EY Global IFRS 17 KPI survey

Future CFO

NOVEMBER 28, 2021

EY’s new survey explores changes to KPIs under IFRS 17 and recommends actions insurers should take now. The post EY Global IFRS 17 KPI survey appeared first on FutureCFO.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Future CFO

NOVEMBER 28, 2021

EY’s new survey explores changes to KPIs under IFRS 17 and recommends actions insurers should take now. The post EY Global IFRS 17 KPI survey appeared first on FutureCFO.

Bramasol

JANUARY 16, 2022

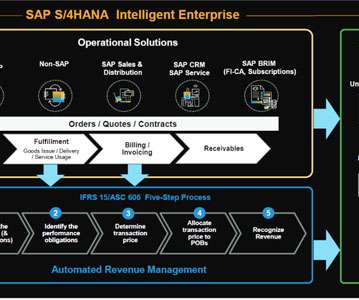

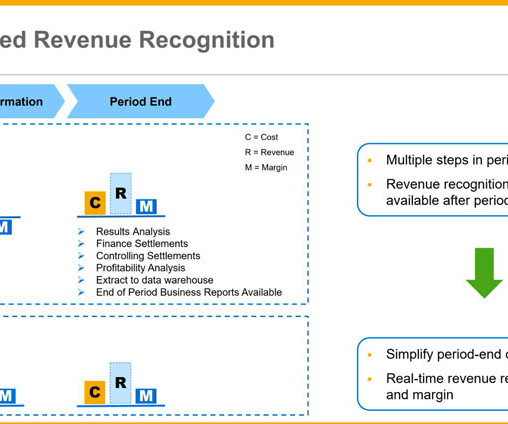

This latest installment in our ongoing DSE blog series takes a step back with a holistic look at the entire order-to-cash process and explores how revenue accounting compliance can seamlessly integrate with DSE. Compliance with ASC 606 / IFRS 15 requires separate cumbersome processes. How to Get Started?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future CFO

FEBRUARY 11, 2020

South Korea life insurance firm Kyobo Life has implemented a high-performance computing platform for IFRS 17 and K-ICS financial reporting compliance, said AON recently. The post IFRS 17: South Korean insurer implements a computing platform for compliance appeared first on FutureCFO.

Future CFO

JUNE 14, 2021

The total IFRS cost faced by the global insurance sector to implement the standard is estimated to hit the range of US$15 billion - US$20 billion, said Willis Towers Watson recently. Estimated IFRS costs vary significantly by insurer size, according to a Willis Towers Watson study which polled 312 insurers from 50 countries.

Bramasol

SEPTEMBER 29, 2023

Globalization CFOs have long needed to assure compliance with two different standards-setting bodies. The other is the International Accounting Standards Board (IASB), whose rules for financial reporting are known as International Financial Reporting Standards (IFRS). More details on climate issues below.)

Bramasol

JULY 22, 2023

Global ESG Regulatory Requirements One of the major ESG compliance developments to watch is the US Securities and Exchange Commission (SEC) proposed regulation on Climate-Related Disclosures and ESG Investing. IFRS S1 requires companies to communicate the sustainability risks and opportunities they face over the short, medium, and long term.

Bramasol

NOVEMBER 8, 2021

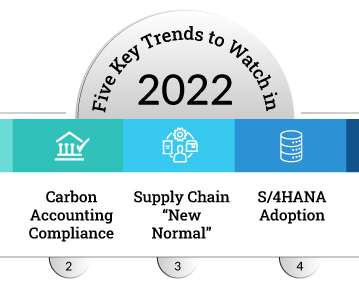

Movement on the part of global accounting groups, such as FASB, IASB and IFRS, to develop detailed compliance guidelines and regulations around carbon-accounting and sustainability. New legislation regarding carbon offsets and disclosure reporting that will materially impact many companies' bottom line.

Reval

MARCH 7, 2017

IFRS 9 is changing hedge accounting forever. Companies in the European Union have only begun to kick off their IFRS 9 initiatives since the European Commission endorsed the standard in November 2016. IFRS 9 Advantages in a Nutshell. IFRS 9 enables hedgers to treat “costs of hedging” as a separate component of equity.

Future CFO

MAY 23, 2021

The post Global IFRS video: Regulatory assets and regulatory liabilities appeared first on FutureCFO. This EY video addresses the IASB’s proposals for the recognition, measurement, presentation and disclosure of regulatory assets, regulatory liabilities, regulatory income and regulatory expense.

Bramasol

OCTOBER 31, 2023

Augmented in recent years by our additional specialization in SAP Quote-to-Cash solutions, Bramasol now offers a unique approach for integrating both frontend customer-facing processes and backend compliance processes within a unified approach that can adapt and scale to virtually any requirements.

Bramasol

JULY 31, 2023

In order to take these bundling scenarios to an optimal level, medical equipment makers need to leverage more integrated solutions that bring all the backend processes together in a seamless end-to-end environment that meshes with compliance and reporting mandates. For revenue recognition, they also must comply with ASC 606 and IFRS 15.

Bramasol

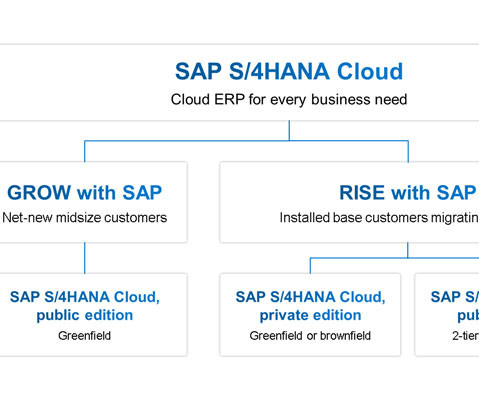

SEPTEMBER 26, 2022

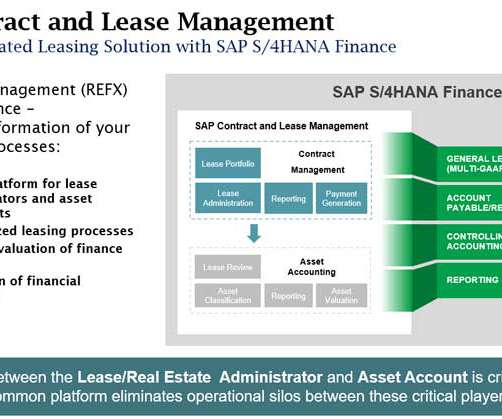

For example, SAP Revenue Accounting & Reporting (RAR) streamlines and simplifies accounting and reporting of complex revenue streams under ASC 606 / IFRS 15 and SAP Contract & Lease Management (CLM) provides asset management and accounting compliance for ASC 842 / IFRS 16. Implementing Anything-as-a-Service (XaaS).

Future CFO

NOVEMBER 2, 2020

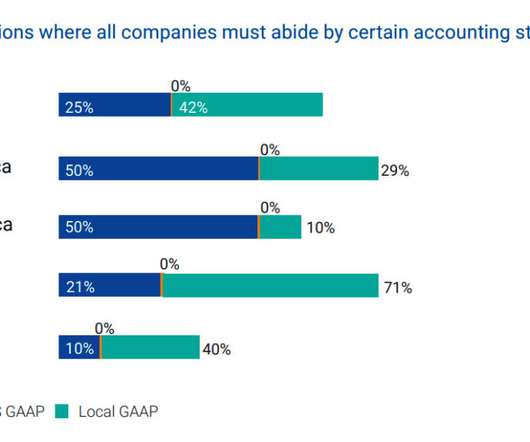

China is the most complex jurisdiction for financial compliance in Asia Pacific while Hong Kong is the easiest, said TMF Group recently. Many jurisdictions are moving towards international accounting standards such as International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP).

Bramasol

OCTOBER 31, 2023

Augmented in recent years by our additional specialization in SAP Quote-to-Cash solutions, Bramasol now offers a unique approach for integrating both frontend customer-facing processes and backend compliance processes within a unified approach that can adapt and scale to virtually any requirements.

Bramasol

SEPTEMBER 12, 2022

Although the initial compliance phase for ASC 606 and IFRS 15 revenue recognition mandates is in the rear-view mirror for most companies, it's important to also keep a focus on the road ahead because optimization of overall RevRec processes across the enterprise will be key to ongoing success.

Bramasol

AUGUST 29, 2022

The shift from CAPX purchase models to subscription based offerings requires medical device manufacturers to adapt their revenue recognition and reporting systems to assure compliance. How DSE Applies to the Medical Device Sector. to optimize readiness, availability, usage levels, locations, maintenance and remote device management.

CFO Share

NOVEMBER 15, 2023

An audit evaluates: Compliance with accounting standards (GAAP or IFRS.) Risks of fraud or non-compliance. Auditors assess your financial statements’ accuracy, ensuring they are free of material misstatements. The validity and accuracy of financial transactions and records. The efficacy of internal controls.

Future CFO

AUGUST 16, 2022

The ISSB, formed by the International Financial Reporting Standards ( IFRS ) Foundation after last year’s UN climate change conference, COP26, published two exposure drafts (EDs) in March 2022 for comment — one on general requirements and a second on climate disclosures.

Future CFO

APRIL 18, 2022

Click on the link to download to discover in detail a list of the benefits that IBM Cognos Controller provide for finance teams: Data collection and validation Reconciliations Workflow and tasks to improve the close cycle Currency conversion Minority interest calculations Inter-company eliminations Group closing adjustments Management adjustments Allocations (..)

https://trustedcfosolutions.com/feed/

JUNE 2, 2022

GAAP, IFRS, and cash base side by side for better visibility. Set spending limits to maintain budget compliance with Sage Intacct Spend Management. Ability to implement user-access controls. Use dimension values to capture your business transactions, operational measures, and budgets in General Ledger. Define your own workflows.

CFO Leadership

OCTOBER 10, 2023

As AI permeates finance, questions about its compliance with audits and financial governance will arise. Fine-tuned AI models could assist with complex regulatory requirements, such as those from IFRS, FINRA, and the SEC. SEC filings, GAAP documentation, FASB accounting standards, IFRS standards, PCAOB, FINRA, etc.),

Future CFO

MARCH 5, 2024

Agriculture, however, falls behind, with 47% of those surveyed in that sector disclosing any form of transition plan.

Future CFO

OCTOBER 27, 2020

TMF Group is a global provider of critical compliance and administrative services, with some 7,800 in-house experts across 80-plus jurisdictions. Local GAAP is much more common than international standards such as IFRS, with 71% of APAC jurisdictions taking the more localised approach. Source: TMF 2020.

PYMNTS

JULY 9, 2020

That can lead to more complex transactions, with amendments to customer orders and more compliance standards, which RecVue’s product can help streamline. RecVue , meanwhile, boasts a revenue management solution that can help companies going through a period of rapid growth in recurring revenue.

CFO Leadership

OCTOBER 18, 2023

As AI permeates finance, questions about its compliance with audits and financial governance will arise. Fine-tuned AI models could assist with complex regulatory requirements, such as those from IFRS, FINRA, and the SEC. SEC filings, GAAP documentation, FASB accounting standards, IFRS standards, PCAOB, FINRA, etc.),

Future CFO

MAY 15, 2023

Technology should be able to unlock cash and working capital assets, uncover savings opportunities in procurement, and ensure hedging and compliance. Effective hedge accounting strategies can be executed with real-time visibility into FX and interest rate exposures, ensuring compliance with regulations such as EMIR and IFRS 9.

CFO Talks

JUNE 7, 2022

The Steward must ensure company compliance with financial reporting and control requirements. Accounting knowledge (IFRS and taxation). Information quality and control rationalisation are top-of-mind issues for the Steward. Competencies include: Working knowledge of risk management, budget, and forecasting tools.

Bramasol

JANUARY 27, 2023

In 2018, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) announced the release of new accounting standards, ASC 842 and IFRS 16, that redefined how organizations must account for leases.

The Finance Weekly

JANUARY 31, 2022

Financial leadership includes strong grip over technical accounting including IAS/IFRS, risk management and compliance, mergers and acquisitions, financial management, financial planning, budgeting & forecasting and integrated financial reporting.

Bramasol

FEBRUARY 29, 2024

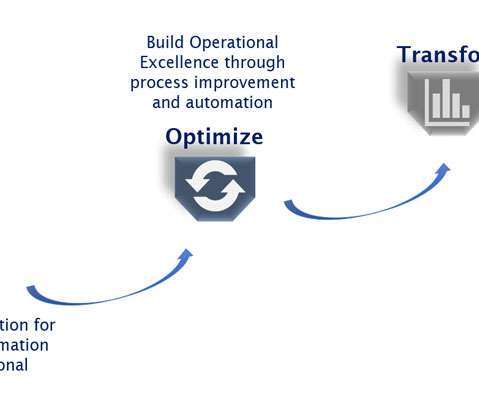

Instead, the Comply, Optimize, Transform approach inherently keeps the future in mind by emphasizing integration of compliance solutions within the overall business operations, while also laying the groundwork for future transformation.

Bramasol

JUNE 10, 2022

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. They also likely will face different taxation structures for specific countries or even local jurisdictions. Controlling (CO).

https://trustedcfosolutions.com/feed/

FEBRUARY 18, 2022

Maintaining accurate records across a diversified portfolio can be a considerable challenge in terms of compliance, transparency, and risk. Financial governance allows your organization to meet compliance requirements, such as IFRS and GAAP updates, by having the right financial controls in place.

Bramasol

AUGUST 31, 2023

Over the past eight years, many episodes in this blog series have focused on revenue recognition and how SAP solutions such as Revenue Accounting and Reporting (RAR) have provided a robust foundation for compliance with ASC 606 and IFRS 15.

CS Lucas

NOVEMBER 29, 2023

There are rollover dates, renewal terms, mandatory pre-payments, covenant compliance, reporting deadlines, administration fees, and much more to orchestrate. This covers volumes, rates, currencies, compliance terms, documentation, counterparties, jurisdictions , timelines, and associated analytics.

Bramasol

OCTOBER 26, 2021

From the beginning of any project, we believe that compliance should never be addressed by using ad hoc or limited scope approaches because such short-term thinking invariably results in process inefficiencies, manual offline workarounds, and a lack of forward migration capabilities. Overview of Comply, Optimize, Transform.

Bramasol

MARCH 24, 2022

This important issue was previously explored last year in Are You Ready for "Carbon Accounting" Compliance? ISSB was established by the IFRS Foundation in response to the Glasgow COP 26 conference in November 2021. and also identified as one the Five Key Trends to Watch in 2022.

The Charity CFO

JANUARY 19, 2023

There are ongoing efforts to establish International Financial Reporting Standards (IFRS) for nonprofits, which, if successful, could result in greater consistency and comparability of financial information across countries. Creating procedures for taking corrective action when necessary.

Bramasol

NOVEMBER 13, 2023

For example, at Bramasol we made a decision over a decade ago to focus on SAP finance solutions for the office of the CFO, with a specific emphasis on the new revenue recognition compliance requirements in ASC 606 and IFRS 15.

CFO Talks

DECEMBER 26, 2021

So that you will eventually have the CFO focusing on three reporting areas, the traditional IFRS, then secondly, business efficiencies, and then because of the difficult economic circumstances we are in, the only way that you can still maintain the bottom line is through better efficiencies. You’ve mentioned the PIC.

Jedox Finance

JULY 11, 2023

Jochen Heßler, Senior Director, Product Management, Jedox Environmental, social, and governance (ESG) has emerged as an important initiative for organizations worldwide as they strive to implement sustainable practices, achieve compliance, and demonstrate substantive value to customers, employees, and investors.

Spreadym

AUGUST 10, 2023

When choosing the best financial reporting software solution, it's important to consider factors such as ease of use, scalability, integration with existing systems, compliance with accounting standards, cost, customer support, and any unique requirements your organization might have.

Bramasol

DECEMBER 13, 2021

From Bramasol's perspective as a leading SAP partner creating business management, finance, and compliance solutions for over 25 years, here are five major areas that we are watching closely and helping our clients prepare to deal with in the coming year - and beyond.

Planful

SEPTEMBER 5, 2019

Planful gives you a robust library of report templates to build the foundation of GAAP and IFRS-compliant balance sheets, income statements, statements of cash flow, and other financial and statutory reports. It integrates with other on-premise and cloud-based business systems to eliminate cut-and-paste tedium and human error.

Planful

AUGUST 1, 2017

US GAAP, Canadian GAAP, IFRS, etc.). Our Consolidation module also helps reduce costs of compliance by generating a broad range of financial statements, with all of the right controls and audit trails to document each step in the process. This includes dealing with the following issues: Currency translation. External board reporting.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content