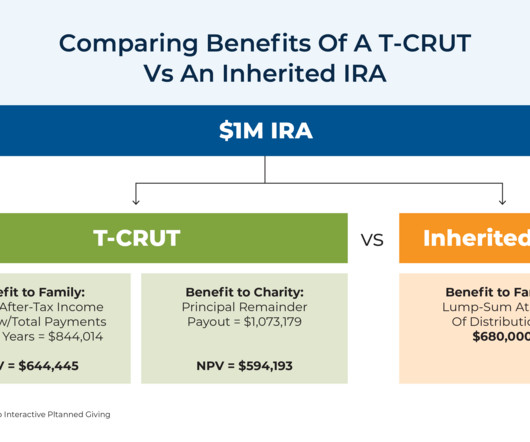

Using A Testamentary Charitable Remainder Unitrust (T-CRUT) To Give Twice To Both Loved Ones And Charitable Organizations

Nerd's Eye View

JANUARY 31, 2024

In late 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act, introducing several significant changes to retirement planning. This shift has led financial advisors to explore new strategies for mitigating the resulting tax-planning challenges.

Let's personalize your content