European Banks Pursue Mergers To Gain Competitive Edge

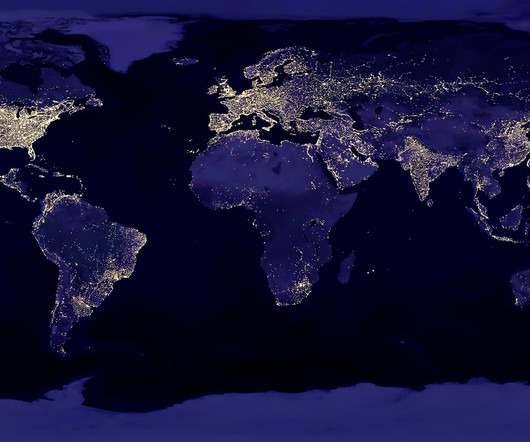

Global Finance

FEBRUARY 14, 2025

Lenders across Europe are ramping up M&A efforts to scale operations, strengthen balance sheets, and navigate an evolving financial landscape. With interest rates stabilizing and capital reserves at healthy levels, banks are taking advantage of strategic acquisitions to fuel growth and enhance profitability. trillion.

Let's personalize your content