MedTech Bundling Requires Both DSE and Lessor Accounting Solutions

Bramasol

JULY 31, 2023

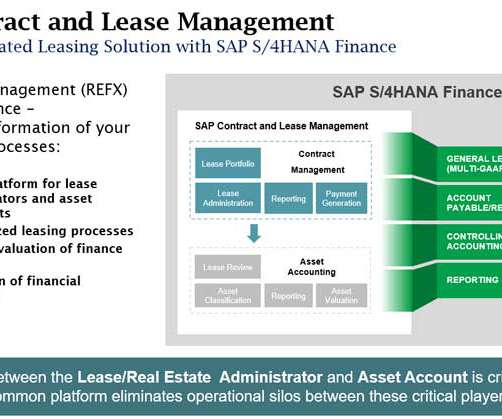

However, even though medical equipment leasing bundled with other services and products is making relationships with customers more holistic, the backend systems for handling lease management and accounting have mostly remained in separate silos from those for subscription management and revenue recognition.

Let's personalize your content