Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

CFO Plans

OCTOBER 29, 2024

A case in point is a mid-sized manufacturing company that saw its accounts receivable days drop by 30% after adopting automated invoicing and digital tracking tools, bolstering their liquidity and paving the way for strategic investments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

CFO Talks

NOVEMBER 11, 2024

Employment Taxes Pay-As-You-Earn (PAYE) : Collected on employees’ income, PAYE is an employer’s responsibility to remit to SARS. Unemployment Insurance Fund (UIF) : This social security tax supports unemployed workers. Both employers and employees contribute, typically 1% of earnings each.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

The Big Picture

JULY 16, 2025

After decades of working, saving, and investing, pivoting to spending down your accumulated wealth can be surprisingly difficult. She joins Barry Ritholtz to discuss what you need to know about planning for retirement. She’s published numerous books on money investing and retirement.

Global Finance

OCTOBER 31, 2024

While home sales and consumer spending have slowed since pandemic-related restrictions ended in early 2023, banks have been busy brainstorming, designing, and introducing clever business strategies, investment paths, and customer services to support and reinvigorate their sector.

Nerd's Eye View

AUGUST 1, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) has proposed an updated Model Rule that would allow state-registered advisors to use testimonials in their marketing materials, four years after the SEC issued (..)

CFO Dive

JUNE 23, 2025

That environment can easily lead to paralysis, with business leaders waiting for more information before undertaking planning actions. However, proactive planning can be a crucial tool that helps businesses to find stability within a challenging environment. What can a business do to plan for continually shifting tax rules?

Nerd's Eye View

OCTOBER 14, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Cost Of Living Adjustment (COLA) for Social Security beneficiaries will be 8.7% for 2023, the largest COLA since 1981.

Nerd's Eye View

SEPTEMBER 20, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) released the latest edition its annual survey outlining the state of state-registered RIAs, showing that the number of state-registered firms and their assets (..)

Nerd's Eye View

SEPTEMBER 7, 2022

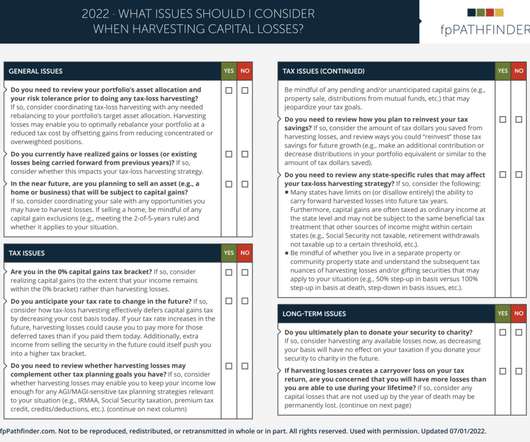

Tax-loss harvesting – i.e., selling investments at a loss to capture a tax deduction while re-investing the proceeds to maintain market exposure – is a popular strategy for financial advisors to increase their clients’ after-tax investment returns. With these three tools (i.e.,

Nerd's Eye View

DECEMBER 25, 2023

We start with several articles on retirement planning: Data showing where American retirees currently stand, from their average net worth to how they spend each hour of the day How, according to a recent study, delaying Social Security benefits typically leads to greater lifetime wealth than claiming benefits early in order to reduce portfolio withdrawals (..)

CFO News Room

DECEMBER 30, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that the passage of “SECURE Act 2.0” has brought a wide range of changes to the world of retirement planning. In fact, while no single change in SECURE 2.0 In fact, while no single change in SECURE 2.0

CFO Plans

OCTOBER 9, 2024

This diligence enabled them to claim substantial deductions, significantly reducing their tax burden and enhancing their financial health. As a result, they were able to invest more in innovation, fueling further growth.

CSC Advisors

SEPTEMBER 27, 2024

5 Tips to Maximize Your SBA Loan Benefits This Tax Season Securing a Small Business Administration (SBA) loan can be a game-changer for your business, providing the necessary capital to invest in growth and operations. This knowledge will help you meet all requirements and maximize your deductions effectively.

CFO Plans

AUGUST 9, 2024

Financial consulting for real estate offers tailored advice on investment strategies, cash flow management, and property valuation. Tip: Conduct regular market analysis with your consultant to stay ahead of industry trends and make informed investment decisions. Optimize your tax planning with expert services.

Spreadym

APRIL 27, 2023

Investment analysis: Business software tools for investment analysis allow you to analyze investment options and evaluate their potential returns. Tax planning: Some financial analysis and planning software includes tax planning tools that help users forecast and minimize tax liabilities and maximize tax deductions.

CFO Plans

AUGUST 23, 2024

Strategic Financial Planning and Tax Savings Tax Planning and Preparation Effective tax planning and preparation can significantly impact your business’s bottom line. A Fractional CFO leverages their in-depth knowledge of tax laws to ensure compliance and identify opportunities for tax savings.

CFO Plans

AUGUST 2, 2024

This evolution allows accounting professionals to focus on strategic activities such as business tax planning and CFO consulting for tech startups, rather than getting bogged down with routine tasks. These platforms offer real-time access to financial data, robust security features, and the flexibility to work from anywhere.

CFO Plans

SEPTEMBER 24, 2024

Discover Digital Accounting Solutions Transition to Cloud-Based Accounting Services Cloud-based accounting services provide unparalleled flexibility and security. This accessibility ensures that business owners and financial advisors can collaborate seamlessly, leading to more effective financial planning and tax strategy formulation.

CFO Plans

JUNE 14, 2024

Cloud-based accounting software offers a seamless, efficient, and secure way to manage your finances. Get started with manufacturing accounting solutions Real Estate Financial Services to Maximize Property Investments Real estate ventures come with their own set of financial complexities.

CFO Plans

SEPTEMBER 24, 2024

Whether it’s optimizing your capital structure or planning for future investments, strategic consulting ensures that your growth is sustainable and aligned with your long-term goals. Get Customizable Accounting Packages Tax Optimization Strategies Maximize Savings Effective tax planning can significantly impact your bottom line.

CFO Plans

SEPTEMBER 24, 2024

For instance, a local bakery might use virtual accounting to manage its cash flow more efficiently, allowing it to invest in new equipment. These services offer personalized guidance on a range of financial issues, from tax planning to investment strategies. Learn more about the benefits of virtual accounting.

CFO Plans

SEPTEMBER 6, 2024

Fractional CFOs usually have a network of professionals providing outsourced tax preparation services, business tax planning services, and accounting and finance consulting. Explore comprehensive financial support with CFO Plans. They help present your financials effectively to attract investors and secure funding.

CFO Thought Leader

OCTOBER 6, 2024

But, recently, we have found that the CFO and the CIO now recognize that they need to work more closely together to drive greater investment in the modernization of financial systems. It’s more about data, and because it’s more about data, there’s more security risk everywhere. Things have changed.

CFO Plans

MAY 30, 2024

Consider the case of a growing tech startup that utilized fractional CFO services to develop a robust financial plan, which helped secure additional funding and scale operations efficiently. Expert accounting consultants can also assist with tax planning and compliance, ensuring your real estate investments remain profitable.

CFO News Room

NOVEMBER 29, 2022

What’s unique about Anh, though, is how, as a solo advisor, she differentiates her firm by leveraging the combination of a high-touch concierge approach to client service with a unique investment management approach through the use of very carefully chosen structured notes to differentiate her portfolio design from other advisors.

CFO Plans

OCTOBER 21, 2024

This priority helped them free up cash flow, which they invested in marketing campaigns to drive growth. A manufacturing firm successfully renegotiated their loan to secure a lower interest rate. Take the next step in securing your business’s financial future with CFO Plans – your trusted partner in financial success.

CFO Plans

OCTOBER 15, 2024

Importance of Adhering to Financial Reporting Standards Accurate and transparent financial reporting is vital for maintaining investor confidence and securing funding. Invest in regular training sessions for your team to keep them informed about the latest financial compliance checklist updates.

CFO Plans

SEPTEMBER 24, 2024

Get expert cash flow management advice to secure your startup’s future. Virtual CFOs provide startup financial advisory services, offering strategic insights and guidance on financial planning, investment decisions, and risk management.

CFO News Room

DECEMBER 20, 2022

Emily is the Senior Financial Planner for Archer Investment Management, a virtual Independent RIA based in Austin, Texas, that oversees $170 million of assets under management for nearly 170 families. And so, ultimately, I… Michael: Not actually that deep on your business succession planning experience as a 20-year-old.

CFO News Room

NOVEMBER 30, 2022

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Barry Ritholtz

AUGUST 15, 2023

Let’s talk a little bit about your alternative investments career. And so alongside of Wall Street recruiting in my senior year, I interviewed at the Yale Investments Office and was fortunate to get that job and violated the two principles I had at the time, which was I wanted to be in a training program and I wanted to leave New Haven.

CFO News Room

FEBRUARY 2, 2022

And that takes you down a road of increasingly complex or sophisticated investment vehicles, the move towards alternatives, the move towards private equity and hedge funds and a lot of different things that get done with the portfolios of high-net-worth clients. Estate planning is commonly a big point of discussion, as well.

CFO News Room

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

CFO News Room

NOVEMBER 19, 2022

A potential compromise during the lame-duck Congressional session could see a boost to the child tax credit and extended tax breaks for businesses. From there, we have several articles on tax planning: How advisors can add value for their clients by managing their exposure to mutual fund capital gains distributions.

Global Finance

DECEMBER 6, 2024

This is particularly true given the faster investment returns and higher geopolitical tensions experienced by the affluent in 2024. For ultrahigh net worth (UHNW) clients, the bank offers access to special exclusive investment opportunities tailored to clients investment knowledge and risk appetite. trillion under supervision.

CFO News Room

DECEMBER 26, 2022

Financial Planning. 101 Things That Advisors Actually DO To Add Value (Beyond Just Allocating A Portfolio) – Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients.

Barry Ritholtz

OCTOBER 19, 2022

That group provides investment services, education and research to more than a thousand financial advisory firms, representing more than $3 trillion in assets. People may not even really understood that they own the company, you know, by investing in the funds in the company. They’ll do tax planning, right?

CFO News Room

NOVEMBER 15, 2022

And that’s what they get for the fact that they have to be part of the calls, they have to facilitate interaction with the insurance company or any transactions, because it’s a securities business, you don’t have a securities license now. And then in July 1 of this year, we launched our own registered investment advisor.

CFO News Room

DECEMBER 17, 2022

But in the world of financial advice, there so far has been little regulation on advisor titles ( unless someone tries to call themselves an “investment counselor”, which ironically is still regulated under the Investment Advisers Act of 1940 ). But many firms will find that their client referral rates are flat.

CFO News Room

FEBRUARY 2, 2022

Dan is a Partner and the Chief Investment Officer at Capasso Planning Partners, a rapidly growing independent RIA based in Charleston, South Carolina that oversees about $250 million of assets under management for 300 client households across the country that are all served virtually. Executive Summary. Dan: It’s interesting.

CFO News Room

NOVEMBER 8, 2022

And the four pillars are the financial plan, risk management, so just checking all their what-if scenarios that something…a husband dies, wife dies, long-term care, disability. And then we look at estate planning. And then in the fall, we look at tax planning. The other one, he’d been there maybe four years.

CFO News Room

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 Executive Summary.

CFO News Room

NOVEMBER 26, 2022

We also have a number of articles on retirement planning: How advisors can incorporate Social Security benefits into a client’s retirement asset allocation. The end of the year is often a busy time for financial advisors, as they help clients with year-end tax planning, taking the proper RMDs, and other time-sensitive tasks.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content