Nonprofit Compliance Requirements

The Charity CFO

APRIL 5, 2023

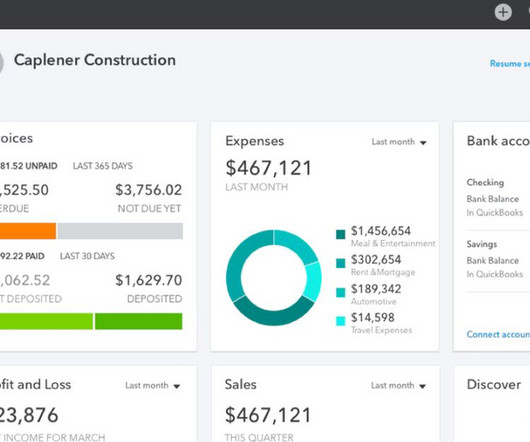

In order to confidently run your organization, it’s important to have a strong understanding of nonprofit compliance requirements. In addition to the many struggles of running a business, nonprofits have additional hurdles to overcome as it relates to their mission, employment strategy, accounting, and compliance.

Let's personalize your content