Business lobby rips Biden’s stock buyback tax plan

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

CFO Network

FEBRUARY 14, 2024

How a Fractional CFO Can Transform Your Financial Strategy! One way to achieve this is by bringing a Fractional CFO (Chief Financial Officer) to your team. Understanding the Role of a Fractional CFO Before diving into the transformational impact of a Fractional CFO, let’s first understand their role.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

JUNE 27, 2022

Hungary’s eleventh hour opposition included concerns about the war in Ukraine and fears about being a first mover on the Pillar Two rules, according to a PwC report.

CFO News

NOVEMBER 24, 2023

Dhankhar stressed that tax evasion and financial frauds endanger the financial stability and economic growth of the economy. “As As watchdogs, your capacity is potent enough to contain these,” he told the gathering of CAs.

Michigan CFO

NOVEMBER 1, 2021

This is when it’s time to turn to a SaaS CFO. For most SaaS businesses looking at seed or series A funding, a SaaS CFO may seem like an out-of-reach luxury. Aren’t CFOs supposed to be for big businesses? With fractional and virtual CFO services, your SaaS business can hire a CFO part time for a fraction of the cost.

CFO News

MARCH 15, 2023

The Indian government is unlikely to make changes to its budget proposal of taxing the total returns on high-value life insurance policies, two government officials said on Wednesday, amid demands by insurance companies to reconsider the move.

CFO Network

NOVEMBER 10, 2021

With outsourced business accounting services , you can get access to professional tax planning advice from a CPA or a CFO. They will be able to advise you on what tax planning strategies to put in place to legally minimize your tax burden each year. You Get Valuable Advice for Your Small Business.

CFO News Room

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

CFO Simplified

MARCH 7, 2024

Robert Garner, a partner in LP’s Corporate and Tax Planning Practice Groups , advises clients on tax planning in connection with a wide variety of transactions. He also has extensive experience in conducting all aspects of federal/state tax due diligence on potential acquisition targets and in transactional tax modeling.

CFO Simplified

MARCH 7, 2024

Robert Garner, a partner in LP’s Corporate and Tax Planning Practice Groups , advises clients on tax planning in connection with a wide variety of transactions. He also has extensive experience in conducting all aspects of federal/state tax due diligence on potential acquisition targets and in transactional tax modeling.

Boston Startup CFO

OCTOBER 13, 2015

Attributes of a Great CFO. I turned to a headhunter and over the next four months we canvassed many resumes and finally found an amazing CFO with the experiences we needed for our growing company. In my opinion, a great CFO walks around and talks to employees, understands customers’ needs and understands where the business is going.

CFO Share

JULY 13, 2023

At our fractional CFO firm , we believe there are three primary financial issues that small businesses face: Planning growth through uncertainty. Growth planning should include your executive team and a CPA for tax planning purposes. Develop a cash flow management plan to improve the runway.

CFO Share

APRIL 5, 2022

Software tools like Avatax help calculate economic sales tax nexus but are not sensitive to physical nexus. With the nexus study as your guide, your CFO or sales tax advisor can register one or many sales tax licenses. A sales tax advisor can help you manage and minimize these penalties.

CFO Share

MAY 18, 2023

VAT vs sales tax can be especially confusing for international businesses. Sales tax is extremely common amongst the USA, whereas VAT is more common in foreign countries. All companies should consider VAT vs sales tax when reviewing their tax planning strategy. Who implements a VAT or sales tax?

The CFO College

APRIL 8, 2021

At CFO Bookkeeper, we use “VIP” to refer to “Valuable Expert, Instructor, Participant.” Valuable Expert : Becoming a valuable expert can mean expanding your accounting and tax knowledge in your niche, or adding CFO-level services, tools, and skills to serve clients in any industry.

Future CFO

JANUARY 15, 2024

This requires a fundamental pivot from tax planning to building as much certainty as possible into transfer pricing positions, which means being as proactive as possible in dealing with anticipated and current controversies.”

Future CFO

OCTOBER 4, 2021

Never say never” are words that Siew Shan Sim, CFO AirAsia, Aviation Group (pictured) lives by. Siew Shan Sim, CFO AirAsia, Aviation Group. Future CFO: When did you start to become interested in finance? Future CFO: What do you enjoy to do most among your current responsibilities? SS: I am a fixer.

Future CFO

MAY 24, 2020

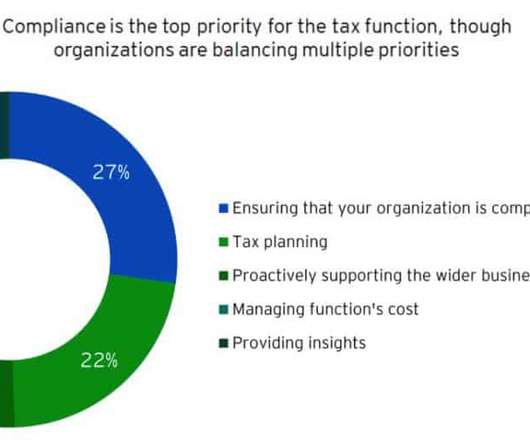

Beyond that, CFOs are expected to optimise every investment dollar for maximum returns on investments and be involved in all discussions and matters that have a financial impact on the company. According to the survey, businesses are seeking a model that balances different priorities that transcend routine compliance tasks.

Creative CFP

JANUARY 17, 2019

In so doing, you will ensure that your business comfortably stays afloat during quieter times. Failing to plan for tax payments Tax planning is not always fun to discuss, but when the tax man knocks on the door, you want to be prepared and not suffer a heart attack.

VCFO

NOVEMBER 1, 2023

Tax Planning is Beneficial and Essential A wise person once said that failing to plan is planning to fail. This is certainly true in the area of taxation, where there are often opportunities to legally minimize or defer the timing of tax payments and to claim income tax credits.

CFO News Room

NOVEMBER 28, 2022

Tax Planning. In addition to managing investments, tax planning is another area where advisors can demonstrate their value in dollar terms. This often starts with reviewing the client’s tax return to ensure they received the credits and deductions for which they were eligible.

CFO News Room

NOVEMBER 29, 2022

And so, that’s how this actually started was, at first, I knew I wanted to just get a deeper dive into our numbers, into our business, our process, and, so, I engaged in the CFO solutions services. And so, that was where I found the gap is that the CFO would identify all these things. Michael: Interesting. ” Right?

Future CFO

SEPTEMBER 14, 2020

Tam noted that FP&A professionals will then need to “revisit their financing and liquidity strategies, centralize decisions for cash release upon the applications of government stimulus, and implement tax planning strategies that can reduce cash expenditures and preserve budget.”.

CFO News Room

DECEMBER 23, 2022

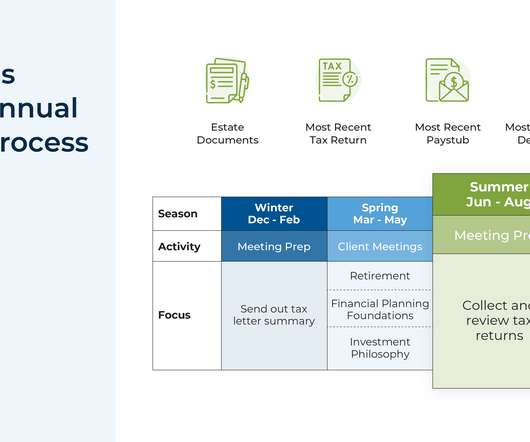

For instance, the first few months of the year could be a good time to focus on tax planning for clients , as their tax returns will be prepared and it is early enough in the year to consider potential tax planning strategies for 2023 (e.g., charitable giving ), and fulfilling RMD requirements.

CFO News Room

DECEMBER 26, 2022

Tax Advice Restrictions For Financial Advisors: How To Offer Tax Planning And Remain In Compliance – Despite the prominent role of taxes in financial planning, advisors are often prohibited by their compliance departments from making recommendations for a specific course of action on a certain tax strategy.

CFO News Room

NOVEMBER 21, 2022

How confident are they that no year-end-tax-planning opportunities were missed across their entire client base? How easily can most advisors figure out the last time they reviewed their clients’ LTC, life, and disability needs? Or whether all Roth and backdoor Roth contributions were made by eligible clients?

CFO News Room

NOVEMBER 22, 2022

And so, a lot of our processes now are more of a CFO’s perspective, where we’re reporting to clients when they want to be reported to. So, we have an internal centralized financial planning team, they are doing all the eMoney plans, all the portfolio manager. We want to save your time, not waste your time.

CFO News Room

NOVEMBER 21, 2022

And the taxes the Biden administration has already imposed in its disingenuously named Inflation Reduction Act (IRA) will be economically harmful in the long run. According to the Tax Foundation , “Biden’s tax plan would have a negative effect on the U.S. economy, reducing long-run GDP by 1.62

CFO News Room

FEBRUARY 2, 2022

Estate planning is commonly a big point of discussion, as well. And for most advisors that takes us down a road of tax planning and lots of different types of trusts and family limited partnerships and GRATs and IDGTs and all the different strategies that are out there, or at least as long as Congress lets us keep playing those games.

CFO News Room

DECEMBER 17, 2022

tax planning or deeper retirement planning ) can be a way to increase client satisfaction and encourage them to be vocal advocates for the firm. For firms with upward-sloping client referral trendlines who want to see this figure move up faster, adding services to the client value proposition (e.g.,

CFO News Room

NOVEMBER 9, 2022

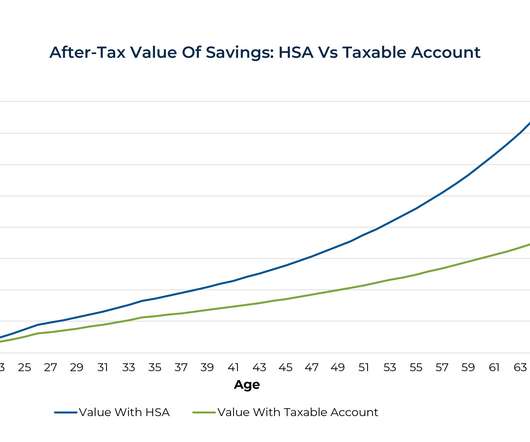

With the Affordable Care Act’s provision allowing children to stay on their parents’ healthcare plans until age 26, parents and their non-dependent adult children who can access family HDHPs have new tax-planning opportunities involving family HDHP coverage and HSA contributions.

CFO News Room

NOVEMBER 15, 2022

So I figured, I had to hold on to the CFO role, because I also am a CPA. While I don’t prepare tax returns, I do a lot of tax planning, and forecasting, and really making sure, possibly even bullying a little bit, to change their charitable contributions to QCDs when they’re 70 and a half.

CFO News Room

DECEMBER 30, 2022

Another core part of an advisor’s tech stack is its custodial provider. But many advisors find that their custodian’s client onboarding processes (e.g., filling out and signing forms) leaves something to be desired.

CFO News Room

DECEMBER 20, 2022

And one of the flyers that came out said that I did estate planning, and tax planning, and business succession planning, and all these things I didn’t know anything about. Emily: Yeah. So, I think that when I really started to feel like the real deal was I started to take on clients that were much larger clients.

CFO News Room

NOVEMBER 23, 2022

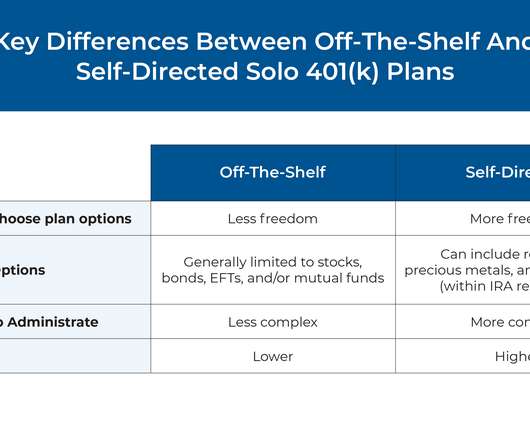

Later enhancements, like the Pension Protection Act of 2006 (which allowed for direct Roth conversions from 401(k) plans) and IRS Notice 2014-54 (which allowed individuals to split pre-tax and after-tax funds when making Roth conversions from 401(k) plans), further increased the value and appeal of solo 401(k) plans.

CFO News Room

FEBRUARY 2, 2022

And very similar to SmartAsset, so you pay upfront, you get the leads, slight improvements with WiserAdvisor where you tend to know a little bit more about the prospect before you talk to them so you at least know they were looking for estate planning advice, they were looking for tax planning advice, that was part of their input system.

CFO News Room

DECEMBER 28, 2022

Jeffrey is the Creator and Program Leader for Savvy IRA Planning® , as well as the Co-Creator and Co-Program Leader for Savvy Tax Planning® , both offered through Horsesmouth, LLC. a Roth account in a 401(k) plan). By contrast, it does not appear that such amounts can be redirected to pre-tax plan accounts by default.

CFO News Room

NOVEMBER 8, 2022

And the four pillars are the financial plan, risk management, so just checking all their what-if scenarios that something…a husband dies, wife dies, long-term care, disability. And then we look at estate planning. And then in the fall, we look at tax planning.

CFO Share

MARCH 9, 2021

Pass-through businesses like sole proprietors, partnerships, and s-corps are subject to the same tax brackets as last year with a maximum income tax rate of 37%. Since your small business tax rates are mixed in with your personal tax situation, be sure to include your personal CPA on any business income tax planning discussions.

CFO Share

MARCH 16, 2021

Information about tax changes the Biden administration is considering leaked yesterday , creating some big headlines in media. First major tax hike since 1993” according to Bloomberg. As a fractional CFO , my first reaction to any tax reform is: what does this mean for small business?

CFO News

MARCH 7, 2024

White House officials said Biden would preview the steps that will be part of a proposed fiscal 2025 budget released next week that aims to cut the federal deficit by $3 trillion while cutting taxes for low-income Americans.

CFO News Room

NOVEMBER 26, 2022

The end of the year is often a busy time for financial advisors, as they help clients with year-end tax planning, taking the proper RMDs, and other time-sensitive tasks. Meb Faber Research). But there are also some perhaps lesser-known opportunities to help clients save money and build loyalty in the process!

CFO Share

SEPTEMBER 15, 2021

Moreover, S-corps and pass-through companies are facing tax increases too…. Elimination of pass-through tax deductions. If you are a high-income S-corp, partnership, or sole proprietor, the proposed tax plan will eliminate your Qualified Business Income Deduction , commonly referred to as the pass-through deduction.

CFO News Room

NOVEMBER 19, 2022

A potential compromise during the lame-duck Congressional session could see a boost to the child tax credit and extended tax breaks for businesses. From there, we have several articles on tax planning: How advisors can add value for their clients by managing their exposure to mutual fund capital gains distributions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content