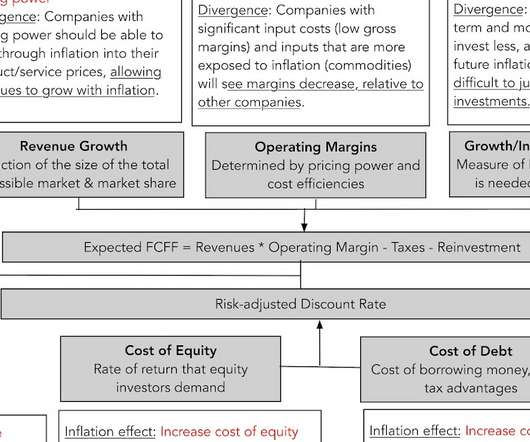

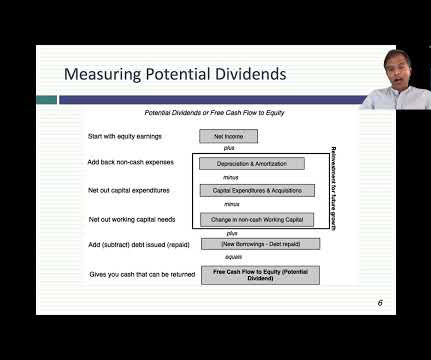

At some point in your SaaS journey, you will be asked about your EBITDA. And then someone will calculate your cash-adjusted EBITDA. EBITDA represents Earnings Before Interest, Taxes, Depreciation, and Amortization. EBITDA attempts to eliminate non-cash and non-operating items.

Let's personalize your content