Enhancing Business Valuation: Aligning Owner Perception with Market Realities

VCFO

SEPTEMBER 21, 2023

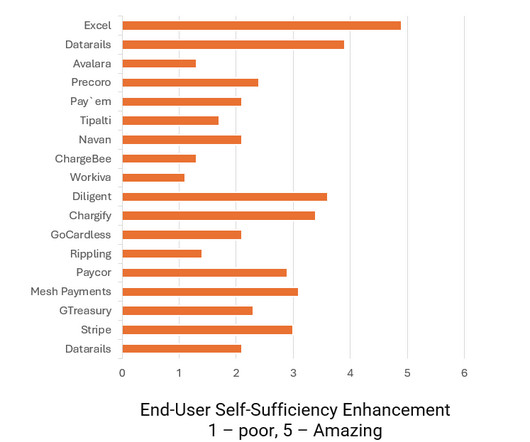

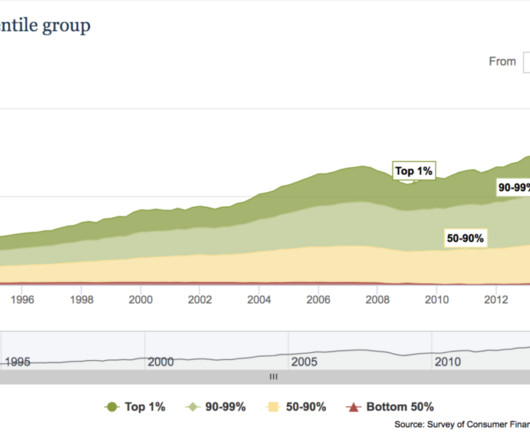

Yet, this perception often differs from the view of the market. Owner’s opinions of their business value can be influenced by inherent biases, flawed valuation methodologies, and factors lurking beyond their control. You can learn how you compare to your competitors and best in class by benchmarking your performance to a peer group.

Let's personalize your content