Differences Between Budgeting and Forecasting in Business

Spreadym

SEPTEMBER 19, 2023

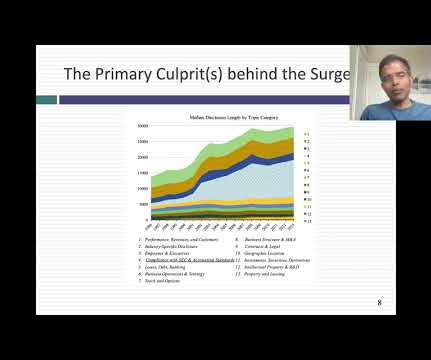

Budgeting and forecasting in business are both financial planning tools used by businesses, but they serve different purposes and have distinct characteristics. Here's an overview of the key differences between budgeting and forecasting. They are meant to provide a current and dynamic view of expected financial performance.

Let's personalize your content