Why agile workforce planning is challenging

Anaplan

APRIL 22, 2021

Learn about the value of and challenges in agile workforce planning from workforce planning experts across a broad range of industries.

Anaplan

APRIL 22, 2021

Learn about the value of and challenges in agile workforce planning from workforce planning experts across a broad range of industries.

CFA Institute

APRIL 18, 2021

Shouldn't all the recent monetary and fiscal stimulus lead to higher inflation? Maybe not.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Jedox Finance

APRIL 22, 2021

What happens when your business plans don’t turn out as thought? To avoid this situation forecasting helps you to be aware of future developments and trends at an earlier time. In this guide we show you what rolling forecasts are, when they really make sense and how you can implement them successfully into your business.

Future CFO

APRIL 21, 2021

The pandemic separates the readiest innovators from the rest, said BCG recently when releasing its report titled Most Innovative Companies 2021: Overcoming the Innovation Readiness Gap. Pharma companies performed strongly this year, joining technology and software companies that have dominated the rankings in recent years, according to the report. The survey — on which the report is based — also identified strong regional variations in the innovation readiness of companies, with China and the US

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Anaplan

APRIL 19, 2021

Digital transformation has opened the door to powerful new ways finance can assess and understand the business, surface insights and opportunities, enable more informed decisions, and contribute measurable business value. This entails systematic changes to the organization’s operating model. Transformational finance leaders are eager to start streamlining business processes and adding new capabilities to analyze […].

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

A Fractional CFO

APRIL 22, 2021

In this quick video, our Founder and CFO, Tony Fremarek, discusses the importance of reviewing your financial statements. Have you reviewed Q1? How does it measure up to your plan? If you aren’t sure where to start, or don’t have a plan… Contact A Fractional.

Future CFO

APRIL 22, 2021

Spend management touches every step of the procure-to-pay (P2P) cycle. Poorly managed spend-related activities, characterised with manual processes, will inevitably lead to overspending, low visibility and other major challenges. Fortunately, a solution is available today to address these problems head on. This Esker eBook identifies the top three pain points associated with current spend management practices and explores how a holistic, AI-driven P2P automation solution can help alleviate these

Anaplan

APRIL 22, 2021

When sales, marketing, and customer service align for end-to-end customer connection, the payoff is streamlined operations and more revenue. .

CFA Institute

APRIL 21, 2021

There is no valid benchmark for the unlisted private equity sector. That needs to change.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Musings on Markets

APRIL 20, 2021

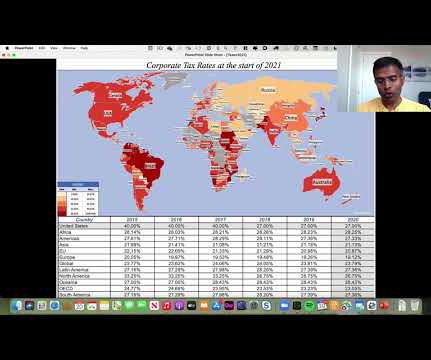

The Biden Administration's $ 2 trillion infrastructure plan, announced with fanfare a few weeks ago, has opened up a debate about not only what comprises infrastructure, but also about how to pay for it. Not surprisingly. it is corporate taxes that are the primary vehicle for delivering the revenues needed for the plan, with an increase in the federal corporate tax rate from 21% to 28% being the central proposal.

Future CFO

APRIL 19, 2021

BlackLine said recently that it has unveiled BlackLine AR Intelligence, the latest offering in its portfolio of accounts receivable (AR) automation solutions designed to complement its broader financial operations management platform. . BlackLine AR Intelligence enables customers to manage financial risks and opportunities by providing access to real-time, actionable data to help them understand their customers’ financial behaviours and use the information to impact strategic and operational dec

PWC UK

APRIL 21, 2021

by Chaitanya (Chet) Patel Senior Manager. Email +44 (0)7506 677656. More articles by Chaitanya (Chet). Continuing our series on opportunities for treasurers around ERP upgrades , it’s worth taking a closer look at the specialist bank connectivity functionality within their TMS. Typically treasury payments are made via the TMS and commercial payments by finance colleagues from various ERPs.

Future CFO

APRIL 20, 2021

How Cloud-Based Automation Supports Your Global Initiative. For over 20 years, many businesses have enjoyed the cost savings, operational efficiencies and process quality improvements that shared services centres (SSCs) were designed to deliver – but often not to the fullest extent. Today, competition has become more intense, cost control more important, and process efficiency pivotal.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

Future CFO

APRIL 18, 2021

Liquidity-fuelled IPO markets in the traditional slow Q1, with 430 deals raising US$105.6 billion in proceeds, said EY recently. The deal number and proceed amount in the quarter represents increases of 85% and 271% year-on-year respectively, which makes the past quarter the best-performing Q1 in the last 20 years, according to the company. Just as traditional IPO markets have been highly active, the special purpose acquisition company (SPAC) IPOs in Q1 have also been breaking records, completin

Future CFO

APRIL 22, 2021

Quarterly VC investment in Q1 2021 flew past the US$100 billion mark for the first time, hitting US$126.9 billion globally across 6,508 deals, up from the previous record of US$98.2 billion across 7,329 deals achieved in Q4’20, said KPMG recently when releasing the latest edition of its quarterly report Venture Pulse by KPMG Private Enterprise. A record nine US$1 billion+ mega-deals by companies located in the US, Asia, and Europe helped drive the surge, contributing more than US$16 billion to t

Future CFO

APRIL 23, 2021

The Luxasia Group is a luxury specialist in retail and distribution with headquarters in Singapore and 15 locations across Asia. It is focused on bringing the best global luxury brands to Asia. As a rapidly growing company in the luxury beauty industry, it was looking to set up a Shared Services Centre (SSC) in Malaysia to centralise its accounting department and automate the processing of supplier invoices — initially for its headquarters in Singapore and then, in a second phase, for its subsid

Future CFO

APRIL 21, 2021

During times of significant disruption and uncertainty, it’s essential for organisations to maintain business process efficiency as well as communication with customers and team members. With more companies making the necessary transition to a remote workforce, it’s changing the way accounts receivable (AR) teams work. Today’s unprecedented situation has had a direct impact on businesses and their ability to manage their AR process and collect cash.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Future CFO

APRIL 20, 2021

Economic integration between China, Japan and Korea will continue to deepen despite China's focus on reducing its dependence on foreign suppliers and developing its technology capabilities, said Moody’s recently. China's booming demand for tech products will continue to boost Korean and Japanese companies, but Chinese competitors pose a long-term threat amid strong government policy support, the credit rating agency noted.

Future CFO

APRIL 21, 2021

We have all heard the phrase, “Necessity is the mother of innovation”. And if 2020 has taught us anything, it is that this is absolutely true. In the wake of the mass business disruption our global economy has seen recently, business leaders are experiencing this concept first-hand — witnessing as cultures evolve in response to unexpected circumstances and act as a catalyst for innovation and change.

Future CFO

APRIL 18, 2021

Organisations that succeed in a changing ecosystem understand that they must be adaptable and empower their workforce by allowing them to focus on a clear mission, said Deloitte. Analysing human connections and using real-time network models can help visualise how decisions are being made and work is getting done in real-time. As a result, organisations can be prepared for change wherever and whenever it happens, the firm added.

Future CFO

APRIL 20, 2021

Business Intelligence is at the crossroads of business and tech and it connects so many different aspects of running the business. It’s a very important, yet often misunderstood and underutilized, part of your organisation. When the data BI brings in is used in a smart and strategic way, it can produce incredible advantages. However, this department needs to be connected to an executive level manager who can manage and promote this data in an effective and convincing way.

Advertisement

In this white paper, we explore the factors to consider in deciding whether the time is right for your Company to consider a new ERP or accounting software, the total cost of ownership and plans necessary to make the potential leap to these systems.

Future CFO

APRIL 22, 2021

As organizations realize the benefits of cloud computing, an increasing number are committed to moving as many of their applications as possible away from their on-premises infrastructure. Research shows that those who achieve this goal can expect to save 16% to 21% in overall IT spending. In addition, buyers rank cloud systems highly for their speed of implementation, scalability, ease of upgrades and agility.

Future CFO

APRIL 22, 2021

Delivering organizational visibility, mission-critical data on a single platform and supporting collaboration across remote work forces, cloud-based software helps companies make quick decisions in today’s unpredictable business environment. When an unprecedented 10-year economic expansion came to a grinding halt in early 2020, a lot of companies were left scrambling to adjust their business processes, workforce and supply chains.

Let's personalize your content