The evolution of payments: What’s on the horizon?

CFO Dive

JUNE 23, 2025

Traditional payment rails are fading. Discover what's on the horizon in our increasingly borderless financial world.

CFO Dive

JUNE 23, 2025

Traditional payment rails are fading. Discover what's on the horizon in our increasingly borderless financial world.

CFA Institute

JUNE 23, 2025

Discover how advanced AI prompting and model selection are reshaping investment analysis—and why mastering these tools is essential for staying competitive.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Navigator SAP

JUNE 20, 2025

SAP Business Suite helps CEOs and business leaders streamline operations, unify business data, and integrate AI for faster insights and smarter decisions.

Global Finance

JUNE 23, 2025

The rapidly evolving nature of AI is a double-edged sword as far as cybersecurity goes. As user-friendly and beneficial as Generative AI (Gen AI) can be, it is also being misused ever more frequently in the form of trickery and manipulation, such as deepfaking the voice, face or name of a person or organisation to elicit payments. By 2027, for example, 17% of total cyberattacks will involve the use of Gen AI, according to Gartner 1.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Trade Credit & Liquidity Management

JUNE 25, 2025

From a Press Release dated June 3, 2025, New York, New York ThetaRay , a global leader in cognitive AI compliance for financial crime, and Spayce , a next-generation cross-border payments platform, have announced a strategic partnership to address evolving financial crime threats and enhance the security of international payments. The collaboration was unveiled at Money 20/20 and comes at a time when financial crime is becoming more sophisticated, with criminal networks operating with the comple

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

The Big Picture

JUNE 24, 2025

Today, I am participating in a few events at Bloomberg’s Hedge Fund Forum 2025. I will be moderating the Emerging Managers Panel: Hear from new and emerging fund leaders on the opportunities and obstacles of launching and growing a differentiated investment strategy in today’s competitive alternatives landscape, including how they are leveraging AI to enhance investment processes, streamline operations, and navigate the early stages of building a fund.

CFA Institute

JUNE 20, 2025

Discover how cutting-edge academic research becomes real-world investment strategy and explore award-winning insights from the Hillsdale–CFA Society Toronto Research Award.

Future CFO

JUNE 25, 2025

GTreasury unveiled its comprehensive and purpose-built AI platform, GSmart AI, designed for treasury and finance operations. According to a press release, GSmart AI will allow chief financial officers and treasurers to navigate the increasingly complex treasury landscape by bringing in secure, actionable insights and agentic actions. The platform provides reliable AI support to finance heads, addressing demands with powerful capabilities, built-in compliance, and full transparency into every act

CFO Talks

JUNE 25, 2025

If You Think Honesty Is Risky, Try Hiding the Truth Clear communication has always been important, but in today’s environment, it has become critical. Finance professionals are being asked to lead under pressure, often while navigating rapid change, tight margins, and tough trade-offs. In these moments, transparency is not just a leadership trait.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CFO Dive

JUNE 23, 2025

Skip to main content Dont miss tomorrows CFO industry news Let CFO Dives free newsletter keep you informed, straight from your inbox. Daily Dive M-F Tech Weekly Every Tuesday By signing up to receive our newsletter, you agree to our Terms of Use and Privacy Policy. You can unsubscribe at anytime. Deep Dive Opinion Library Events Press Releases Topics Subscribe Search Subscribe Search Strategy & Operations Financial Reporting Compliance Technology Treasury Risk Management Leadership An articl

Trade Credit & Liquidity Management

JUNE 25, 2025

According to the 2025 Association for Financial Professionals (AFP) Liquidity Survey , 61% of organizations identified safety as their foremost objective for short-term investments, significantly outpacing liquidity (35%) and yield (5%) as priorities. Even so, the emphasis on liquidity increased by five percentage points from the previous year, while the focus on yield remained stable.

CFA Institute

JUNE 25, 2025

Explore a new approach to replicating private equity returns with daily liquidity, combining futures, dynamic asset allocation, and risk management overlays.

CFO Thought Leader

JUNE 19, 2025

A Finance Strategic Moment As CFO of a newly public company, John Rettig championed a bold $2.5B acquisition—nearly half of Bill’s market cap at the time. Backed by strategic conviction and rigorous analysis, he helped accelerate market penetration and proved the value of finance leadership that thinks—and acts—like a CEO. Now Watch Our Complete Episode Featuring CFO John Rettig of Bill When CFO John Rettig joined Bill, he brought a mindset shaped by two decade-long CFO tenures.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CFO News

JUNE 20, 2025

New Delhi, June 20 (IANS) The Central Board of Direct Taxes on Friday said that it regularly receives detailed financial data under global tax cooperation frameworks, including the Automatic Exchange of Information (AEOI) with over 100 jurisdictions, including Switzerland, which it uses to verify ITRs filed by Indian taxpayers.

CFO Dive

JUNE 20, 2025

“Maybe we should start thinking about cutting the policy rate at the next meeting, because we don’t want to wait until the job market tanks,” a Federal Reserve official said.

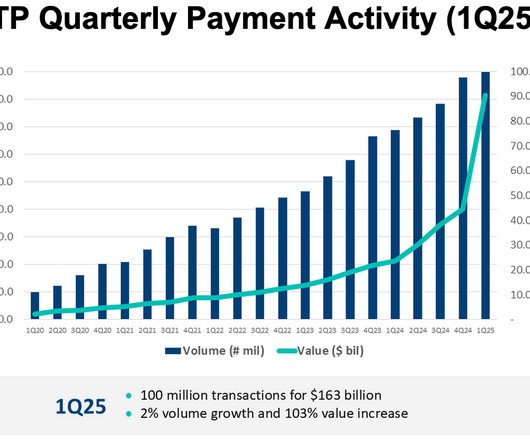

Trade Credit & Liquidity Management

JUNE 24, 2025

The Clearing House raised the real-time payments (RTP) transaction limit from $1 million to $10 million in February 2025. Since the increase, Bank of America (BofA) reports that transactions over $1 million now account for more than half the total value of U.S. real-time payments processed for corporate clients. Rival network FedNow raised its own limit from $500,000 to $1 million on June 24, 2025.

Future CFO

JUNE 19, 2025

The promise is seductive: Artificial intelligence will liberate finance professionals from mundane tasks, creating space for strategic thinking that drives business value. "Any repeatable process that you have within finance automated should free up time [for FP&A professionals] to focus more on strategic thinking," says Justin Barch , managing director of revenue and growth at the Association of Financial Professionals (AFP).

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Global Finance

JUNE 19, 2025

Part of the “One Big Beautiful Bill” Act currently before the US Senate, the levy would affect 40 million to 50 million noncitizens in the US, including undocumented migrants as well as green card and visa holders, with those from India, Mexico, China, and the Philippines particularly exposed. Some experts suggest the effect would be enough to send Mexico’s economy into a recession this year.

Nerd's Eye View

JUNE 24, 2025

Welcome everyone! Welcome to the 443rd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Griffin Kirsch. Griffin is the owner of GK Wealth Management, an RIA based in Reno, Nevada, that oversees $200 million in assets under management for 450 client households. What's unique about Griffin, though, is how he has grown his AUM to $200 million in five years (with a 70% margin in terms of earnings before owner compensation) by providing high-touch planning for busines

CFO Dive

JUNE 25, 2025

The audit watchdog this week announced penalties totaling $8.5 million on three Netherlands firms. Last year, KPMG Netherlands alone was fined $25 million in connection with an exam cheating scandal.

Trade Credit & Liquidity Management

JUNE 24, 2025

From a Press Release dated June 11, 2025, Philadelphia, Pennsylvania Matera , a leading financial technology provider, has partnered with Circle , the global issuer of the USDC stablecoin, to integrate stablecoins as a mainstream payment method within core banking systems. This marks the first time a banking technology provider in the region has natively integrated USDC, aiming to bridge digital currencies and traditional financial systems.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Future CFO

JUNE 19, 2025

When it comes to dealing with changes, being one step ahead is a must for organisations to ensure the best result possible. For chief financial officers overseeing operations across Asia-Pacific, the Middle East, Europe, and the Americas, building compliant, scalable finance functions in unfamiliar jurisdictions is a high-stakes challenge. Asset acquisitions, market entries, and decentralised operations demand more than technical expertise, as they require navigation around fragmented regulation

E78 Partners

JUNE 19, 2025

“We regret implementing XYZ finance system.” It’s a sentiment we hear too often from CFOs—particularly those who were focused on fixing yesterday’s problems instead of preparing for tomorrow’s opportunities. Many finance teams implement ERPs or EPMs that solve point-in-time pain. The result? A complex patchwork of solutions that fit the past but fail the future.

CFA Institute

JUNE 24, 2025

Mee‑Hyoe Alana Koo is a multilingual communication, education, and content professional with more than 15 years of experience spanning journalism, translation, interpretation, and strategic consulting. She holds a B.A. in International Relations & English Literature from Ewha Womans University in South Korea. She is TESOL‑certified (Arizona State University) and a graduate of the Literature Translation Institute of Korea.

CFO Dive

JUNE 23, 2025

The U.S. auditor watchdog got a legislative reprieve through the "Byrd bath" process last week. But the battle over its future is likely to persist, experts say.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Trade Credit & Liquidity Management

JUNE 25, 2025

Traditional credit reports provide a valuable foundation, but they’re no longer enough on their own. Today’s business environment is far more complex and fast-moving than in the past. In this data-driven economy, risk assessment demands more than simply evaluating whether a customer will pay their bills. To truly understand and manage credit risk today, modern companies must look beyond the basics and leverage new technologies, alternative data, and broader information sources.

CFO News

JUNE 20, 2025

Finance Minister Nirmala Sitharaman urged tax officials to enhance GST registration, refund processing, and grievance redressal mechanisms. She emphasized faster GST and customs refunds, reduced dwell times at ports, and speedy closure of investigations. Sitharaman also stressed preventing tax evasion, streamlining GST registration using technology, and resolving taxpayer grievances promptly.

CFO Talks

JUNE 24, 2025

The Board Bought a Fantasy. You’re Living the Nightmare! When a business model stops working, the signs are everywhere. Decisions take too long. People argue over priorities. Teams duplicate work because no one is sure who is responsible for what. Clients feel the disconnect before the board does. And often, finance is the first to spot that the numbers no longer make sense.

Let's personalize your content