Cube AI suite aims to ease finance platform, communication gaps

CFO Dive

JUNE 2, 2025

With planning now a constant on the CFO’s to-do list, AI can help finance chiefs ease critical communication gaps between platforms, Cube CEO Christina Ross said.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

JUNE 2, 2025

With planning now a constant on the CFO’s to-do list, AI can help finance chiefs ease critical communication gaps between platforms, Cube CEO Christina Ross said.

Nerd's Eye View

JUNE 23, 2025

Advisors have a relatively brief window of time to communicate their value to prospective clients. This means advisors must communicate both their services and values within a very limited – and not always synchronous – span of time. Financially motivated prospects, meanwhile, benefit from clarity and specificity.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

CFO Plans

NOVEMBER 18, 2024

In the ever-evolving financial services industry, maintaining transparent communication between boards and stakeholders is more crucial than ever. Explore Proven Communication Strategies that enhance financial transparency, offering actionable insights for leaders aiming to foster trust with investors and boards.

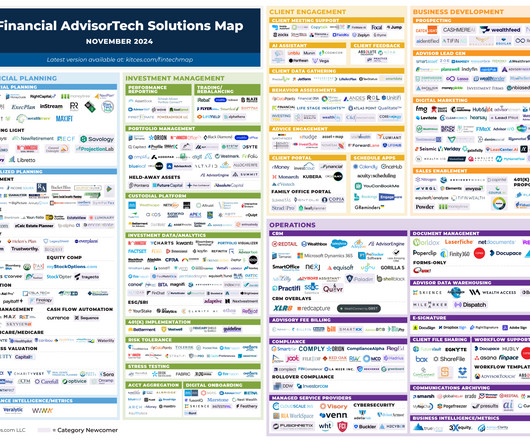

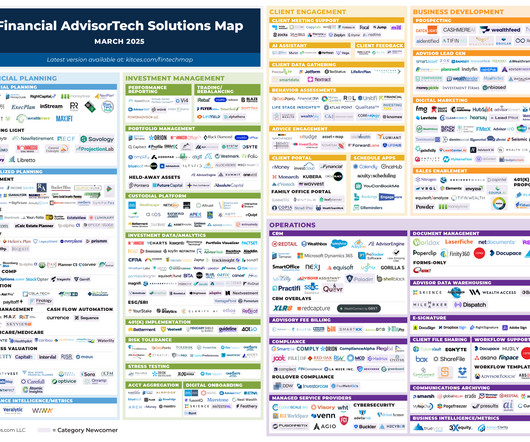

Nerd's Eye View

NOVEMBER 4, 2024

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Advertiser: GEP

Whether you're focused on supply chain planning or logistics and distribution, digital supply chains ensure transparency, communication, collaboration, flexibility, and responsiveness — factors vital to each part of this booming industry.

Nerd's Eye View

DECEMBER 26, 2024

Just a few decades ago, giving financial advice was largely a manual process – printing lengthy financial plans, processing physical checks, and managing paper files. AI offers exciting possibilities as a brainstorming partner, editor, and copywriter.

Nerd's Eye View

MAY 15, 2025

After all, it can feel odd to create an estate plan that will impact a client’s grandchildren… when those grandchildren may be older than the advisor themselves! But walking through every page of a financial plan line by line could take up an entire afternoon and often isn’t necessary.

Nerd's Eye View

JANUARY 15, 2025

The penalty calculations were complex and difficult to estimate, and the provisions were poorly communicated to those affected. This lack of clarity made retirement planning significantly more challenging. Now that the WEP and GPO have been repealed, retirement planning will be significantly easier going forward. Read More.

Embark With Us

MARCH 12, 2025

Communication is the lifeblood of any post-merger integration and ensures everyone, from frontline clinical staff to administrative personnel and patients, stays informed and engaged throughout the process. Early and Transparent Communication of the Integration Plan Don’t be shy about the merger and pending integration.

Advertisement

Setting the stage for successful organizational change always begins with clear, thoughtful communication. When it comes to rolling out a new travel and expense (T&E) policy, establishing a well-structured communication plan is key to ensuring that all employees understand the changes and their impact.

The Finance Weekly

JANUARY 19, 2025

Artificial intelligence (AI) is changing financial planning and how industries operate. This helps businesses allocate resources efficiently and plan for long-term growth. Lets think about it how will you use AI to take your financial planning to the next level? What is AI in Financial Planning?

Nerd's Eye View

NOVEMBER 11, 2024

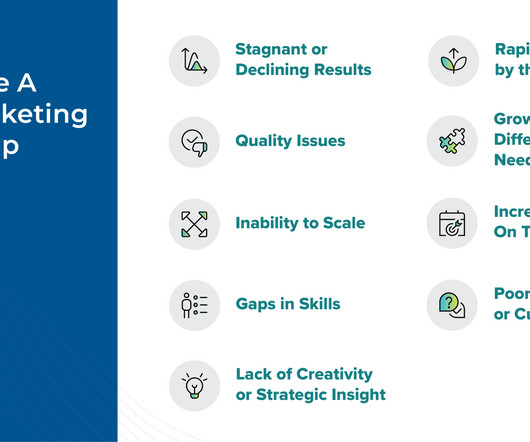

To sustain firm growth, financial advisors often face a dilemma: to focus on what originally drew them to the profession – like financial planning – they often must first do an extensive amount of business development. Even those who do have an interest in marketing may find it challenging to dedicate the time to do it well.

Nerd's Eye View

APRIL 22, 2025

So, whether you're interested in learning about the difference between estate and legacy planning, how to engage in deep legacy planning conversations with clients, or using intimate client events to attract new prospects, then we hope you enjoy this episode of the Financial Advisor Success podcast, with Vanessa N. Read More.

The Finance Weekly

FEBRUARY 22, 2025

Did you know that 47% of businesses still rely on spreadsheets for financial planning, despite the risks of errors and inefficiencies? Workday Adaptive Planning aims to solve this problem by offering a cloud-based Financial Planning & Analysis (FP&A) solution with AI-powered forecasting, budgeting, and workforce planning tools.

CFO Talks

NOVEMBER 14, 2024

Without strong relationships, even the most well-planned strategies can face obstacles, from miscommunication within teams to missed opportunities with clients and investors. Leading by Example Finance teams often look to the CFO for cues on communication and collaboration. This oversight can be costly.

CFA Institute

APRIL 8, 2024

Deana Harmon is the investment director for PNC Institutional Asset Management® responsible for leading the advisory services offering for defined-contribution plans. In addition, as an investment thought leader, Harmon heads the group’s investment insight and communications with clients, the media, and industry leaders.

Global Finance

DECEMBER 18, 2024

Younger, globally minded clients are driving a shift to offshore investments, making strategic and flexible wealth planning more critical than ever. Mariana Oiticica : It is increasingly vital to their long-term strategic planning.

Nerd's Eye View

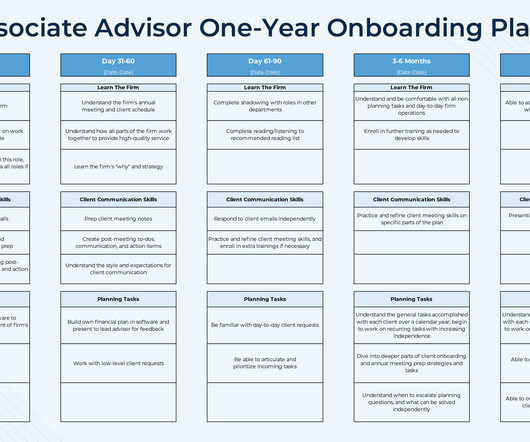

MARCH 24, 2025

For smaller firms – especially those with little to no experience onboarding new advisors – creating a well-paced financial plan can feel daunting. However, a structured and flexible onboarding plan not only helps an associate advisor ramp up efficiently but also ensures a smooth transition into an autonomous and fulfilling role!

CFA Institute

SEPTEMBER 27, 2024

In this role, he leads PNC IAM’s efforts to provide 3(21) investment advisory, 3(38) investment management, financial wellness, and employee education services for defined contribution plans. Dall is a director on the Leadership Committee of Plan Sponsor Council of America (PSCA) and the chair of PSCA's Thought Leadership Council.

Jedox Finance

JULY 3, 2025

You've crafted a brilliant strategy, secured board approval, and communicated the vision across the organization. When it comes to operational planning, FP&A leaders are struggling to connect ambitious strategies and day-to-day reality. Every CFO knows the feeling.

Nerd's Eye View

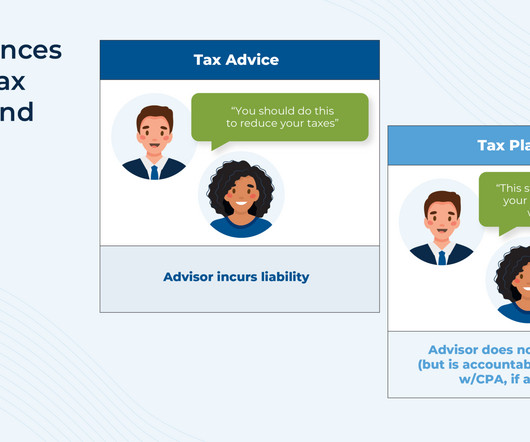

JUNE 18, 2025

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. But as the profession has evolved toward more holistic planning, tax considerations have likewise expanded into more areas of advice, including Roth conversions, charitable strategies, and small business structuring.

Future CFO

OCTOBER 27, 2024

At the forefront of this situation, the archipelago's chief financial officers and finance leaders are expected to be sustainability champions, integrating ESG factors into their financial planning and reporting processes. Sustainable goals often involve investing in new technology processes or even entering a new market.

Fpanda Club

MAY 17, 2022

Budget and annual planning cycle - these words can make many people tremble. Aimed at determining firm’s short-term objectives and transforming them into operational plan by allocating available resources, annual planning exercise is mostly considered by its stakeholders to be a curse rather than a savior. Too much game playing.

Fpanda Club

MARCH 19, 2025

Yes, I said that, I am addicted to financial planning and analysis. After 15+ years in Financial Planning & Analysis (FP&A), Ive learned some hard truths things I wish someone had told me earlier in my career. Listen to understand, not just to reply Effective communication is critical in the world of FP&A.

Lime Light

DECEMBER 10, 2024

In todays fast-paced business environment, CFOs and finance teams must go beyond crunching numbersthey need to communicate effectively, offer strategic insights, and deliver impactful presentations. ChatGPT-4 is a game-changing tool that enhances the efficiency and creativity of finance professionals.

CFO Talks

JANUARY 15, 2025

Vision to Reality: How to Turn Organisational Goals into Achievable Plans Every organisation has a visiona statement of purpose and a picture of the future it strives to create. Your unique perspective on finance and strategy places you at the center of turning big-picture ideas into achievable plans that drive the business forward.

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Pricing the impact of financial planning can be challenging, because many of its benefits – like peace of mind – are intangible, compelling in value but difficult to match with an exact price.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

CFO Talks

NOVEMBER 21, 2024

I believe in breaking challenges down into manageable tasks, which makes them less overwhelming and easier to address systematically. I also rely on open communication and collaboration, particularly when the challenge involves a team. This helps in developing a well-informed strategy to tackle the problem.

Navigator SAP

MARCH 11, 2022

Enterprise resource planning (ERP) solutions have been around for decades, so you likely have a sense of what they can do. Does the lack of communication between your different applications make things harder? Enhance Your Communications and Collaborations Collaboration can make everything run better in a business.

Nerd's Eye View

NOVEMBER 26, 2024

In this episode, we talk in-depth about how Kevin's firm's new hire training program ramps up through the first 6 months, starting with an initial 90-day stage that uses standardized case studies to teach the firm's financial planning process and how to review and input data into the firm's systems, followed by a second 90-day stage that builds new (..)

Future CFO

JANUARY 14, 2025

This means that every decision made in the board room is crucial to the overall results and endpoint of each and every plan and initiative, hence finance leaders should have a clear view of the road they have to take. He says that after a few years of work experience, it is good to start career planning.

CFA Institute

FEBRUARY 8, 2024

In this role, he leads PNC IAM’s efforts to provide 3(21) investment advisory, 3(38) investment management, financial wellness, and employee education services for defined contribution plans. Dall is a director on the Leadership Committee of Plan Sponsor Council of America (PSCA) and the chair of PSCA's Thought Leadership Council.

CFA Institute

NOVEMBER 1, 2024

The secret sauce of Canadian pension plan returns lies in their ability to attract top talent, carefully design compensation frameworks, and adapt to market conditions.

E78 Partners

JANUARY 28, 2025

These delays risked disrupting planning momentum, increasing stakeholder fatigue, and impacting the target companys performance. Solutions: Recalibrate Resource Allocation: Ensure target company resources focus on completing diligence requirements without distractions from PMI planning.

Nerd's Eye View

MAY 19, 2025

While some of these programs still exist, the role of an associate advisor has evolved alongside the broader financial planning profession. Some programs emphasize technical expertise, while others focus on communication skills needed to engage effectively with clients.

Nerd's Eye View

NOVEMBER 29, 2024

Also in industry news this week: While many financial advisors are paying close attention to the potential extension of sunsetting measures within the Tax Cuts and Jobs Act (TCJA) in the coming year, legislation related to retirement savings could be on Congress' agenda as well Fidelity is planning to change the default for its existing RIA non-retirement (..)

Nerd's Eye View

DECEMBER 3, 2024

Read More.

Nerd's Eye View

MARCH 21, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a report from Cerulli Associates found that, amidst an industry-wide trend towards comprehensive financial planning and away from pure transaction-based investment management, asset-based fees currently represent 72.4%

Nerd's Eye View

MARCH 3, 2025

Advisor-focused AI meeting note solution Jump has completed a $20 million funding round, which reinforces its status as the emerging market leader in the crowded AI meeting note category – a status that may only increase from here if AI meeting notes, like most established AdvisorTech categories, evolves into a "winner-take-all" market where (..)

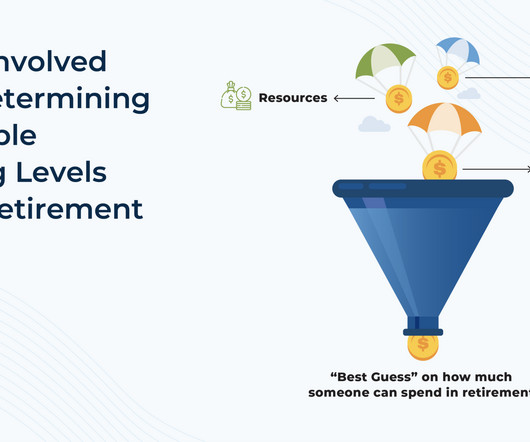

Nerd's Eye View

APRIL 24, 2024

Over the past few decades, advicers have used Monte Carlo analysis tools to communicate to clients if their assets and planned level of spending were sufficient for them to realize their goals while (critically) not running out of money in retirement.

Nerd's Eye View

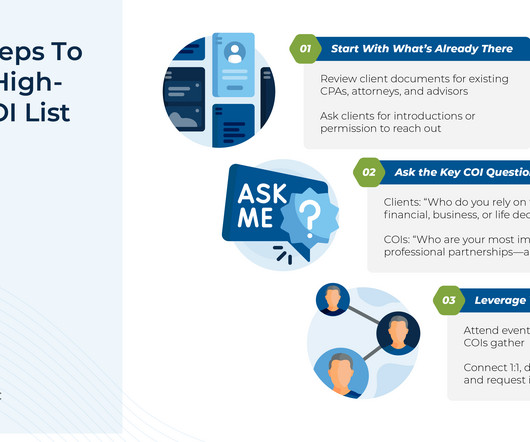

APRIL 14, 2025

In this article, Tiffany Charles, Chief Growth Officer at Destiny Capital, and Kitces.com Senior Financial Planning Nerd Sydney Squires offer a thoughtful framework for approaching COI relationship development with greater intentionality. The first meeting is focused on building rapport and conducting an initial assessment.

Nerd's Eye View

DECEMBER 12, 2024

There's an old joke in the financial planning industry that the ideal client is "anyone with a pulse". In this 153rd episode of Kitces and Carl, Michael Kitces and client communication expert Carl Richards discuss how advisors can navigate the challenge of managing underpaying clients.

Nerd's Eye View

JANUARY 31, 2025

Also in industry news this week: While RIA M&A deal flow hit record levels in 2024 (both in terms of volume and the speed of completing them), firm valuations saw relatively modest gains In its latest annual regulatory oversight report, FINRA joined the SEC in flagging the potential risks to firm and client data from the use of third-party vendors (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content