Mastering Financial Services with Cash Flow Management

CFO Plans

OCTOBER 29, 2024

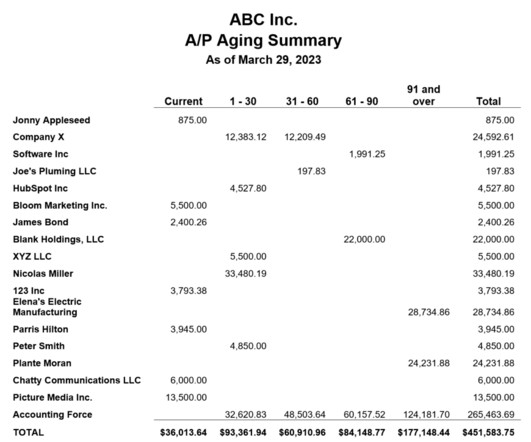

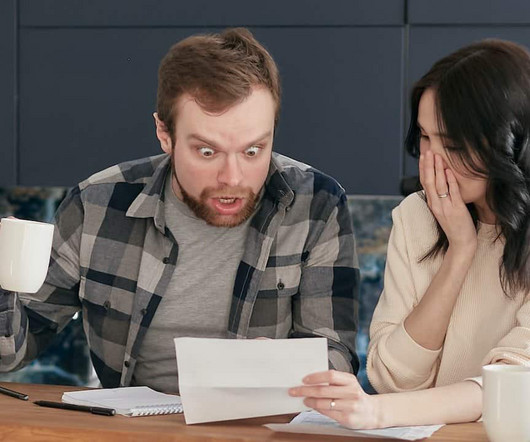

This article explores effective strategies for accounts receivable and payable management, offering actionable insights to enhance financial stability and promote growth. Strategic Budget Planning as a Success Blueprint The journey to financial stability begins with strategic budget planning.

Let's personalize your content