Making family offices your go-to source of capital

CFO Dive

FEBRUARY 17, 2022

The money is often long term and can come with sector expertise, specialists say.

CFO Dive

FEBRUARY 17, 2022

The money is often long term and can come with sector expertise, specialists say.

CFA Institute

FEBRUARY 16, 2022

Will quantum computers break the blockchain?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Private Funds CFO

FEBRUARY 18, 2022

Investec’s Hansford heads to MassMutual; NAV-crazed in Miami Beach; FFA recognizes industry figures.

Navigator SAP

FEBRUARY 17, 2022

How do you keep employees engaged and business thriving in an economic landscape marred by the ongoing effects of the COVID-19 pandemic on society at large? Enterprise resource planning (ERP) systems are one way to keep up with ever-changing variables and to derive the insights that are critical to keep growing your business in uncertain times. The ERP functional areas of management are extensive, as they aid almost every part of a business.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CFO Dive

FEBRUARY 18, 2022

Finance leaders are wrestling with shortages and delays while demand-side pressure from customers can mean costly inventory build-up.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Private Funds CFO

FEBRUARY 17, 2022

Hot topics and goings on at the FFA conference in Miami Beach; StepStone announces new class of partners, managing directors.

Navigator SAP

FEBRUARY 15, 2022

“An investment in knowledge pays the best interest,” said Benjamin Franklin. Enterprise resource planning systems (ERP), such as Navigator’s SAP ByDesign solution, are specifically designed to pay dividends with the kind of knowledge you need to make business-critical decisions.

CFO Dive

FEBRUARY 16, 2022

Women tend to give shorter, less upbeat and clearer presentations and to include more numbers and fewer euphemisms in earnings calls, according to Kate Suslava of Bucknell University.

https://trustedcfosolutions.com/feed/

FEBRUARY 18, 2022

Family offices are growing in popularity. It used to be the domain of a relatively small number of wealthy families. As families continue to increase their wealth, family offices continue to grow and need to be able to organize and centralize the family’s business and personal financial affairs. The management of a Family office can be complex as it generally involves the oversight of a broad range of service providers and entities in the pursuit of managing the family’s wealth.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Private Funds CFO

FEBRUARY 16, 2022

Day one of the Global Fund Finance Symposium; Kline Hill promotes Danielle Buccola to CFO.

Navigator SAP

FEBRUARY 13, 2022

If you’re a small manufacturer looking to go big, how do you get from A to Z with minimal growing pains? You’re going to need increased capacity, a bigger staff headcount, and scaled-up manufacturing abilities—each a challenge on its own. With this combined complexity, you need to manage operations and processes smoothly and be able to adapt quickly before chaos arises.

CFO Dive

FEBRUARY 17, 2022

Companies facing a surge in cybercrime can take several steps to limit the risk — and cost — of a ransomware attack.

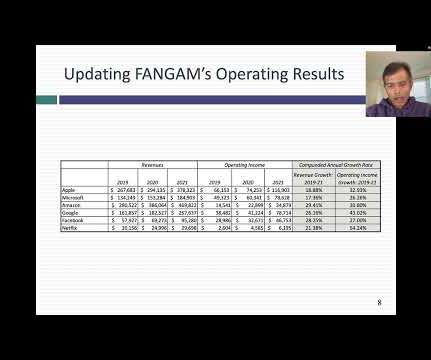

Musings on Markets

FEBRUARY 12, 2022

It has been a rocky year so far, in 2022, with worries about inflation competing with hopes about recovery for the market's attention. In the midst of all the action, to no one's surprise, have been six stocks (Facebook, Amazon, Netflix, Google, Apple and Microsoft or FANGAM) that have largely driven US equities for the last decade, roiling the market with their most recent earnings reports.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Private Funds CFO

FEBRUARY 14, 2022

'A lot of smaller and mid-market funds have no idea what’s about to happen – and even when it happens, they still may not have any idea,' expert worries.

CFA Institute

FEBRUARY 14, 2022

What does the Saudi Arabian National Debt Management Center's debt strategy look like?

CFO Dive

FEBRUARY 16, 2022

CFOs have never had access to more data about their organization’s operations and outputs, but they can’t leverage this resource with legacy systems and manual processes.

Embark With Us

FEBRUARY 17, 2022

When a transaction is on the horizon, you have to be on your A-game. No matter if it's a merger, acquisition, or straightforward investment, it's time to put your best foot forward, shine your company's metaphorical shoes, and give that external party an accurate but compelling reason to proceed with the transaction.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Private Funds CFO

FEBRUARY 17, 2022

The well-known face in fund finance is aiming to start the insurer’s origination business.

Collectiv

FEBRUARY 15, 2022

When enterprises embrace a genuine data-driven culture, it doesn’t just transform efficiency and revenue. It also transforms the employee experience and the overall impact employees can make within the business. Even when the benefits of a data-driven enterprise are clear, it’s common for teams to resist change. This causes enterprise leaders to put off digital transformation, concerned they won’t realize a high ROI due to slow adoption.

CFO Dive

FEBRUARY 18, 2022

Some SPACs with conflicting interests harm investors by bringing weak companies to the IPO market, the CFA Institute said.

Embark With Us

FEBRUARY 15, 2022

Think about the moment you first peered over the rim of the Grand Canyon. Or walked through a grove of towering Sequoias. Or maybe just anything that took your breath away when you initially experienced it. Pretty memorable, right? Did you ever think you'd feel a similar sensation to a tool that will redefine how your finance organization operates?

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Private Funds CFO

FEBRUARY 16, 2022

The private markets investment firm named 17 new managing directors and partners.

CFA Institute

FEBRUARY 17, 2022

This detailed stock market study attempts to extend Robert Shiller’s development of narrative economics.

CFO Dive

FEBRUARY 14, 2022

After a record year for whistleblower awards, SEC Chair Gary Gensler wants to increase the enticements for those who disclose financial misconduct.

The Charity CFO

FEBRUARY 17, 2022

Why does your nonprofit need an operating reserve? . A report released last year by Candid and the Center for Disaster Philanthropy estimated the worst-case scenario would lead to the closure of 38% of nonprofits in the United States. Hopefully, we’ll fall far short of that number. . But there’s little doubt that nonprofits with reserve funds in place were more likely to survive when their offices closed suddenly and funding disappeared almost overnight in 2020.

Advertiser: GEP

“What should we do about the tariffs?” There’s no straightforward answer — every leader has a different expectation. CFOs want numbers. COOs want action. CEOs want strategy. And supply chain and procurement leaders need to be ready with the right response — fast. That’s why GEP has created a simple three-part framework that will help CPOs and CSCOs brief the board and C-suite with clarity and confidence.

Let's personalize your content