Good Intentions, Perverse Outcomes: The Impact of Impact Investing!

Musings on Markets

OCTOBER 12, 2023

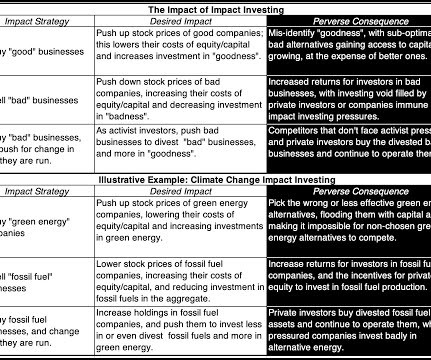

In response, I have been told that the problem is not with the idea of ESG, but in its measurement and application, and that impact investing is the solution to both market and society's problems. It is human nature to want to make the world a better place, but does impact investing have the impact that it aims to create?

Let's personalize your content