How CFOS are balancing investments between technology and talent

CFO Dive

DECEMBER 5, 2022

As CFOs move from efficiency to value creation, where does the balance lie between investment in technology and investment in people?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

DECEMBER 5, 2022

As CFOs move from efficiency to value creation, where does the balance lie between investment in technology and investment in people?

CFO Dive

JULY 18, 2022

Citigroup marches forward with technology investments as companies rethink their tech spending.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

CFO Dive

NOVEMBER 30, 2022

Investing in digital skills can help financial leaders better prepare for the ‘autonomous finance’ future, where human employees collaborate alongside machines for best results.

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Musings on Markets

APRIL 20, 2025

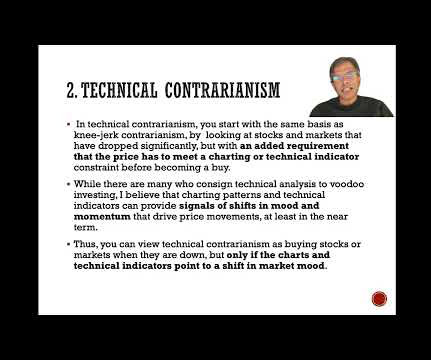

Buying the dip" falls into a broad group of investment strategies that can be classified as "contrarian", where investors act in contrast to what the rest of the market is doing at the time, buying (selling) when the vast majority are selling (buying) , and it has been around through all of market history.

Advertiser: GEP

As inflation and geopolitical instability worsen, many companies are going slow on investments. But investing in supply chain and procurement technology will help manage inflationary pressures better. Here are 3 tools that GEP recommends for your company to use.

CFO Dive

OCTOBER 10, 2022

Most CFOs are evaluating technology investments on a case-by-case basis, while about 33% report they have the appetite for aggressive investment in order to outstrip their competitors, the study found.

Global Finance

JANUARY 31, 2025

After the space sector, India opened up its last frontier, nuclear power, to private investments with an immediate market potential worth $125 billion. To begin with, 50 small pressurized heavy water power reactors with capacities of 220 MW each will be lined up with an investment of $26 billion.

Global Finance

DECEMBER 6, 2024

Global Finance: How has sustainable investing evolved as an aspect of long-term wealth planning? Daniel Wild: Sustainable investing has become a core component, with the approach becoming increasingly nuanced to reflect clients goals. GF: How crucial is it for banks to develop proprietary models for sustainable investing?

CFO Dive

FEBRUARY 10, 2022

Inefficient use of technology often takes root early. Knowing why employees avoid or under use new tools can help you leverage your spend.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment.

CFA Institute

JUNE 10, 2025

Markus Schuller is the founder and managing partner of Panthera Group, a multi-award-winning firm recognized for pioneering the practical integration of Human and Artificial Intelligence into institutional investment processes. Originally from Washington, D.C., Wojtek Wojaczek, PhD, is a finance executive, educator, and ecosystem strategist.

CFO Dive

JANUARY 16, 2024

The technology also triggered concerns including the potential for data privacy risks and negative workforce impacts such as job displacement.

Future CFO

MARCH 26, 2025

Chief financial officers are in it for a balancing act on sustainability mandates, technology investments, and economic and geopolitical shifts. Other key takeaways are the following: AI investments should be aligned with business objectives and demonstrate clear ROI.

E78 Partners

NOVEMBER 22, 2024

Effective technology expense management is essential for companies looking to optimize budgets and stay competitive in today’s fast-paced digital landscape. Businesses must develop a strategic approach that addresses common obstacles and ensures that technology investments align with their operational goals to avoid these issues.

E78 Partners

DECEMBER 12, 2024

The coming together of private equity and technology is redefining how organizations operate, innovate, and compete. For private equity backed firms, adopting cutting-edge technological solutions is not just an advantageits a necessity for maximizing efficiency, driving growth, and maintaining a competitive edge.

Barry Ritholtz

JANUARY 8, 2025

This is no time for confessing At The Money: with Matt Hougan on Crypto Technology (January 8, 2025) Are you crypto-curious? Fulltranscript below. ~~~ About this weeks guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. I’m Barry Ritholtz.

E78 Partners

JANUARY 29, 2025

Effectively managing technology expenses is more important than ever. This is where technology expense management automation comes into play. E78 explores how AI in technology expense management (TEM) is transforming the landscape of expense management, providing businesses with enhanced visibility, automation, and financial control.

Future CFO

FEBRUARY 19, 2025

As the Asia-Pacific region faces a financial revolution, micro-investments gain traction in transforming how people engage with financial markets. Nellutla enumerates key trends driving micro-investments in APAC: 1. The Rise of ESG and Sustainable Investing Consumers in APAC are increasingly conscious of where their money goes.

CFA Institute

JANUARY 8, 2025

Our Conversations with Frank Fabozzi, CFA series aims to bring leading experts in finance and economics into dialogue to explore critical issues shaping the industry's future.

Future CFO

FEBRUARY 9, 2025

In this environment, CFOs must prioritise cybersecurity investments that deliver a tangible return on investment. One of the main challenges in securing cybersecurity investments lies in the nature of cybersecurity itself. How can we maximise the return on these investments while achieving our security goals?"

Barry Ritholtz

FEBRUARY 25, 2025

The transcript from this weeks, MiB: Charley Ellis on Rethinking Investing , is below. Charlie Ellis is just a legend in the world of investing. He was chairman of the Yale’s Endowment Investment Committee and his, not only did he write 21 books, his new book, rethinking Investing, is just a delightful snack.

Global Finance

DECEMBER 18, 2024

Younger, globally minded clients are driving a shift to offshore investments, making strategic and flexible wealth planning more critical than ever. Global Finance : How is the increased demand for offshore investments in Latin America impacting high-net-worth clients long-term strategies?

CFO Thought Leader

DECEMBER 1, 2024

In this episode of Planning Aces , Jack Sweeney and Brett Knowles share insights from CFOs Sandra Wallach (Amprius Technologies), David Morris (Guardian Pharmacy Services), and David Eckstein (Vanta). Brett Knowles: Identifies a “crawl, walk, run” approach to technology adoption and its impact on FP&A as a strategic partner.

CFO Dive

JULY 16, 2024

While AI investments are surging, many companies are failing to invest in infrastructure necessary to optimize the technology, the research found.

E78 Partners

MAY 14, 2025

Technology is reshaping private equity (PE) by enabling portfolio companies to achieve operational efficiency, revenue growth, and higher valuations. The technology function is now emerging as an indispensable partner in driving sustainable value creation and competitive advantage.

CFO Dive

MARCH 2, 2023

Only 34% of large companies showed signs of being strategic about their technology investments in financial disclosures, according to a recent report from Deloitte.

Global Finance

DECEMBER 27, 2024

Tanzanias socioeconomic transformation drives economic dominance by attracting substantial investments and dominating intraregional trade. Stable democracy, accompanied by critical economic reforms and interventions, has seen Tanzania emerge as a bastion of foreign direct investment (FDI). Outsiders, however, are taking note.

CFO Talks

MAY 8, 2025

How Savvy CFOs Evaluate Investment Risks As a CFO, you know that investment decisions can be a game of high stakes. Whether its expanding into a new market, acquiring a promising technology, or simply diversifying your organisations portfolio, every opportunity comes with a side of risk. Risk Without Reward?

CFO Dive

AUGUST 6, 2024

Companies that invest in the pricey technology may need to wait two to three years on average to see a return on investment, market analyst Ash Sharma said.

CFO Thought Leader

MAY 15, 2025

Today, every tech investment starts with clear KPIs; initiatives missing targets are terminated early to redeploy capital more productively elsewhere quickly.

E78 Partners

APRIL 16, 2025

Technology is embedded in every corner of the modern enterprisefrom SaaS subscriptions and cloud infrastructure to telecom and mobile services. As organizations scale, so do their technology expenses. What if TEM was thought of as a strategic lever for CFOs and CIOsa way to align technology investment with business value?

Global Finance

APRIL 5, 2025

Throughout 2024, the infrastructure sector was highly active for investment bankers, with robust deal flow across renewable energy, digital transformation, and critical infrastructure projects. In October, the firm partnered with the European Investment Bank (EIB) to create a portfolio of bank guarantees of up to 1 billion (about $1.1

CFA Institute

MAY 14, 2025

Dan Philps, PhD, CFA, is the head of Rothko Investment Strategies, where he leads an AI-driven systematic equities investment business that has delivered strong, fundamentally-driven alpha for institutional investors since its inception in 2013. He is a CFA charterholder and a member of the CFA Society of the UK.

Global Finance

DECEMBER 27, 2024

New technologies promise vast increases in growth and efficiency. Disruptive technologies are not only reshaping the business landscape, but forcing CFOs to rapidly evolve their strategies and embrace innovation. They need to understand what capabilities and return-on-investment will be delivered. CAGR to 2034.

CFO Dive

JUNE 13, 2022

To navigate a “constantly changing” macro-economic environment, State Street is focusing on reducing its day to day technology spend in favor of more strategic operational investments in AI, automation and like technologies, according to its CIO and CFO.

CFO Dive

JANUARY 14, 2025

Only 2% of C-suite leaders plan to invest $250 million or more in the technology this year, KPMG found.

Global Finance

APRIL 5, 2025

trillion of investment-grade and $419.8 Investment-grade bond volume is down 14% thus far across the globe and global high-yield volume is 16% lower. So far in 2025, the bank has served as a bookrunner for Mars substantial, eight-part investment-grade bond issue, aimed at financing the acquisition of Pringles maker Kellanova.

Global Finance

APRIL 5, 2025

The top three sectors when it comes to dealmaking, according to McKinsey, are global energy and materials (GEM); telecom, media, and technology (TMT); and financial services. billion in 121 projects across six countries, nearly double the amount it invested in 2023. In Ukraine, the bank deployed $2.6 billion valuation.

Future CFO

JANUARY 22, 2025

At the FutureCFO Conference series, organised by Cxociety, finance leaders in Indonesia, Malaysia, Singapore, the Philippines and Thailand ranked automation and degitalisation (80%), investing in talent and employee development (58%) and continuous innovation (47%) as the top three strategies most important to sustainable growth in 2024.

Barry Ritholtz

NOVEMBER 26, 2024

Full transcript below. ~~~ About this week’s guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. I’m Barry Ritholtz, and on today’s edition of At the Money , we’re going to discuss how retail investors can responsibly invest in crypto.

Global Finance

APRIL 5, 2025

Until more information becomes available, lets celebrate the investment banks that brightened up the M&A landscape in 2024. As a top Asian investment bank, UBS completed 30 transactions last year with a total deal value of $14.4 ADIA and APG acquired a 53.3%

CFA Institute

JANUARY 7, 2025

He is pursuing a PhD at CentraleSupélec, specializing in natural language processing to develop decision models for financial market investments. He has more than 15 years' experience in investment management and research. Baptiste Lefort is a data scientist and PhD student. Eric Benhamou, PhD, is head of R&D at AI For Alpha.

CFO Plans

MARCH 2, 2025

By implementing flexible financial management practices, they maintained liquidity and invested in innovation, positioning themselves ahead of competitors when the market rebounded. The post Navigating the Whirlwind of Change in Technology appeared first on CFO PLANS | Blog.

CFO Dive

APRIL 26, 2024

The federal government has stepped up investment in quantum technologies, more than doubling research and development spending since 2019.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content