Oiling The Many Moving Parts Of Cash Flow Management

PYMNTS

DECEMBER 14, 2020

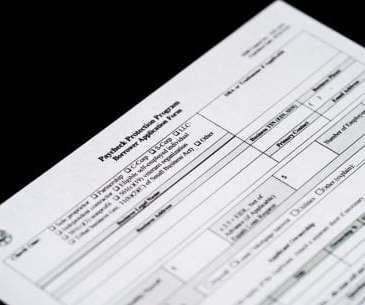

Amid market volatility, organizations are finding it imperative to accelerate their accounts receivables while extending accounts payables and still maintaining positive buyer-supplier relationships. Achieving real-time data analytics is a lofty goal for organizations without the proper tools. Many Moving Parts.

Let's personalize your content