Understanding the M&A Process Before Making a Deal

CFO Talks

FEBRUARY 26, 2025

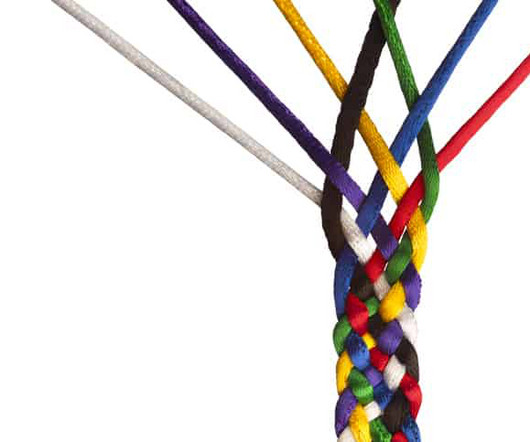

Understanding the M&A Process Before Making a Deal Mergers and Acquisitions (M&A) are some of the biggest decisions a business can make. To make M&A work, companies must carefully analyse the target business, negotiate the right price, and successfully combine both businesses.

Let's personalize your content