Transforming accounts payable operations through AI

Future CFO

JANUARY 26, 2024

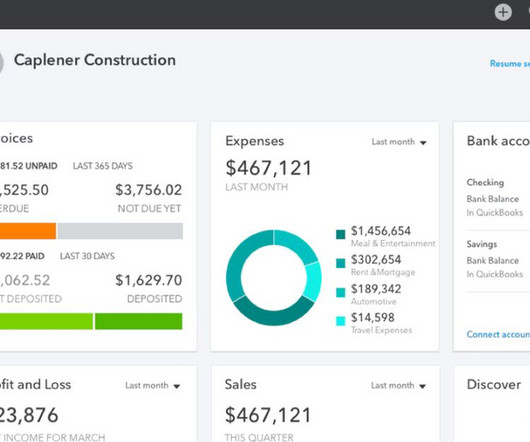

Systems powered by artificial intelligence are without a doubt revolutionising invoice processing in finance departments. The technological advancement provides more than just automation and reshapes roles, empowering finance teams to zero in on strategic activities like data analysis, supplier negotiations, and decision-making.

Let's personalize your content