How Much Equity Should a Business Give Away?

CFO Share

MAY 6, 2022

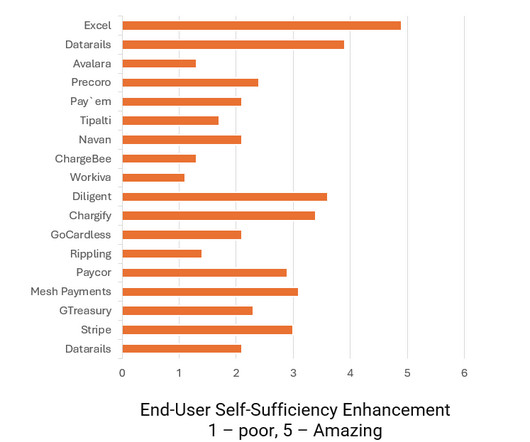

Giving away company equity in a startup . How to value startup equity. You still own the same number of shares, but the total number of shares has increased. The sooner your exit, the less risk meaning you get a higher valuation. This can range from 0.1% Three years? Five years? Funding Rounds.

Let's personalize your content