Customer Concentration

CFO Simplified

APRIL 15, 2022

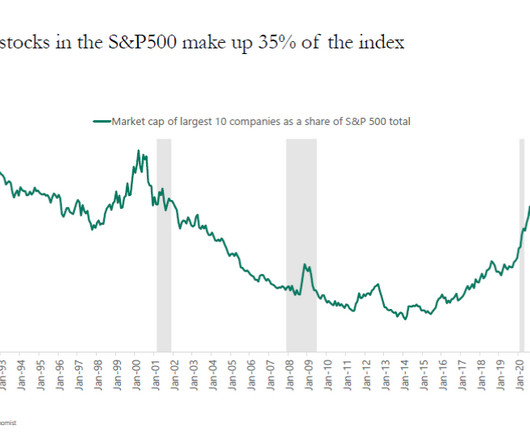

How many customers account for 80% of your sales? Customer concentration had become an ever-bigger problem as borrowing increased. Pricing pressure, inventory requirements, and product development costs had greatly affected profitability. Significant Findings and Recommendations: Reduce Customer Concentration.

Let's personalize your content