Bank, finance leaders brace for rate volatility

CFO Dive

MARCH 7, 2023

The majority of leaders at financial institutions say interest rates will drive business model guidance this year but few are leveraging financial data to support these changes.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MARCH 7, 2023

The majority of leaders at financial institutions say interest rates will drive business model guidance this year but few are leveraging financial data to support these changes.

Future CFO

DECEMBER 29, 2024

She points out that finance is no longer just about metrics and measurements but about leveraging technology to gain insights that support strategic initiatives. This includes real-time data analysis, which allows finance leaders to respond swiftly to market changes and identify growth opportunities.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Future CFO

JANUARY 22, 2025

This shift from traditional finance transformation towards a growth-centric mindset underscores CFOs' need to leverage technology strategically. For CFOs, this means managing financial data and utilising technology to provide insights that drive strategic decision-making.

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Future CFO

FEBRUARY 14, 2025

"The ability to integrate AI into financial planning also means we are seeing improved efficiency, allowing Finance teams to focus on strategic initiatives rather than administrative tasks." In his view, there is still room for growth for Finance teams, particularly in fully leveraging AI-driven automation.

CFO Plans

DECEMBER 2, 2024

These insights empower owners to make data-driven decisions that support long-term growth. Leverage Financial Insights in Hospitality In the hospitality industry, leveraging financial insights is essential to remain competitive.

Global Finance

DECEMBER 16, 2024

However, from the perspective of our 1,000 financial advisors, even though each of them has around 400 clients, they are only familiar with around one-third of their customers. If we can leverage AI to roll out hyperpersonalization at scale, our wealth management profits would grow significantly. That is on the horizon for us in 2025.

Navigator SAP

MARCH 11, 2022

Entrepreneurs often love leveraging the power of applications to accomplish their work, but how truly effective is your software if it’s all siloed in disparate systems? Bookkeeping and financial tracking tend to get more complicated over time. Read on to learn why ERP can improve your bottom line.

Bramasol

JANUARY 15, 2025

The Spread of Agentic AI Over the past two years, the rise of Generative AI applications, started by Open AI's ChatGPT and quickly followed by big players such as Google, Meta, Apple and more, have radically changed the world of business and personal usage cases for leveraging artificial intelligence.

PYMNTS

JULY 26, 2020

The announcement by the Consumer Financial Protection Bureau ( CFPB ) comes on the heels of a symposium it held in February which included experts from consumer groups, financial technology (FinTech) companies, trade groups, banks and data aggregators. Congress created the legislation in 2010 that created the CFPB.

PYMNTS

APRIL 7, 2020

What we’re trying to do is leverage open banking to replicate a FedEx or Amazon experience where businesses know where their payment is at any given point of time, so they have real-time cash flow positioning.”.

Global Finance

DECEMBER 27, 2024

Cloud computing is having a significant impact on organizations and especially the CFO, where its allowing for real-time access to financial data, says Craig Stephenson, global head of Tech, Ops, Data/AI, and InfoSec Officers Practice at Korn Ferry. We dont always see that happen, she says.

CFO Talks

MARCH 13, 2025

This is the power of Financial Information Systems (FIS). Financial data is no longer just about tracking income and expenses; its a strategic tool that helps businesses make smarter, faster, and more informed choices. Often, finance teams work separately from sales, operations, and HR, leading to inconsistent financial data.

Future CFO

OCTOBER 25, 2023

With the rampant incidents of frauds and scams related to finance, machine learning can be leveraged to detect and prevent financial fraud, allowing a company or an organisation to respond in real-time. The post Leveraging machine learning to detect financial fraud appeared first on FutureCFO.

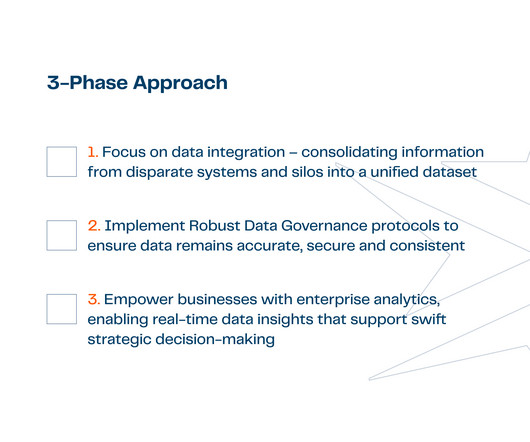

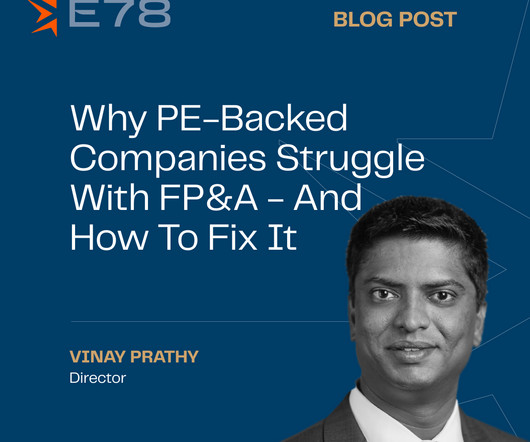

E78 Partners

OCTOBER 30, 2024

To drive growth, improve profitability, and enhance decision-making, companies can leverage the power of refined operational disciplines – Forecasting, Planning, and Analytics (our take on FP&A). Creating a ‘Single Source of Truth’ for Financial and Operational Data Accurate and reliable financial information is essential.

Trade Credit & Liquidity Management

JUNE 9, 2025

Share The Role of AI in Financial Statement Analysis The integration of artificial intelligence (AI) into financial statement analysis is transforming this process. By automating routine calculations and data preparation, AI frees credit analysts to focus on deeper interpretation and strategic judgment.

The Finance Weekly

FEBRUARY 23, 2025

Budget approval ensures financial stability, prevents unnecessary expenses, and keeps projects on schedule. Present financial data with clear charts for faster decision-making. Provide business context to support data-driven discussions. Leverage FP&A software for real-time tracking and forecasting.

E78 Partners

FEBRUARY 26, 2025

Shift FP&As focus from reactive reporting to proactive financial advisory, supporting CFOs and executive teams with scenario planning and real-time analytics. Learn how leveraging financial analytics improves decision-making 3. Utilize real-time dashboards for cash flow, working capital, and key financial indicators.

Future CFO

FEBRUARY 15, 2021

According to Terry Smagh , senior vice president & general manager, Asia Pacific & Japan, BlackLine, the company undertook the study is to understand and recognise the critical role that financial data plays in informing businesses about strategy and continuity, the poor visibility if any, and the lack of real-time access to data.

PYMNTS

FEBRUARY 2, 2018

Information technology (IT) management solutions provider Kaseya, which targets managed service providers (MSPs) with its offerings, is linking up with small and medium-sized business (SMB) accounting firm Xero to help businesses gain greater control over their financial data. The companies said Thursday (Feb.

E78 Partners

DECEMBER 12, 2024

Automation Solutions: Streamlining Back-Office Operations The operational complexity of private equity, from regulatory compliance to financial data management, can burden resources and divert attention from strategic priorities.

Global Finance

OCTOBER 22, 2024

A panel of industry experts at the Sibos 2024 conference on Tuesday discussed the critical role of data sharing and fraud detection in the modern financial landscape. However, due to existing privacy laws and regulations, banks remain hesitant to share financial data. If data is shared, it is done via lateral agreements.

Global Finance

JUNE 9, 2025

The technology uses a generative AI conversation assistant in Microsoft Teams, analyzing raw financial data to produce personalized insights for Brazilian micro and small businesses. The bank is also working with the Bancolombia Foundation to incubate and scale social impact projects.

CFO News

MARCH 16, 2025

MSMEs face challenges accessing credit due to traditional assessments, lack of formal financial data, and high operational costs. Experts suggest leveraging alternative data, digital processes, and government incentives to improve credit accessibility and support fintech partnerships for better risk assessment and scalability.

PYMNTS

DECEMBER 8, 2019

“Some risks are similar to those from financial firms more broadly, … [stemming] from leverage, maturity transformation and liquidity mismatches, as well as operational risks,” the report said.

PYMNTS

DECEMBER 29, 2020

Consumer Bank Chief Digital Officer Mike Naggar said the FI aims to provide customers "a choice, convenience and control of their financial data. WEX Talks Bank Partnerships To Advance B2B Payments. The company is focusing on users that may be underbanked, lacking traditional bank accounts.

PYMNTS

JUNE 24, 2020

Specifically, payments giants are buying up data aggregators, which let consumers share data with thousands of apps — and in the process are taking on the roles of trusted intermediaries as information flows across the financial services landscape. We’ll leverage expertise, and we’ll leverage technology.”.

CFO Talks

NOVEMBER 27, 2024

Review existing data: Look at your company’s historical trends, current financial data, and market research. Even if the data isn’t perfect, it can give you a starting point. Use visuals, like charts or dashboards, to explain financial data. Ask questions: What information do you have now?

CFO Thought Leader

MARCH 3, 2025

Guillenwho led the automakers push for production scale and supply chain agilitybelieved a different path could better serve the company, but needed someone with operational and financial data at her fingertips. Read More Lets go talk to himjust you and me, Guillen said. “Always stay connected to the details.

CFO Thought Leader

JANUARY 29, 2025

Whether leading acquisitions or guiding cross-functional teams, Collis uses financial narratives to clarify priorities and inspire action. Someone has to be the storyteller, Collis tells us, emphasizing how framing financial data in relatable terms helps drive organizational alignment and decision-making.

Collectiv

JANUARY 24, 2025

Instead of squinting at endless rows and columns, visualizing data is easy with Power BIs intuitive dashboards. For organizations leveraging Microsoft Fabric , Power BI becomes even more powerful. Centralize Financial Data Data silos are the enemy of efficiency. Small wins lead to big momentum.

The Charity CFO

FEBRUARY 20, 2025

Provide Financial Literacy Training: To department heads and anyone else in the organization interested in being part of the process and empowering better decision-making. Leverage Your Board : The reason your board exists is strategic oversight and supporting your team in these matters.

The Finance Weekly

FEBRUARY 26, 2025

Charting and Graphing Tools Create interactive financial visuals to support decision-making. Self-service Reporting Empower stakeholders with easy access to real-time financial data. Automated Report Generation Streamline financial reporting processes with pre-built templates.

PYMNTS

DECEMBER 18, 2020

We look forward to working with Brex in pioneering the way financial data is utilized to help businesses grow and achieve their goals.”. Both Finicity and Brex use the Financial Data Exchange (FDX) API standard, which leverages the OAuth standard for authenticating and authorizing account access.

CFO Thought Leader

JULY 19, 2024

This insight spurred the creation of Ledge, a platform designed to automate repetitive tasks and streamline financial data management Read More Tal’s experiences highlighted the critical role of AI in transforming finance functions. Jack Sweeney: We want to want to touch on AI with you. I think rightfully so.

PYMNTS

NOVEMBER 23, 2020

There’s no shortage of consulting advice and press clippings that will state the importance of actionable data for companies as a selling, operational and marketing strategy. Big data, it used to be called. Last week, the Department of Justice gave the green light to Mastercard’s $825 million acquisition of data aggregator Finicity.

CFO Talks

APRIL 17, 2025

Critically, CFOs must move beyond siloed financial data and begin synthesising a broader spectrum of intelligence. The most progressive finance teams are investing in business intelligence capabilities, leveraging dashboards, scenario models, and rolling forecasts to guide resource allocation in real time.

The Charity CFO

MARCH 13, 2025

Enforce Strong Internal Controls Without internal controls, nonprofits are vulnerable to financial mismanagement and fraud. Establish clear approval processes for all financial transactions, including vendor payments and employee reimbursements.

CFO Talks

SEPTEMBER 28, 2024

To translate financial performance into actionable results, start by understanding the key drivers behind your financial data. Turn Data into Decisions Data is your secret weapon. By leveraging data analytics, you can turn financial insights into strategic decisions that drive tangible results.

Future CFO

APRIL 3, 2023

Leveraging data to offer informed decisions Going beyond RPA, the shift to the cloud and vast amounts of data now available means CFOs have an opportunity and expectation to broaden their focus to not only improve the bottom line, but to also contribute to the top line by leveraging data to provide actionable business insights.

Future CFO

AUGUST 21, 2023

As a profession we have made significant progress over the years leveraging technology to streamline how we manage historical data and more recently, leveraging analytics on predicting outcomes.

CFO Share

JULY 16, 2024

For small businesses employing a fractional CFO , understanding the core responsibilities of a CFO can help leverage their expertise effectively. Strategic Planning and Forecasting CFOs create long-term financial plans and forecasts. They regularly audit processes to maintain the integrity of financial operations.

PYMNTS

NOVEMBER 9, 2020

there are indications that the opening of data flows between financial services companies has led to strong innovation (and demand for that innovation), and more regulation may loom. The mechanic of digital conduits, and the consent, open the door to digitization and data aggregation, simplifying and streamlining daily financial life.

PYMNTS

MAY 11, 2017

With direct, secure integration through Capital One’s new application programming interface (API), small businesses will be able to connect their Capital One financial data to their Xero cloud-accounting solution through a fully digital process. Many of the world’s leading financial institutions now share this vision.

Bramasol

OCTOBER 2, 2024

SAP green ledger provides bottom-up, audit-ready sustainability values that are managed with the same precision as corporate financial data. Leveraging Regulatory Compliance - by drawing investment from funds and individuals who prioritize ESG values and by avoiding fines and sanctions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content