SEC approves new PCAOB audit confirmation standards targeting fraud

CFO Dive

DECEMBER 7, 2023

Since early 2021 SEC Chair Gary Gensler has called on the PCAOB to more aggressively oversee the accounting firms that audit publicly listed companies.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

DECEMBER 7, 2023

Since early 2021 SEC Chair Gary Gensler has called on the PCAOB to more aggressively oversee the accounting firms that audit publicly listed companies.

CFO Dive

DECEMBER 7, 2022

The PCAOB cracked down against KPMG for several alleged violations in the latest sign of tougher oversight of the accounting firms that audit publicly listed companies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

CFO Dive

APRIL 12, 2023

Back in September, the Big Four accounting firm announced plans to split its auditing and consulting arms into two entities. Now, ‘Project Everest’ has been halted.

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

CFO News Room

NOVEMBER 14, 2022

accounting regulators to inspect China-based audits is raising questions about the role of unregistered auditors in the Chinese gambling enclave of Macau, where several U.S.-listed audit watchdog. audit watchdog. WSJ | CFO Journal. A recent agreement between Washington and China allowing U.S. Associates Inc.,

Future CFO

MAY 26, 2022

EY is considering a global audit spinoff amid growing regulatory pressure, according to media reports. EY and other Big Four accounting firms — PwC, Deloitte, and KPMG — have long been slammed for their lack of independence in their auditing of company accounts from which they also generate income with consulting, tax, and advisory services.

CFO Dive

MARCH 12, 2025

The audit watchdog imposed fines as high as $700K on nine KPMG member firms for failing to disclose other accounting firms involved in audits, among other quality control violations.

CFO News

DECEMBER 29, 2024

The ICAI is not authorized to issue standards on quality management or amend audit norms for accountancy firms. The dispute arose after ICAI issued new standards and audit changes, which NFRA considered illegal. The matter aligns with aligning domestic audit norms with global standards.

Beacon CFO Plus

NOVEMBER 30, 2023

How to Divide Responsibilities and Prioritize Communication The relationship between a fractional or outsourced Chief Financial Officer (CFO) and your company’s public accounting firm should be collaborative, clear, and well-defined. This ensures your company’s financial and accounting needs are met effectively.

CFO Dive

JUNE 22, 2022

The new requirements come as many companies have expanded their operations globally, leading to an increase in audits executed by multiple accounting firms.

The Charity CFO

APRIL 28, 2023

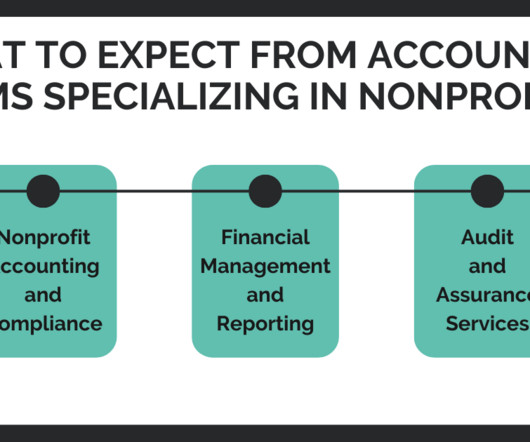

Is there an advantage to working with accounting firms specializing in nonprofits? However, running a nonprofit comes with unique challenges that require specialized expertise, particularly in financial management and accounting. Accounting firms specializing in nonprofits can help you comply with these regulations.

CFO News

MAY 22, 2025

India's Big Four accounting firms, traditionally known for audit and tax services, are now dominating technology consulting. This shift marks a significant pivot, with firms like Deloitte and EY dedicating a large portion of their workforce to this rapidly growing sector.

Future CFO

JANUARY 22, 2024

Two audit firm solutions of Wolters Kluwer have been pre-approved by the Infocomm Media Development Authority (IMDA), a statutory board of the Singapore government, said Wolters Kluwer Tax & Accounting (TAA) Asia Pacific (APAC) recently.

Future CFO

FEBRUARY 23, 2023

Auditing and accounting talent shortage continue to make employers toss and turn, according to a global survey of more than 4,100 accountants and 2,300 auditors. When it comes to talent retention, more than 85% of accountants and 90% of auditors said it is either somewhat or extremely difficult.

CFO News

AUGUST 16, 2024

Accountancy firm PwC has been fined by the UK's Financial Conduct Authority for failing to report suspicions of fraud during an audit of the LCF fund, in the watchdog's first ever fine against an auditor.

CFO Thought Leader

OCTOBER 2, 2024

The Plante’s collaborative culture—not to mention the promise of a CFO role within a few years—aligned perfectly with her leadership ethos and goals. On transitioning from public accounting to industry: “I wanted to feel connected to a business, as opposed to maybe going from every company to company that we were auditing.

CFO News

FEBRUARY 15, 2023

The exchanges had sought a clarification from the company after Business Standard reported that the embattled Adani group had appointed accountancy firm Grant Thornton for an independent audit of some of its companies in a bid to come clean of the damning allegations levelled by the US short-seller Hindenburg Research and to assure investors and regulators. (..)

CFO News

MARCH 25, 2025

Accounting firm PwC has been fined 4.5 The fine relates to PwC's audit of Wyelands Bank's financial records for the year 2019. million (approximately $5.8 million USD) by Britain's Financial Reporting Council (FRC). The FRC announced the sanction in a statement released on Tuesday.

CFO Talks

AUGUST 23, 2023

Nonkululeko Gobodo’s advice for shattering glass ceilings Written by: Leigh Schaller Nonkululeko Gobodo, one of the founders of what would become South Africa’s largest black-owned accounting firms as well as the first black female CA(SA) spoke to Chwayita Deliwe, co-owner of CN Outsourced Finance on the CFOClub Podcast.

Focus CFO

APRIL 7, 2023

We are pleased to announce that Jim Murdy has joined the FocusCFO, bringing his skills to small and medium-sized businesses in Southeast Ohio by providing Fractional CFO services. He reated and managed the first internal audit department at a community hospital located in Wheeling, WV.

BlueLight

JULY 30, 2020

The financial implication of these decision is critical and the CFO is the executive helping the CEO navigate these decisions. Historically, the CFO role was focused on backward looking information: ensuring on-time and accurate financial reporting. The CFO suite doesn’t want to be the “department of No.” It evolves with stage.

PYMNTS

SEPTEMBER 24, 2018

A research firm has discovered that the number of material accounting mistakes made by U.S. Massachusetts-based Audit Analytics looked at disclosures from more than 9,000 U.S.-listed listed companies since 2005, finding firms that had to reissue their financials due to errors. public companies has gone up this year.

CFO News Room

DECEMBER 16, 2022

As a financial executive, the chief financial officer (CFO) is responsible for the financial health of an organization. The CFO role is multi-faceted and includes everything from financial planning and analysis to business budgeting, financial decision-making, and risk management. The CFO primarily controls financial affairs.

The Charity CFO

APRIL 19, 2022

When most nonprofits think about ‘accounting issues,’ they’re concerned about poorly prepared financial reports, bookkeeping errors, gaps in communication with funders, bad audits and a million more things in this vein. Has the Department of Labor audited your organization for misclassifying contractors as employees?

The Charity CFO

JULY 2, 2024

The first thing you need to do to modernize your operations is assess your current processes and policies with an operations audit. During your audit, take a look at your current systems, workflows, and procedures to identify areas that are working well–and those that need improvement. Get the free guide!

CFO News

JULY 16, 2023

The size of the contract will require the Big Four accounting firm to call in staff from other countries to work on the audit, two people told the FT. PricewaterhouseCoopers (PwC), which has been Credit Suisse's auditor since 2020, will audit the acquired bank's accounts for 2023, according to the newspaper.

CFO Talks

AUGUST 10, 2022

Welcome to this SAIBA CFO podcast, SAIBA is the South African Institute of Business Accountants, it has more than 12 000 members in the country and specialises in a wide range of disciplines such as accountancy and tax, training and development, career enhancement, legislation and financial reporting.

The Charity CFO

JANUARY 21, 2022

Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit. But once you start getting larger donations or grants, fund accounting quickly becomes a necessity. .

The Charity CFO

JANUARY 17, 2022

The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. These financial statements are required for a nonprofit audit. Get the free guide!

CFO News

SEPTEMBER 25, 2023

Kishore Biyani, founder of the Future Group, has challenged the forensic audit process and report submitted by accounting firm BDO India LLP and its lender, Bank of India, at the Bombay High Court. This development comes after Bank of India asked Future Retail and its promoters to respond to a forensic audit report.

CFO Talks

FEBRUARY 20, 2024

Farhaan Moolla: Innovative Leadership: The Journey of a modern and dynamic CFO Written by: Staff writer In this podcast Farhaan Moolla, a seasoned CFO with a notable career in financial leadership and strategic planning, shared his journey, beginning with his entrepreneurial family background. Farhaan : Mornin g, Nicola a s !

The Charity CFO

OCTOBER 4, 2022

That doesn’t mean that the operations manager needs to be an accountant. Generally, they’ll oversee the accounting team or work as a liaison with an outsourced accounting firm. But ultimately, they are responsible for ensuring that the accounting work is done correctly and on time. Get the free guide!

The Charity CFO

APRIL 2, 2024

It’s important to do your due diligence when looking for an accounting partner. Nonprofit accounting has several major differences from for-profit accounting. An accounting firm that specializes in nonprofit accounting knows the legal and tax limitations of a nonprofit organization. Contact us today !

The Charity CFO

MAY 31, 2024

Prepare for Audits Inaccurate financial data is one of the top mistakes found in nonprofit audits , but a well-organized bookkeeping system can help you be ready for an audit. Learn More About Nonprofit Accounting Technology Diving into the world of nonprofit accounting software can feel like information overload.

Future CFO

SEPTEMBER 7, 2022

According to to “Sustainability – Jobs and Skills for the Accountancy Profession”, a joint study by ISCA, EY, Singapore Management University (SMU) and Singapore Accountancy Commission (SAC), the chief finance & sustainability officer (CFSO) is an emerging C-suite position.

The Charity CFO

JULY 1, 2024

Nonprofit Accounting Expertise and Experience Nonprofit accounting isn’t the same as for-profit business accounting. Your organization needs a nonprofit accountant who understands the differences and has experience in nonprofit accounting. Get the free guide!

PYMNTS

JULY 5, 2017

For a chief financial officer (CFO), having technology — from ERP systems to cloud accounting and cash forecasting tools — has become paramount when deploying a successful growth strategy. The nature of financial reporting is to communicate facts aggregated using accounting rules. These facts can be audited back to the source.

The Charity CFO

APRIL 25, 2024

About The Charity CFO The Charity CFO is an accounting firm specializing in serving nonprofits through outsourced accounting and fractional CFO services. We know what a nonprofit goes through each day, and we utilize technology to simplify our clients’ accounting processes. Where is the money?

Future CFO

NOVEMBER 27, 2022

Sanjay Patil , executive partner for finance and supply chain transformation at IBM Consulting , ASEAN, says the CFO role is evolving and is now aligned with the priorities of the CEO for the organisation including improved efficiencies and customer experience. Why is artificial intelligence important to the CFO and the finance team?

The Charity CFO

JULY 3, 2024

For example, if you don’t have time to conduct a review, you could hire an external accounting firm to perform an audit or reduced scope of work. An easy solution is to work with a nonprofit accounting and financial firm, such as the Charity CFO, to help you organize and complete your review.

Future CFO

AUGUST 18, 2022

When it comes to ESG assurance, 82% of engagements were limited in scope in 2020, essentially the same as in 2019 (83%), according to a joint study by IFAC, American Institute of CPAs (AICPA) and Chartered Institute of Management Accountants (CIMA) that reviewed data from 1,400 global companies from the G20 nations plus Hong Kong and Singapore. .

https://trustedcfosolutions.com/feed/

SEPTEMBER 20, 2021

As the CFO or Venture Capitalist of a Private Equity Fund, you may already have an ERP system in place. Sage Intacct Is An Excellent Wrapping — Trusted CFO Solutions is the Right Partner. There are multiple accounting firms like Trusted CFO Solutions that work with Sage Intacct. About The Author.

Future CFO

MARCH 1, 2023

Additional key findings Use of Sustainability Accounting Standards Board (SASB) standards and the Task Force on Climate-Related Financial Disclosures (TCFD) framework have increased significantly between 2019 and 2021: there was a 29% increase for SASB standards usage and 30% for the TCFD framework.

The Charity CFO

AUGUST 15, 2023

Myth #3: Nonprofit Accounting (GAAP) and the IRS Rules are the Same Another common misconception is that GAAP and IRS rules are the same when it comes to nonprofits, however, they are not. One key differentiator is that what is recorded following GAAP is what will show up on the audit and may not show up on the IRS tax form, Federal Form 990.

The Charity CFO

APRIL 18, 2024

For instance, working with a nonprofit accountant, like The Charity CFO, can help you reduce your risk of financial non-compliance. Consider these three tips to help you start leveraging data without compromising user data: Use cloud-based accounting and customer data software like QuickBooks Online. Get the free guide!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content