As margins tighten, CFOs are split on FinOps: CloudBolt

CFO Dive

JULY 13, 2023

FinOps has gone mainstream as a way to reduce complexity and cost of cloud management. Finance leaders are still waiting to see benefits from implementing the practice.

CFO Dive

JULY 13, 2023

FinOps has gone mainstream as a way to reduce complexity and cost of cloud management. Finance leaders are still waiting to see benefits from implementing the practice.

Jedox Finance

JULY 11, 2023

Jochen Heßler, Senior Director, Product Management, Jedox Environmental, social, and governance (ESG) has emerged as an important initiative for organizations worldwide as they strive to implement sustainable practices, achieve compliance, and demonstrate substantive value to customers, employees, and investors. According to KPMG, 65% of international dealmakers believe ESG is a key consideration when making investments and in merger and acquisition decisions, 1 and EY reports that 99% of invest

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future CFO

JULY 9, 2023

AI and analytics will be will be critical to corporate success over the next two years, according to a survey by Gartner. Survey results indicate that strategists believe that, on average, 50% of strategic planning and execution activities could be partially or fully automated though only 15% are currently the case, Gartner pointed out. In addition, 79% of corporate strategists said that technologies such as AI, analytics, and automation will be critical to corporate success over the next 24 mon

Navigator SAP

JULY 12, 2023

Navigator Business Solutions has been named to the Bob Scott’s Top 100 VARs for 2023.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

CFO Dive

JULY 11, 2023

A sudden spike in oil prices poses the biggest threat to U.S. economic growth, Moody’s Analytics Chief Economist Mark Zandi said.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CFO News

JULY 10, 2023

The Directorate General of GST Intelligence in the Centre and the Bureau of Investigation in States, which deal with the investigation based on intelligence inputs from various authorities or agencies, are the proper officers for GST offences, experts say.

Navigator SAP

JULY 14, 2023

Most professional services organizations have completed digital transformation, which is the trendy way of saying that they’ve moved operations to the cloud. Now that most of these businesses are in the cloud, though, the next evolution has arrived: using the advantages of digital transformation to actually drive intelligent decision-making. Forget digital transformation.

CFO Dive

JULY 10, 2023

Business executives worldwide see growing risks from income inequality and shifts in political leadership, McKinsey said.

CFA Institute

JULY 14, 2023

Amar Pandya, CFA, is the portfolio manager of the Pender Alternative Arbitrage Fund, Pender Alternative Arbitrage Plus Fund, Pender Alternative Special Situations Fund, and Pender Small/Mid Cap Dividend Fund. He joined the company in October 2017. He began his investment career in 2011 in the portfolio management training program at a large global financial services company.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Barry Ritholtz

JULY 8, 2023

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • The Physics of Kaizen: Why Somebody Should Get Credit for Fixing Problems That Never Happened : Toyota’s culture of Kaizen: continuous improvement. It is an obvious statement: companies should be continually improving. Companies that are able to successfully adopt a culture and practice of Kaizen have the ability to establish a dominant position in their market. ( Taylor P

Business Credit Blogger

JULY 11, 2023

How to Get Funding for Your Startup Fast Are you in the early stages of launching your business and in need of funding? It can be overwhelming when it comes to deciding how to begin or where to apply. In today’s post, we’ll unpack several ways for you to get funding for your business. The […] The post How to Get Funding for Your Startup Fast appeared first on Business Credit.

CFO Dive

JULY 14, 2023

The majoriy of finance departments studied were about as efficient as a “monster truck,” a Hackett Group researcher said. There are steps companies can take to make them run more like Priuses.

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors whose social media archiving tools do not yet cover the new app.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Barry Ritholtz

JULY 14, 2023

Jim Reid of Deutsche Bank notes the pattern of gradual downgrades before earnings season begins is back to normal. As the rest of the quarterly earnings roll out, we should expect earnings to improve as we roll deeper into earnings season and as “later estimate beats” come in. This quarterly earnings pattern is shown above in the chart from his colleague Binky Chadha.

CFO News

JULY 13, 2023

In order to ensure that companies are mindful of how they are integrating their value chain into the sustainability and ESG policies of their organization SEBI has introduced the BRSR Core Framework for assurance and ESG disclosures for top 1000 companies in a phase-wise manner in the next three financial years.

CFO Dive

JULY 12, 2023

The electric vehicle maker’s new interim CFO, Jonathan Maroko, is replacing Yun Han, who resigned from the top finance role. The company announced it will also be restating certain financial reports.

Nerd's Eye View

JULY 13, 2023

Establishing successful client relationships as a financial advisor relies on good communication skills not just to present information persuasively and with confidence, but also to establish client rapport that allows meaningful and engaging relationships to be built. For many who are new to the financial planning profession and who have no experience working with clients, participating in client meetings can trigger feelings of anxiety, especially for those who share the common fear of public

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Barry Ritholtz

JULY 13, 2023

The Consumer Price Index was up 3% year over year in June, as reported by BLS yesterday. The FRED chart above shows the near round trip from the prior decade’s range of 0-2% up to the 9% peak, and now back down to 3%. Over the past year, I have been writing a lot about inflation — what people get wrong about it, why the FOMC is always late to the party, and what the various causes of inflation — real, modeled, and imagined — actually are.

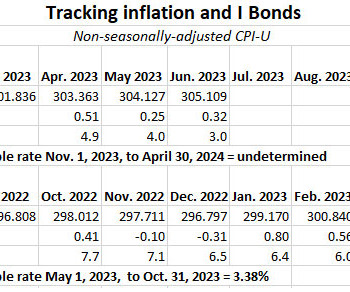

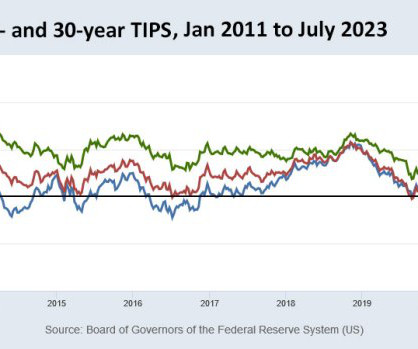

Tips Watch

JULY 12, 2023

By David Enna, Tipswatch.com The just-released June inflation report is going to be greeted with glee, I think. It was exactly what the stock and bond markets were hoping for. What happened?

CFO Dive

JULY 12, 2023

The company and former Amazon executive Tim Stone mutually agreed to scrap plans for him to take over as CFO.

CFO News

JULY 12, 2023

Retail inflation accelerated for the first time in five months in June on the back of a jump in vegetable prices.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

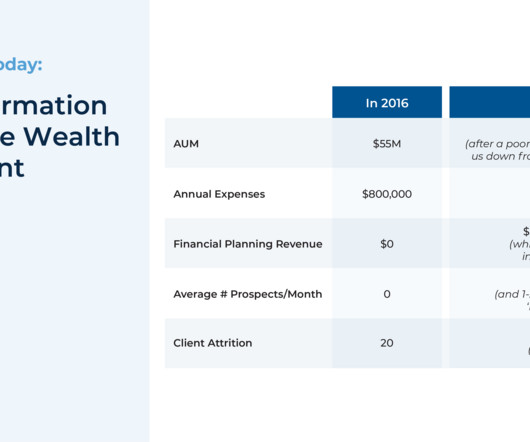

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family. At the same time, the business strategies that worked for the original owner might not be suitable or as successful for their successor, which can force the 2nd-generation owner to take a different path to ensure the firm

Tips Watch

JULY 9, 2023

By David Enna, Tipswatch.com Over the last year (plus a few months) I have been gradually adding to my holdings of Treasury Inflation-Protected Securities. Mostly with nibble purchases, but sometimes — when the opportunity looks good — with larger investments.

CFO Dive

JULY 11, 2023

CFOs can use predictive analytics to avoid panic buying, anchor price bias and overpaying suppliers, Edmund Zagorin, an executive with the procurement platform Arkestro, writes.

CFO News

JULY 11, 2023

The council has recommended to notify the rules for GST appellate tribunal by August 1, 2023 for setting up of tribunal at the earliest.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Let's personalize your content