CFOs cast wider nets for currency hedges

CFO Dive

DECEMBER 20, 2022

Companies have traditionally relied on such hedging instruments as forward currency contracts, options and swaps. Now many are looking beyond the tried and true.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Currencies Related Topics

Currencies Related Topics

CFO Dive

DECEMBER 20, 2022

Companies have traditionally relied on such hedging instruments as forward currency contracts, options and swaps. Now many are looking beyond the tried and true.

CFO Dive

JUNE 7, 2022

For CFOs intrigued by the promises of cryptocurrency, decoupling the movements of the coin from the promise of virtual currencies’ underlying technology will be key to successful adoption, says Gartner.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFO Dive

FEBRUARY 23, 2023

Though the U.S. dollar has trended weaker since hitting a two-decade high in September, U.S. Bank’s Paula Comings still advises companies to revisit their hedging policies.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFO Dive

AUGUST 15, 2024

Whether for increased revenue or profitability, corporate growth requires price increases — potentially as frequently as every six months, Adam Echter writes.

Advertiser: Fluence Technologies

This checklist covers: Integration of Data Currency Translation Intercompany Eliminations Partial & Cross Ownership Multiple Reporting Standards Financial & Management Reporting Mid-market companies have been forced to rely on standalone Excel and Tylenol for too long.

Global Finance

MARCH 5, 2025

During his campaign, Argentine President Javier Milei promised to close the countrys central bank and adopt the dollar as the countrys currency. According to Leoni, dollarization should be a temporary solution, as the main economic problems are not solved by controlling only the currency emissions. from 2004-2007.

CFO Dive

AUGUST 1, 2023

Mark Shifke steps into the company’s top finance seat as it wraps up bankruptcy proceedings for one of its subsidiaries amid sharpening regulatory scrutiny of the crypto space.

PYMNTS

NOVEMBER 23, 2020

Consumers are moving to digital payments and cryptocurrency in droves, and it’s inevitable that more central banks will issue digital forms of currency, PayPal CEO Dan Schulman said in a televised interview on Monday (Nov. PayPal isn’t the first large name in tech to jump on the digital currency bandwagon. 23) Benzinga report.

CFA Institute

JUNE 4, 2025

This post examines the potential consequences of coordinated dollar depreciation today -- from FX volatility and insurance risk to broader macroeconomic impacts.

PYMNTS

DECEMBER 18, 2020

To that end, the Bahamas may stand out as an epicenter of sorts for the rise of central bank digital currencies (CBDCs). As reported by Reuters , the Sand Dollar – a new digital currency issued and backed by the Bahamian central bank – is now in circulation, and bit by bit, has been making inroads into retail use cases.

Strategic Treasurer

APRIL 30, 2025

Attendees will learn leading practices for identifying currency exposures, executing effective hedges, and optimizing strategies to mitigate FX risk. Access Free Resources The post Webinar: FX Hedging in Highly Volatile Markets: Tools & Tactics for Taming Currency Risk | May 21 appeared first on Strategic Treasurer.

Musings on Markets

JUNE 2, 2025

Sovereign Defaults: A History Through time, governments have often been dependent on debt to finance themselves, some in the local currency and much in a foreign currency. However, those defaults, and especially so in recent years, have been supplemented by countries that have chosen to default on local currency borrowings.

CFO Dive

JULY 8, 2024

The May theft of over $300 million worth of bitcoin from Japanese cryptocurrency exchange DMM Bitcoin is the largest digital currency heist so far this year.

CFO News

MARCH 17, 2025

This decision follows a Memorandum of Understanding signed between RBI and Maldives Monetary Authority in November 2024, aimed at promoting the use of local currencies for bilateral transactions.

Global Finance

MARCH 1, 2025

At the end of January, on a vote of 55-2, El Salvadors Legislative Assembly passed modifications to the Bitcoin law, eliminating the word currency but keeping it legal tender. As part of a $1.4 The changes will take effect May 1, 90 days after the legislation appeared in the official newspaper.

Global Finance

DECEMBER 11, 2024

From a monetary perspective, traditionally Egypt was focused on fixing the foreign currency and protecting the Egyptian pound. Since March 2024, we have been focused on the inflationary effect, currency pricing is set according to market dynamics and so far, it has proven very successful.

Global Finance

OCTOBER 29, 2024

Nigeria’s central bank will automate foreign exchange (FX) trading starting in December, replacing the decade-old over-the-counter system to enhance transparency and liquidity in its currency markets. This shift is expected to level the playing field, reducing opportunities for bias and favoritism in foreign currency allocation.

CFO Talks

NOVEMBER 20, 2024

Handling Currency Complexity As a cross-listed company, your financial reports might be presented in multiple currencies, depending on the requirements of the exchanges. Consider hedging strategies to reduce the impact of currency fluctuations. Miscommunication here can lead to confusion or worse—a lack of trust.

CFO Dive

MAY 24, 2024

and elsewhere have turned to digital assets as an alternative to conventional currencies, according to Deloitte. A growing number of companies in the U.S.

CFO Dive

OCTOBER 31, 2023

The dollar rose against other major currencies during the third quarter, eroding revenues at large companies such as Pfizer and Exxon Mobil, FactSet said.

CFO Dive

DECEMBER 6, 2022

As interest rates have risen against a backdrop of volatile equity and currency markets, lower-risk T-bills are drawing more interest.

CFO News

MARCH 16, 2025

State-owned Engineers India and MECON, alongside four private firms, have been shortlisted for RBI's project to modernize its currency management infrastructure. RBI seeks to address challenges faced by other central banks and ensure sustainable currency management.

CFO Dive

OCTOBER 10, 2022

and market volatility may sustain demand for the dollar, which has soared 18% against a basket of currencies in 2022. Rising interest rates in the U.S.

CFO Dive

JANUARY 27, 2023

The FASB is on track to issue proposed new standards for cyrpto currency by April. The imposion of crypto exchange FTX is likely to sharpen scrutiny of the project.

Global Finance

DECEMBER 26, 2024

Comprehensive FX management integrates tools, analytics, and AI to mitigate currency risks. A comprehensive foreign exchange (FX) exposure management strategy combines tools and techniques to identify, measure, and manage currency risks, empowering businesses to confidently navigate the complexities of the global marketplace.

Global Finance

DECEMBER 26, 2024

Currency reserves could be as low as $200 million. The pound returned to its former value of 13,000 to the dollar. Raoufs longer-term challenges are more than daunting. According to the World Bank, Syrias economy has shrunk by 85% since its civil war broke out in 2011.

Global Finance

DECEMBER 27, 2024

However, there are pockets of risk, including a high public debt, a foreign currency shortage, and jitters over the coming 2025 presidential election. Vital Statistics Location: East Africa Neighbors: Mozambique, Malawi, Zambia, DRC, Burundi, Rwanda, Uganda, and Kenya Capital city: Dodoma Population (2024): 69.3

Global Finance

JUNE 5, 2025

GF : What is HSBC’s strategy for incorporating emerging payment technologies such as digital currencies—including central bank digital currencies (CBDCs)—andhow do you see these impacting your payment solutions? Our innovative analytics tools can detect when a payment is made in an alternative currency.

CFO News

OCTOBER 23, 2024

BRICS nations have decided to boost trade using local currencies and explore new financial infrastructures. They agreed to study the feasibility of an independent cross-border settlement system and establish a BRICS reinsurance company. The New Development Bank will also be developed further.

Global Finance

JUNE 6, 2025

For the most part, a lot of what people are talking about is not a currency. We call it a cryptocurrency, but it’s not a currency. Koller: Stablecoins are cryptocurrencies tied to real-world assets, usually the US dollar or another fiat currency. Koller: We don’t address it, and I’ll tell you why. It is a speculative investment.

Future CFO

JUNE 1, 2025

The region is experiencing easing inflation and interest rates yet remains challenged by heightened geopolitical tensions, especially between the US and China, which impact currency volatility and supply chain strategies. He stresses the critical importance of comprehensive hedging for multi-currency and multi-country exposures.

CFO News Room

JANUARY 18, 2023

Weeks before cryptocurrency exchange FTX filed for bankruptcy , dozens of young Nigerians in skintight dresses and brightly colored suits shimmied under limbo bars, posed for photos in front of the company’s logo and sipped expensive liquor at a swanky beachfront venue.

CFA Institute

JUNE 20, 2024

Pete Vatev, CFA, FRM Pete Vatev, CFA, FRM, is a lecturer in finance at Virginia Commonwealth University’s School of Business in Richmond, VA. Before joining academia, he was in finance where his last job was the head of portfolio risk management at a hedge fund. He holds a BA in economics and an MBA in finance from the University of Chicago.

Global Finance

DECEMBER 5, 2024

Due to our passive position in foreign currency, motivated by our current financing, an exchange loss of 130 billion pesos was recorded, Pemex announced in a financial report. Pemexs total sales were 7.7% lower than in third-quarter 2023. The company blamed a 6.8% depreciation of the Mexican peso against the dollar.

Global Finance

DECEMBER 26, 2024

With FX risk management, adaptability is critical because every company has its own risk profile shaped by its market, currencies, and business model. Identifying exposures accurately is the foundation: knowing exactly where currency risks arise in revenues, costs, or balance sheet items is crucial to ensuring they can be managed effectively.

PYMNTS

DECEMBER 28, 2020

Digital currencies could render the SWIFT global payments network unnecessary, RT.com reported, citing the Central Bank of Russia (CBR). Olga Skorobogatova, first deputy governor of the CBR, said 30 countries are working on their own national digital currencies, some of which could launch in five to seven years.

Global Finance

DECEMBER 26, 2024

During such periods, investors redirect their portfolios quickly, seeking safe-haven currencies to lower their risk levels. This movement of capital to safer markets strengthens the strongest currencies and depreciates other currency pairs. GF: Is there a growing demand for currencies other than the US dollar?

Global Finance

JUNE 9, 2025

Customers can also use Salary Transfer and instant transfer features with these currencies. Reflect benefits from a host of new digital features, including multicurrency subaccounts for deposits, savings, and payments. Arabi Shopix, another Acabes product, is an e-commerce website creation service.

CFO News

MAY 29, 2025

Reserve Bank of India's annual report is out. Security printing costs surged to Rs 6,372.8 crore in 2024-25. This is a 25% jump. Banknote value and volume also saw increases. Rs 500 notes remain dominant. Most Rs 2000 notes have returned after withdrawal. E-rupee usage is up. The central bank is focusing on localizing banknote production.

Global Finance

MAY 16, 2025

” Since the 2019 crash, the local currency has dropped 98% in value and most Lebanese cannot access their deposits. . “Now it needs to be used: whether by banking authorities for restructuring the sector, by the judiciary, or by the tax administration.”

Future CFO

NOVEMBER 19, 2024

Tay notes that Southeast Asia’s IPO market encountered significant regional challenges in 2024, including currency fluctuations, regulatory differences across markets, and geopolitical tensions, which affected trade and investment.

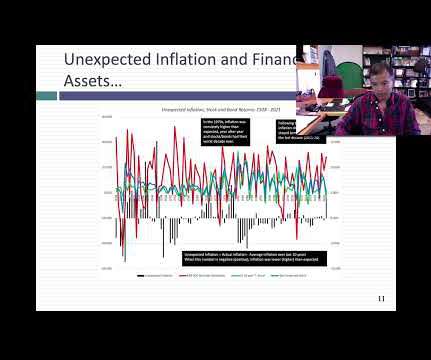

CFO News Room

JANUARY 21, 2023

By the end of 2021, it was clear that this bout of inflation was not as transient a phenomenon as some had made it out to be, and the big question leading in 2022, for investors and markets, is how inflation will play out during the year, and beyond, and the consequences for stocks, bonds and currencies.

CFO Talks

FEBRUARY 18, 2025

Protects the business from risks like currency fluctuations and interest rate hikes. Understanding Market Volatility Market volatility refers to the way stock prices, currencies, and interest rates change over time. For example: If a currency drops in value, imported goods become more expensive.

CFO Dive

FEBRUARY 28, 2024

Can the dollar’s reign as the world’s reserve currency persist? This Fed official makes a strong case, but digital doubts may remain.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content