The evolution of accounting

Future CFO

JANUARY 22, 2024

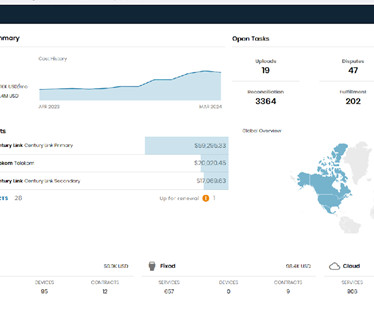

The accounting industry is undergoing profound transformation due to rapid technological advancements across all sectors in the market. Modern accounting software integrates seamlessly with diverse financial systems, automating tasks such as data entry, bank reconciliation, and invoice processing.

Let's personalize your content