3rd Quarter Economic And Market Outlook: Understanding Risks And Opportunities In The Web Of Inflation, Interest Rates, Valuations, And More

Nerd's Eye View

OCTOBER 4, 2023

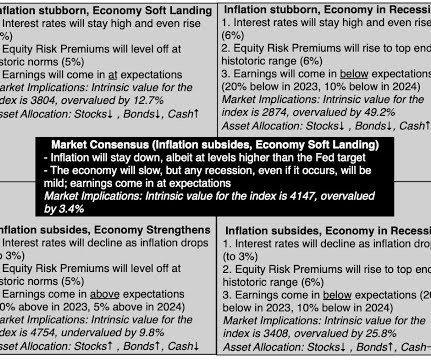

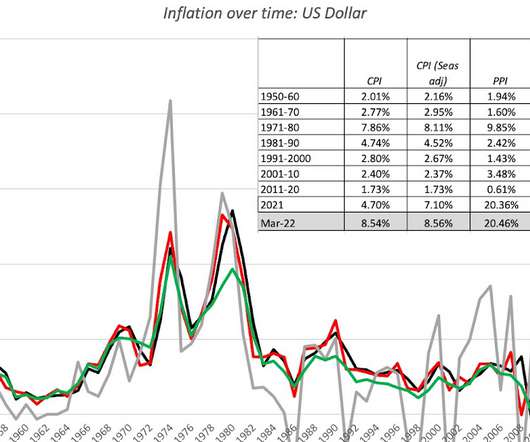

People often talk about "the economy" as a single entity whose parts move in unison, with a small number of key indicators (such as GDP, the unemployment rate, and inflation) moving reliably in relation to each other.

Let's personalize your content