50 Shades of FP&A Maturity

Fpanda Club

MARCH 28, 2021

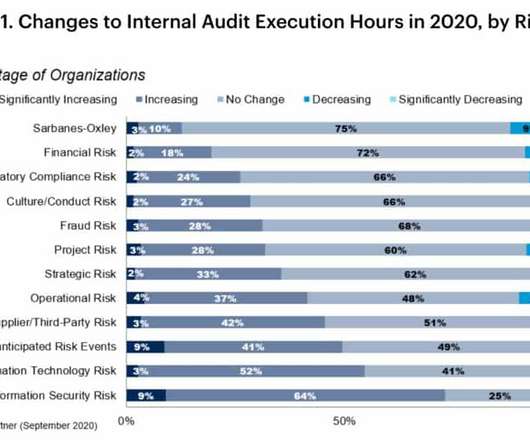

Recent technological advancements and constant changes in the business environment enable the finance function in general and FP&A teams in particular to adopt new ways of work, new practices, new tools to meet the needs of their internal and external customers. Unfortunately, 75% of time of FP&A teams is still allocated to data gathering and process administration.

Let's personalize your content