The crucial role of legal expertise in mergers and acquisitions

One to One

JANUARY 12, 2024

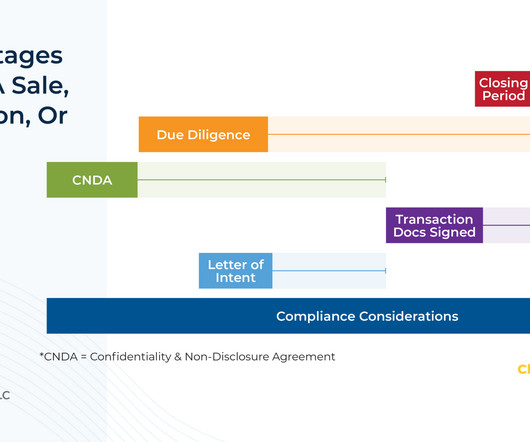

Mergers and acquisitions (M&A) are complex, high-stake transactions that demand a blend of strategic insight, financial acumen, and legal expertise. The post The crucial role of legal expertise in mergers and acquisitions appeared first on ONEtoONE Corporate Finance. While M&A advisory firms play Read More.

Let's personalize your content