Finance vs. Accounting

CFO Simplified

DECEMBER 12, 2021

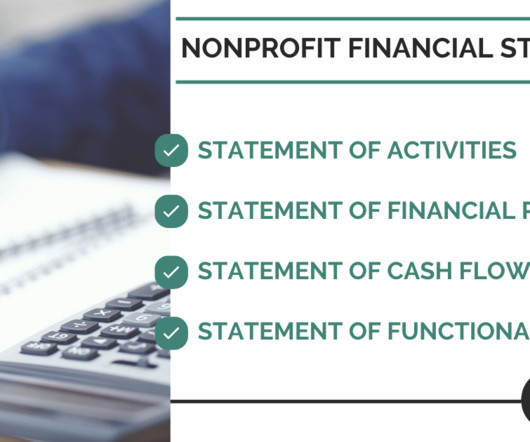

The terms “finance” and “accounting” are often used interchangeably. There are, however, very real differences between finance and accounting. While many business owners look for a CFO to bolster their existing accounting team, here at CFO Simplified, we consider that a CFO would be categorized squarely in the finance category.

Let's personalize your content