Office market approaches ‘peak downsizing’ precipice: CBRE

CFO Dive

AUGUST 23, 2024

For the first time since the pandemic, corporate real estate executives’ sentiment has shifted slightly in favor of portfolio expansion, according to a CBRE report.

CFO Dive

AUGUST 23, 2024

For the first time since the pandemic, corporate real estate executives’ sentiment has shifted slightly in favor of portfolio expansion, according to a CBRE report.

Navigator SAP

AUGUST 2, 2024

Consumer shopping patterns are quietly undergoing a dramatic shift as spending has moved from brick-and-mortar retail stores to online webstore purchases, to social selling on TikTok and other social media platforms. Instead of sales happening in dedicated stores, it now is retail everywhere.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

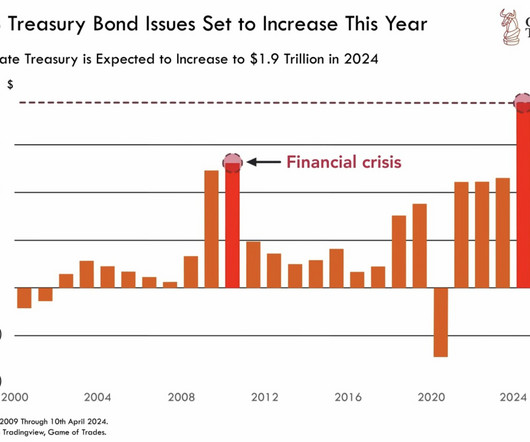

Barry Ritholtz

AUGUST 12, 2024

I’m deep in my book writing work discussing federal debt when I see a tweet that simply epitomizes the entire genre. Full disclosure: My priors on federal debt are that I don’t know where the line of too much should be drawn, but I do know that none of the terrible things we were warned about over the past 50 years due to excess debt have come to pass.

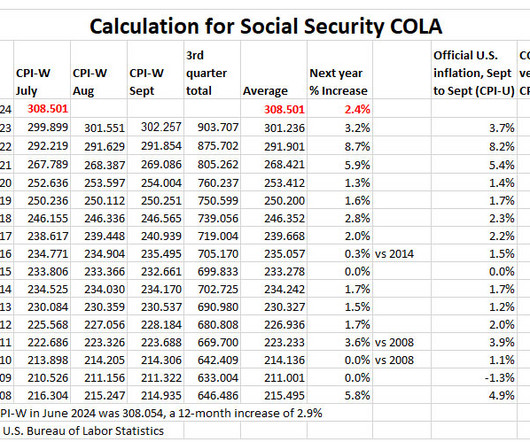

Tips Watch

AUGUST 14, 2024

By David Enna, Tipswatch.com The Federal Reserve got the sort of inflation report it desired for July, with the U.S. annual rate dipping below 3.0% for the first time since March 2021.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

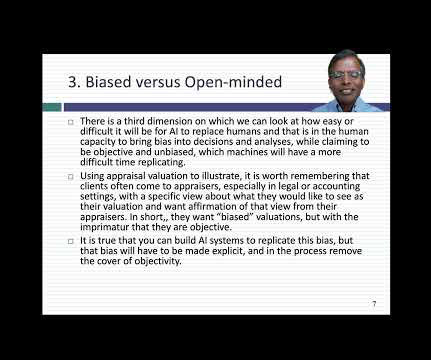

Musings on Markets

AUGUST 28, 2024

It seems like a lifetime has passed since artificial intelligence (AI) became the market's biggest mover, but Open AI introduced the world to ChatGPT on November 30, 2022. While ChatGPT itself represented a low-tech variation of AI, it opened the door to AI not only as a business driver, but one that had the potential to change the way we work and live.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Navigator SAP

AUGUST 16, 2024

Life Sciences businesses are relatively unique. They have long lead times between investments and commercialization, leading to unpredictable revenue streams and cash flow gaps. The cost of research and development also can be a significant drain on resources, requiring precise tracking and allocation so budgets stay in line.

Nerd's Eye View

AUGUST 23, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a new study indicates that while financial advisory firms are largely satisfied with their tech stacks, they take a range of approaches to applying tech: from "innovators" that invest in tech to differentiate themselves from their competition and to enhance the client experience to "operators" that invest in technology largely to improve operations and internal efficiency

Global Finance

AUGUST 16, 2024

The rattled corporation faces a rocky road through a wide-ranging restructuring, but some analysts see a more competitive company emerging. Century-old global mining-and-metals conglomerate Anglo American plc has been on a roller coaster since the end of May, when it dramatically cut off merger talks with rival BHP and instead announced a sweeping restructure of its portfolio.

Driven Insights

AUGUST 2, 2024

SaaS metrics software - also known as subscription billing management software or recurring billing software - should be one of the most powerful weapons in a SaaS CEO's arsenal. The complexities of managing subscriptions are real and the costs of poor subscription management are substantial. Moreover, the SaaS-specific metrics or key performance indicators (KPIs) these systems are capable of producing can be game changing for a management team and board of directors.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CFO Dive

AUGUST 27, 2024

Every transformation should include a robust and detailed business case with defensible and realistic numbers, writes ISG’s Jon Lightman.

Musings on Markets

AUGUST 19, 2024

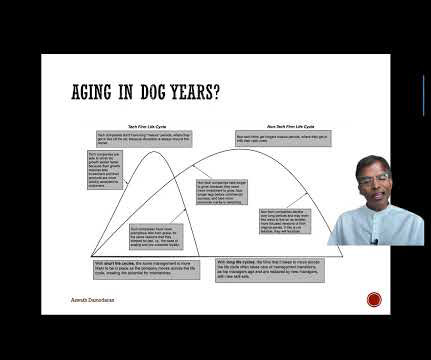

As I reveal my ignorance about TikTok trends, social media celebrities and Gen Z slang, my children are quick to point out my age, and I accept that reality, for the most part. I understand that I am too old to exercise without stretching first or eat a heaping plate of cheese fries and not suffer heartburn, but that does not stop me from trying occasionally.

Navigator SAP

AUGUST 13, 2024

In an era where speed, intelligence, and precision dictate success, Navigator Business Solutions is thrilled to announce the game-changing release of SAP S/4HANA Cloud Public Edition 2408. This isn’t just another update—it’s a revolution in ERP, supercharged by cutting-edge AI that’s set to redefine how businesses operate and innovate.

Barry Ritholtz

AUGUST 11, 2024

Our story so far : Stuck at home over the pandemic, it was a perfect time to revisit a pastime of my youth – buying cheap beater cars, and turning them into something fun and worthwhile. Only this time, I have a lifetime of experience with what does and doesn’t work well, along with a somewhat more generous budget. All of this got restarted about a decade ago; I was personalizing a 2013 flood salvage-title Rubicon ; it reminded me how much fun it was to do these little projects.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Global Finance

AUGUST 1, 2024

Corporate finance experts say going public is cool this summer; that’s not the case for a billionaire hedge fund manager’s overhyped IPO. Toward the end of July, several companies looking to go public told vastly different stories than the one billionaire Bill Ackman weaved on social media. The hedge fund manager grabbed headlines on Wednesday, July 31, when he decided to no longer plan an initial public offering (IPO) for his firm, Pershing Square USA.

Tips Watch

AUGUST 26, 2024

Shorter-term rates will fall. The future of longer-term rates is uncertain. By David Enna, Tipswatch.com Just a few days ago, on Aug. 22, the U.S.

CFO Dive

AUGUST 7, 2024

By taking point on technology initiatives, CFOs can shape the future of how their company leverages new solutions, Workday’s Terrance Wampler said.

Future CFO

AUGUST 8, 2024

Given that ESG and sustainability can drive value, leaders must navigate these with cross-function expertise. According to an industry expert, Scott Lane , CEO and founder of Speeki , a full-service ESG and sustainability reporting and management partner to large multinationals, fund managers and corporates must bring in cross-function ESG generalists to boards, rather than experts with a narrow expertise in sustainability or diversity.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Navigator SAP

AUGUST 30, 2024

Despite what software vendors think, there’s a balance between having the latest features and continuing to use what works even if it is an older solution. Software is a tool for getting something done and not the goal itself for most businesses. But with every piece of software that is used by a business, there does come a time when updating legacy software makes sense.

Bramasol

AUGUST 9, 2024

Bramasol brings you a packaged solution that can get your subscription business up and running in 3 months on SAP Cloud Public Edition. Learn about a powerful solution that enables you to manage a variety of subscription models including tiered pricing, consumption or bundles on an integrated platform including core finance, ERP and revenue recognition.

Global Finance

AUGUST 6, 2024

Daniel Labovitz, the former NYSE head of regulatory policy, is swapping the traditional stock market blues for a greener pasture. As the CEO of the Green Impact Exchange (GIX), he aims to introduce the first US stock market exclusively focused on the $50 trillion-plus global green economy. If GIX gets the green light from the US Securities and Exchange Commission, it plans to kick off trading in 2025.

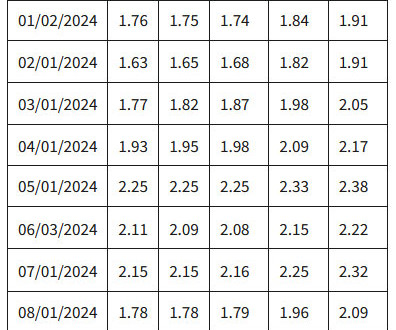

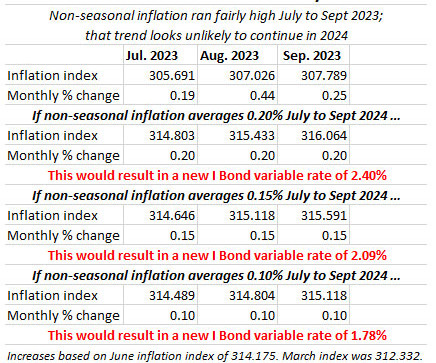

Tips Watch

AUGUST 7, 2024

By David Enna, Tipswatch.com We are halfway through the I Bond’s interest-rate-setting period, with the next reset coming on Nov. 1 — or more probably on Halloween Day, Oct. 31. On that day, the U.S.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CFO Dive

AUGUST 7, 2024

Many companies are zeroing in on data contained in emails and other “unstructured” formats as they rush to lay the groundwork for AI projects, Komprise found in a study.

Future CFO

AUGUST 26, 2024

Amid continued experimentation, increased investment, and early enthusiasm, there is a growing need to demonstrate the value of generative artificial intelligence initiatives, according to Deloitte. The third quarterly edition of the Deloitte AI Institute's "State of Generative AI in the Enterprise" report revealed that data and risk remain key challenges to scaling Generative AI.

Navigator SAP

AUGUST 23, 2024

Consumer products firms selling direct-to-consumers used to be an innovation worth noting. But now it is quickly becoming table stakes as social media becomes a dominant sales vehicle and consumer spending spreads across a wider range of channels.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans. Which wasn't necessarily a big issue back when most clients hired advisors after they had already retired and were able to roll over their employer plans into an IRA managed by the advisor; but as advisors have increasingly taken on working-age clients (and t

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Let's personalize your content